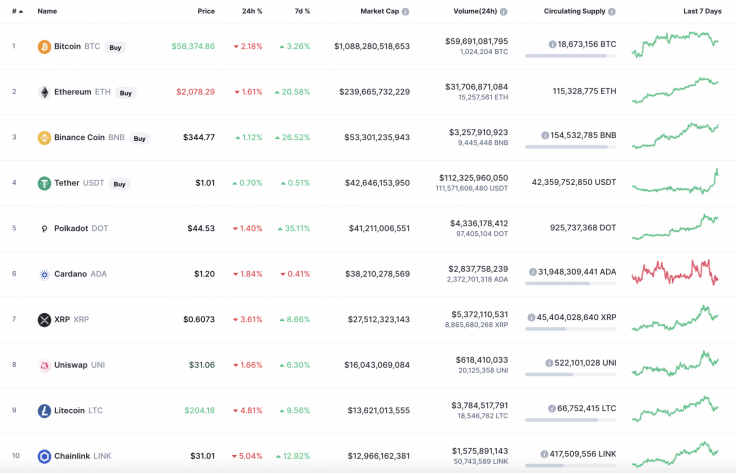

The last day of the week has turned out to be bearish for most of the coins. Binance Coin (BNB) is the only exception to the rule, rising by 1.12% since yesterday.

Top 10 coins by CoinMarketCap

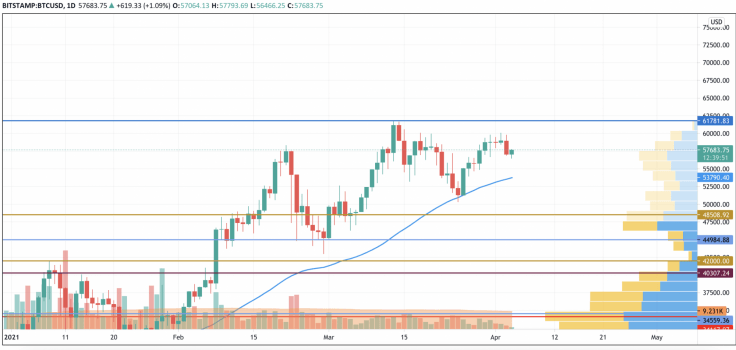

BTC/USD

Bitcoin (BTC) has shown a price decrease since yesterday. It declined by 2.54%.

BTC/USD chart by TradingView

On the daily chart, Bitcoin (BTC) has bounced off, confirming the fact that yesterday's decline was just a drop to gain liquidity for the ongoing rise.

In this case, the leading crypto now has the chance to test the level of $58,500 shortly.

Bitcoin is trading at $57,660 at press time.

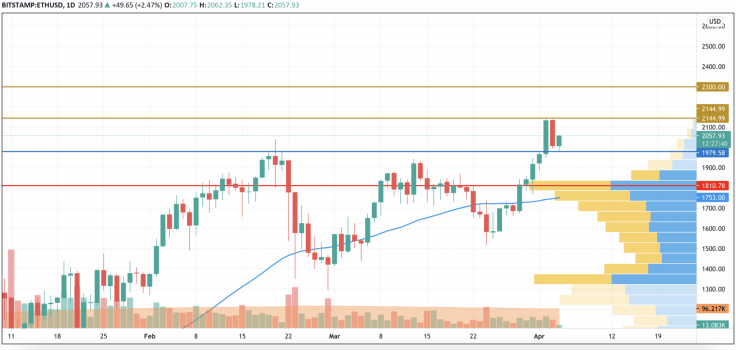

ETH/USD

The rate of Ethereum (ETH) has not decreased as much as that of Bitcoin (BTC).

ETH/USD chart by TradingView

From the technical point of view, Ethereum (ETH) is ready to keep the growth going after yesterday's decline, as one can consider the drop a retest of the mirror level but not the start of a bearish trend. Respectively, the potential short-term target is $2,300.

Ethereum is trading at $2,055 at press time.

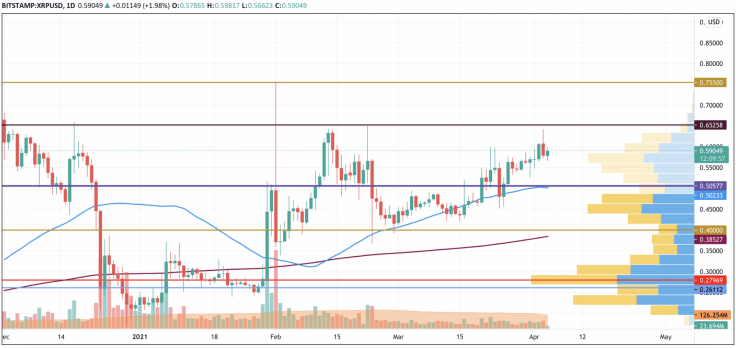

XRP/USD

XRP is the top loser today as its rate has gone down by 4.37%.

XRP/USD chart by TradingView

Despite the decline, the long-term trend remains bullish. Buyers' dominance will become more visible when XRP fixes above $0.652. In this case, the next level of $0.75 may be attained within the next few days.

XRP is trading at $0.5892 at press time.

Any financial and market information given on U.Today is written for informational purposes only. Conduct your own research by contacting financial experts before making any investment decisions.

Recommended Content

Editors’ Picks

BNB Price Forecast: Poised for a decline on negative Funding Rate

BNB price hovers around $696.40 on Thursday after declining 4.58% in the previous two days. BNB’s momentum indicators hint for a further decline as its Relative Strength Index and Moving Average Convergence Divergence show bearish signals.

Ripple's XRP eyes recovery following executives' dinner with Donald Trump

Ripple's XRP is up 2% on Wednesday following positive sentiments surrounding its CEO Brad Garlinghouse's recent dinner with incoming US President Donald Trump. If the recent recovery sentiment prevails, XRP could stage a breakout above the upper boundary line of a bullish pennant pattern.

Has Bitcoin topped for the cycle? Here's what key metrics suggest

Bitcoin experienced a 2% decline on Wednesday as the cryptocurrency market grapples with recent losses. On-chain data has indicated a shift in the accumulation of the leading cryptocurrency, suggesting that holders are increasingly selling their assets.

Ethereum Price Forecast: ETH could decline to $3,110 despite increased accumulation from whales

Ethereum briefly declined below the $3,300 key level, recording a 4% loss on Wednesday as short-term holders led the selling pressure. If the buy-side pressure of large whales fails to outweigh the bears, the top altcoin could decline to $3,110.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.