Can Cardano hit $100 as cynics criticize Bitcoin's $1 million bet?

- Cardano proponents on crypto Twitter argue that the Ethereum-killer could hit the bullish target of $100.

- The US Federal Reserve is battling rising inflation while printing more fiat, fueling a bullish narrative for decentralized cryptocurrencies.

- The recent banking collapses have positioned Cardano and Bitcoin as safe havens, according to experts.

In the light of the US banking crisis and rising inflation in the largest economy in the world, crypto proponents are bullish on decentralized cryptocurrencies gaining relevance. Cardano proponents argue that the Ethereum-killer altcoin is ready for a bull run to its $100 target while cynics continue to criticize former Coinbase CTO Balaji Srinivasan’s $1 million Bitcoin bet.

Also read: Breaking: Coinbase argues core staking services are not securities in its letter to SEC

Why crypto experts are betting big on $1 million Bitcoin and $100 Cardano

The US Federal Reserve’s battle against rising inflation and the collapse of two of the United State’s largest banks, Silicon Valley Bank (SVB) and Silvergate, sent shock waves through market participants.

Interestingly, the US Central Bank’s latest decision to coordinate with central banks and enhance provisions for the liquidity of the US Dollar have raised concern among traders.

The US Fed took steps to guarantee deposits of all banks in its economy and assisted the banking system with nearly half the amount that it did during the 2008 crisis. According to Fortune, the Central Bank allocated $143 billion to holding companies for failed banks and lent $148 billion through a discount window program.

The Fed inaugurated its Bank Term Funding Program (BTFP) and lent $11.9 billion to help banks raise funds to meet the needs of all depositors and increased the frequency of its swap operations from weekly to daily for the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank.

The Federal Reserve’s liquidity injection in its banking system is considered bullish for decentralized cryptocurrencies like Bitcoin. The steps taken by the central bank are drastic when compared to the Covid crisis of 2020 and the 2008 financial crisis.

In light of these moves by the largest central bank in the world, experts like former Coinbase CTO Balaji Srinivasan and BitMEX founder Arthur Hayes have turned bullish on Bitcoin. Srinivasan recently made headlines for his $1 million Bitcoin bet. The expert predicted that BTC price is likely to hit $1 million within 90 days.

I will take that bet.

— Balaji (@balajis) March 17, 2023

You buy 1 BTC.

I will send $1M USD.

This is ~40:1 odds as 1 BTC is worth ~$26k.

The term is 90 days.

All we need is a mutually agreed custodian who will still be there to settle this in the event of digital dollar devaluation.

If someone knows how to do this… https://t.co/tcuBNd679T pic.twitter.com/6Aav9KeJpe

Srinivasan challenged pseudonymous analyst James Medlock on Twitter that the US Dollar will enter hyperinflation within 90 days, for a $1 million bet.

As the $1 million Bitcoin bet garnered backing and criticism both on crypto Twitter, Cardano proponents put forth the $100 ADA narrative, on similar lines.

@LucidCIC, a Cardano proponent and crypto influencer on Twitter is bullish on both Bitcoin and Cardano for their decentralization.

Let's breakdown what has everyone calling for a $1,000,000 $BTC and a $100 $ADA:

— Lucid (@LucidCiC) March 20, 2023

: Banks never recovered financially from the lockdowns.

: Banks and the government continued printing more fiat.

: We did not stop inflation by raising rates but scared everyone without a… https://t.co/1lVxydrZgS

What makes Cardano an alternative to investors hit by banking crises?

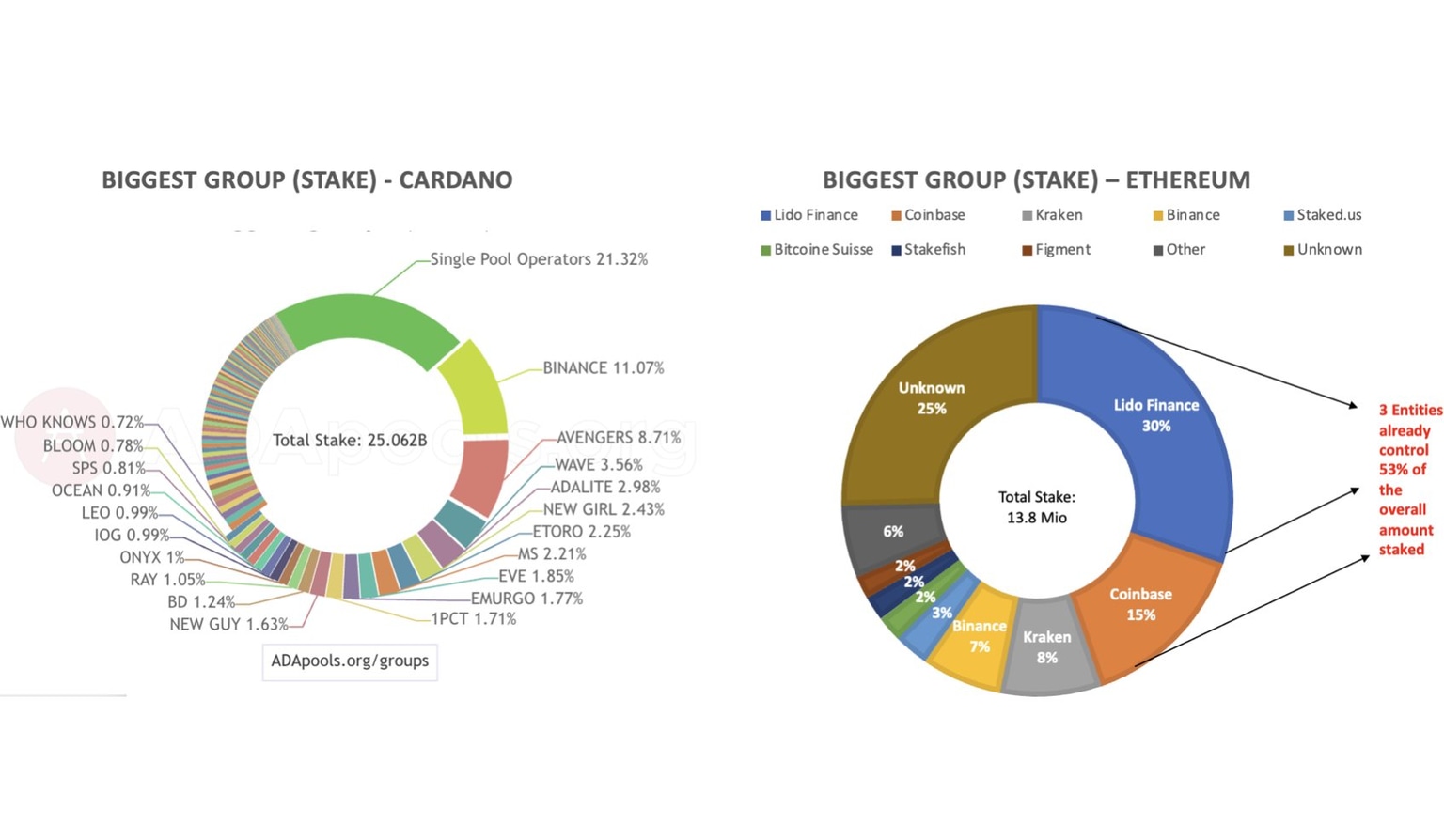

Experts supporting the $100 Cardano narrative argue that the Ethereum alternative blockchain is more decentralized than most other Proof-of-Stake blockchains, including ETH. To substantiate this claim, it is key to identify the Nakamoto coefficient or Minimum Attack Vector (MAV), a metric that determines the decentralization of validator nodes.

A validator node verifies transactions and adds new blocks to the blockchain. Its decentralization helps determine how decentralized a blockchain network is. As of December 2022, Cardano had a MAV of 24 and Ethereum a MAV of 3.

MAV of Cardano and Ethereum

The above data substantiates the claim that Cardano is eight times more decentralized than the Ethereum network. Stakers on the ADA network have full custody of their assets while staking on a hardware wallet. They delegate voting power to a staking pool operator of their choice while their ADA tokens are stored securely in a hardware wallet.

Cardano’s uncomplicated staking process has made it a popular choice among crypto market participants. Further, the ADA blockchain’s decentralization and utility make it an ideal choice for investors looking for avenues to hold their funds during the banking crises, according to Lucid.

If Cardano misses its $100 target, what’s next?

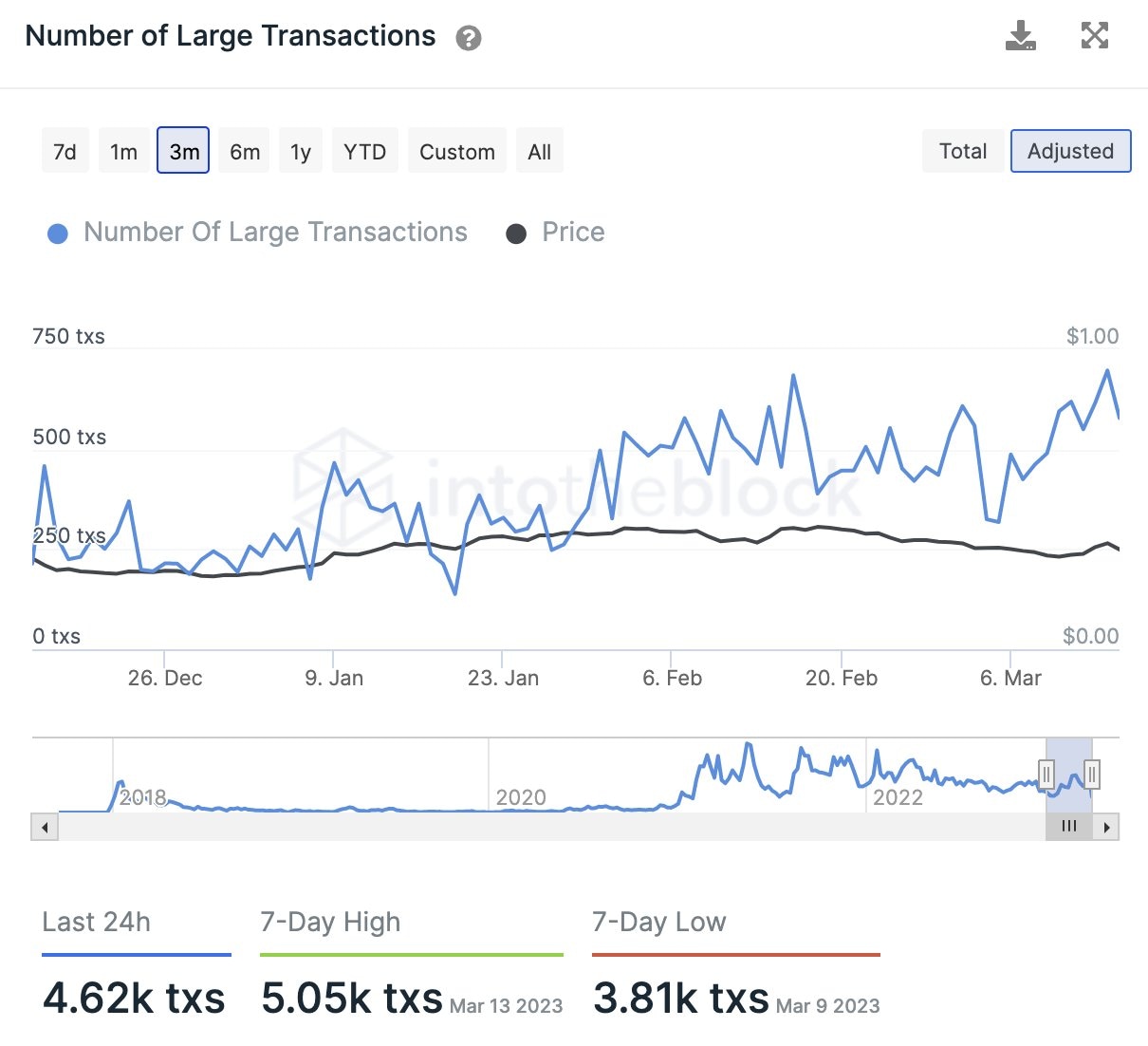

The Ethereum-killer blockchain noted a spike in whale activity over the past week. Based on data from crypto intelligence tracker IntoTheBlock, the number of transactions exceeding $100,000 hit a seven-day high above 5,000 on March 13.

Whale activity on Cardano

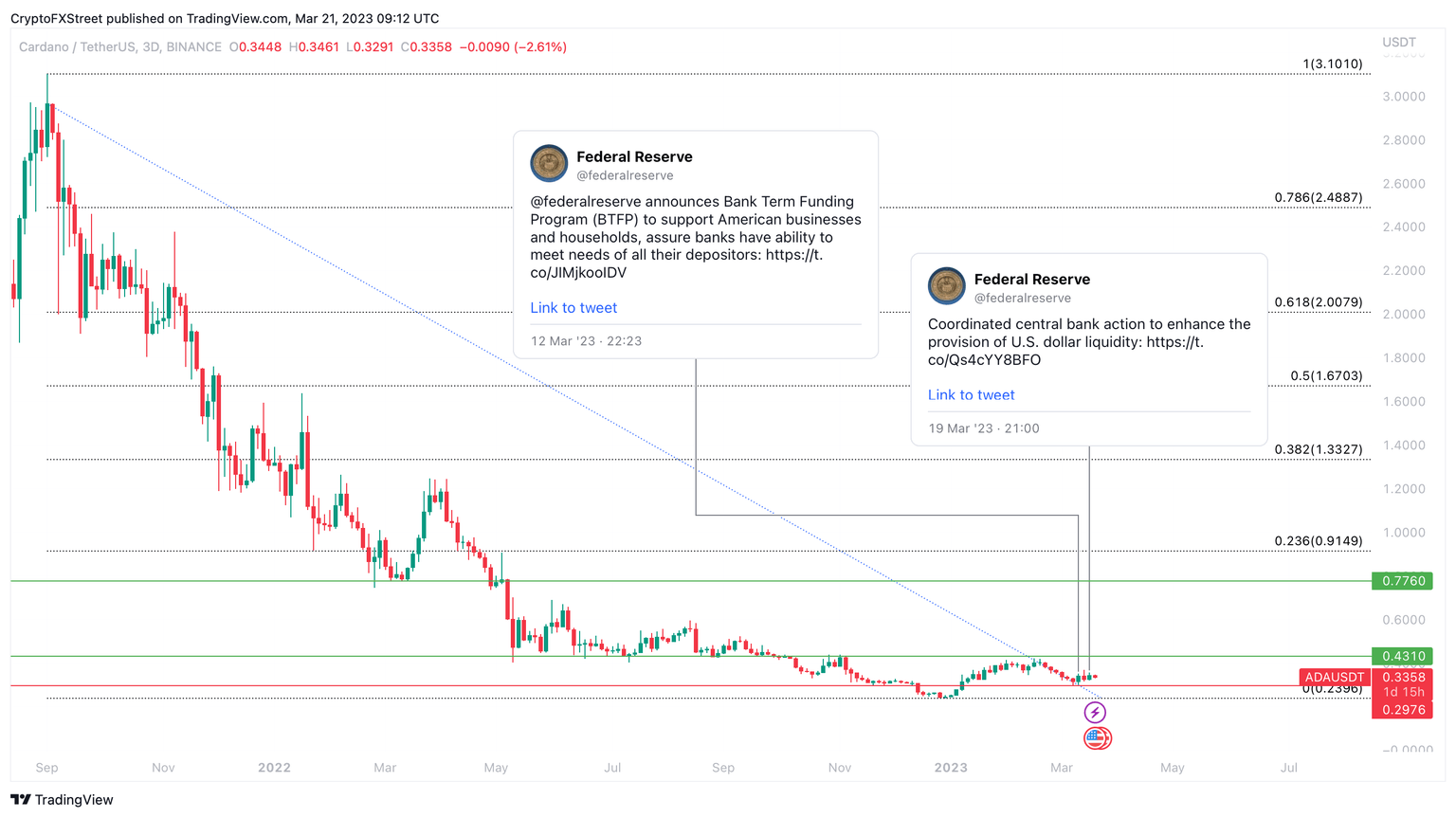

Typically, an increase in activity by large wallet investors is indicative of rising selling pressure on the asset and a subsequent correction in its price. In the short-term, following the two announcements by the US Federal Reserve discussed in the opening, ADA price failed to register a significant reaction.

As seen in the Cardano/TetherUS three-day chart below, ADA is exchanging hands at $0.33. In the event of a correction, ADA price could plummet to support at $0.23.

ADA/USDT 3D price chart

Cardano faces immediate resistance at $0.43 and $0.77 in its uptrend. The first bullish target is the 23.6% Fibonacci Retracement level of $0.91. In the past thirty days, ADA yielded 16.7% losses for holders.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.