The crypto world is eagerly awaiting Bitcoin's rally, with bated breath. Instead, Bitcoin has suffered a 11.2% loss since the beginning of April.

A number of factors prevent the rally from taking place. I have mentioned many times before that Bitcoin is becoming increasingly correlated with the stock market and thus is unable to act independently.

US stock market earnings season has begun, and things are off to a rocky start with a number of Wall Street lenders reporting mixed results. The biggest bank in the United States by assets, JP Morgan, reported a 42% loss in Q1 profits and expressed a bearish tone – pointing out significant geopolitical and economic challenges ahead related to inflation, supply chain difficulties, and the ongoing war in Ukraine.

Additionally, the Federal Reserve has signaled that it will raise rates even more aggressively to counter soaring inflation – further pressuring stocks and therefore the crypto market. Yet, as I mentioned in my previous article, the effect of the Fed's hiking cycle tends to be delayed and isn't likely to show up in full force until the end of the year.

The stock market seems destined to fall amid rising interest rates, slowing economic growth, and limited global liquidity. But does that mean the worst is yet to come for the crypto market?

Not necessarily so. What is the correlation between two assets? When you look at it like it is something immutable, it means that crypto will sink in the same boat with stocks. However, when you realize that these figures simply reflect investor perception of these assets, which changes over time, you will be less pessimistic.

Moreover, we may be entering a new BTC rally cycle that may see the flagship cryptocurrency's price surge as stocks begin to crash and investors flee them. This could lead to a drop of this correlation, and investors will return to seeing crypto as a hedge and diversifier.

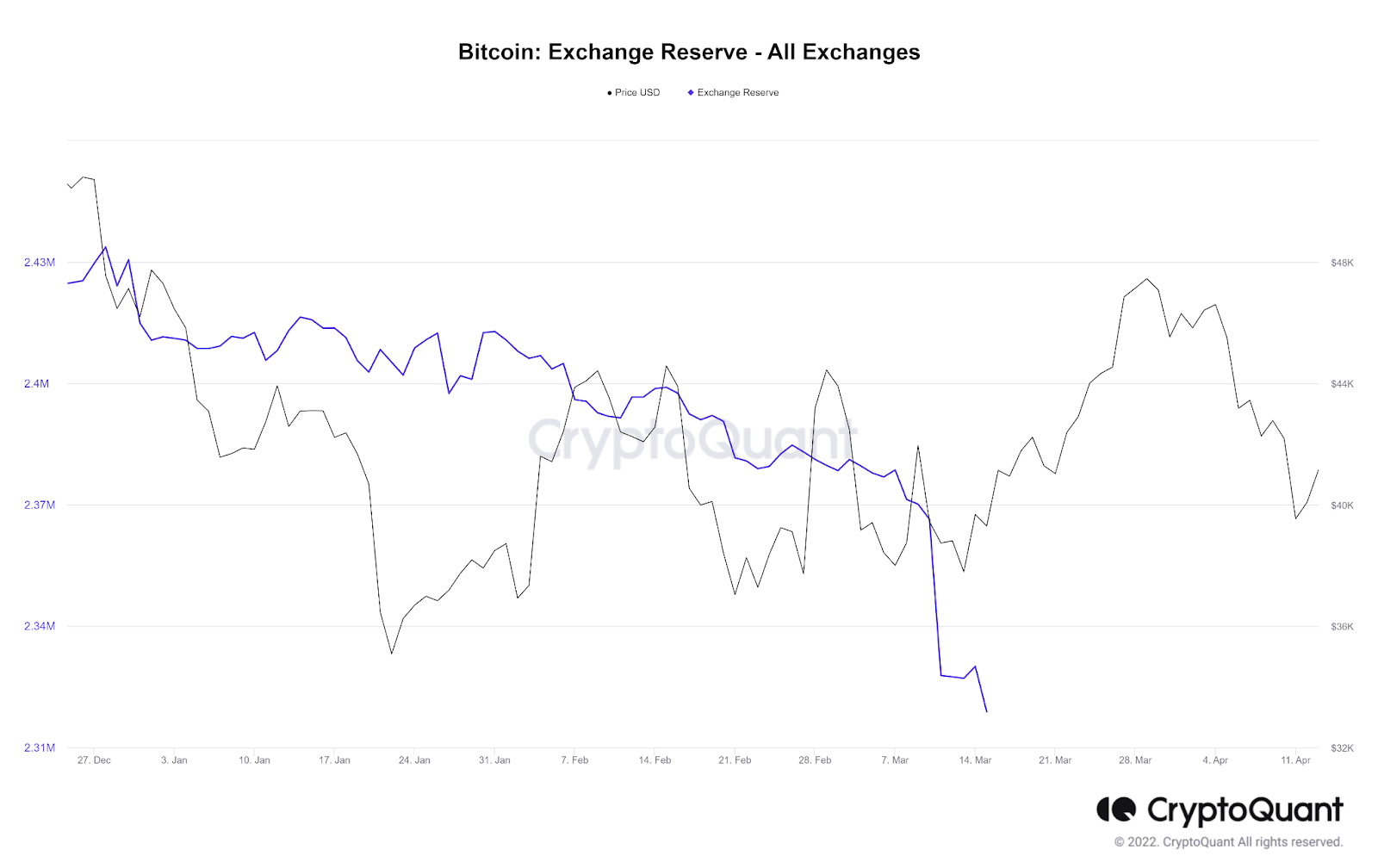

The chart below shows a decreasing trend, which indicates fewer coins are available on exchanges, creating a scarcity effect, which supports bullish movement and indicates the buying pressure is increasing.

Source: CryptoQuant

Web3 tokens with high potential

Checkout.com, a leading payment provider, has released the Demystifying Crypto report, outlining the results of surveys of over 30,000 consumers and 3,000 fintech companies around the world and providing an outlook for the adoption of crypto payments. According to it, crypto payments adoption will soar this year, with companies building bridges between Web2 and Web3 playing a key role.

As a result, Web3 projects are likely to gain momentum in the coming months, which will result in their tokens increasing in value. These are some of my top picks from the Web3 sector that are generating substantial protocol revenue and that I believe will appreciate in the near and long term.

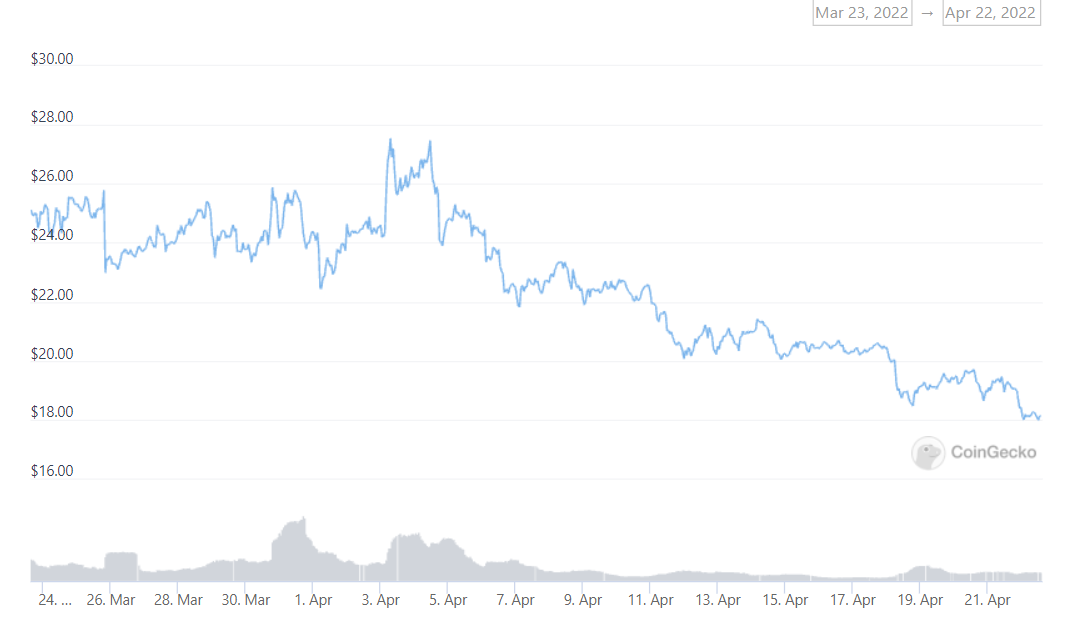

Filecoin (FIL)

Price: $18.98 | Market Cap: $3.67B

The Filecoin protocol is a decentralized storage network based on IPFS, or Interplanetary File Storage. The project is designed to use unused storage worldwide to create a low-cost storage market for users. The goal is to ensure that file storage is permanent and distributed across the Web. The opposite is true of centralized cloud storage solutions where data is stored on servers owned by private corporations.

FIL is the native cryptocurrency of the decentralized storage network. Filecoin will be the payment method for those who wish to access storage. Nodes that provide storage to the network will be rewarded with FIL. Despite not rallying currently, it still rose 3.8% month-over-month.

Source: CoinGecko

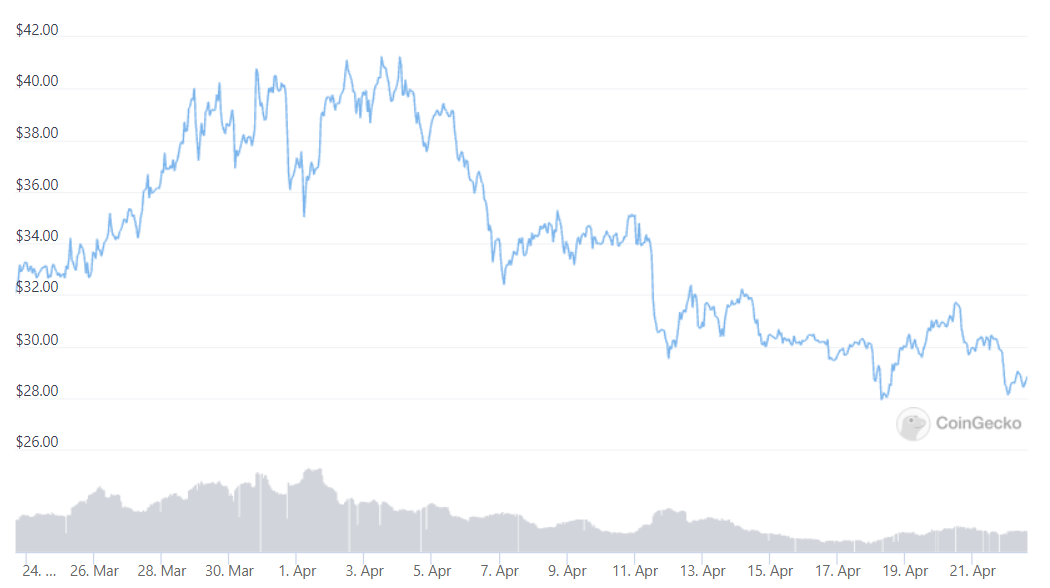

Helium (HNT)

Price: $18.10 | Market Cap: $2.10B

Helium (HNT) is a blockchain-based network that aims to prepare the Internet of Things (IoT) for the future.

Helium's mainnet allows low-powered wireless devices to communicate with each other and send data to one another.

Hotspots, which combine a wireless gateway with a blockchain mining device, act as nodes. HNT, Helium's native cryptocurrency token, is mined and earned by users who operate nodes. The HNT price has increased 42.6% since last year.

Source: CoinGecko

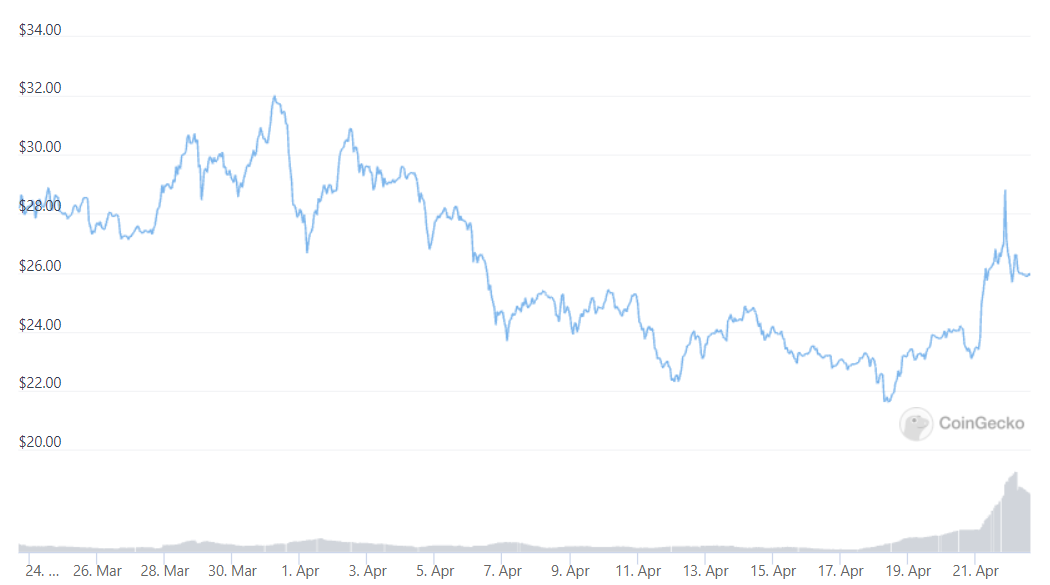

Arweave (AR)

Price: $28.76 | Market Cap: $962M

Arweave is a decentralized network that aims to offer indefinite storage of data. The network primarily hosts "the permaweb" - a permanent, decentralized web with a number of community-driven platforms and applications. It established a DAO in January 2020, comprised of core community members, to develop and expand its network and ecosystem.

Its flagship product is based on Arweave's "blockweave," a variation of blockchain technology in which each block is linked both to the one immediately preceding it and also to a random earlier one.

By doing this, Arweave claims more data will be stored since miners will be able to access randomly generated previous blocks to create new ones and get rewarded.

In June 2020, it released "profit sharing tokens," allowing developers to receive dividends when network transaction fees are generated from their apps, and hosts incubators focused on building permaweb-based applications.

Although AR is not soaring as high due to tough market conditions, it still posted a yearly gain of 25.6% against the greenback, and outperformed BTC by 67.66% year-over-year. The developing technology it promotes makes it very promising.

Source: CoinGecko

Livepeer (LPT)

Price: $25.96 | Market Cap: $549M

Livepeer is the first fully decentralized live video streaming network protocol. For new and existing broadcaster companies, the platform will provide a blockchain-based, economically efficient alternative to centralized broadcasting solutions. The platform enables developers to build video streaming applications. It has been live on Ethereum's mainnet since May 2018 and is run by a decentralized network of token-holding node operators. The network provides video streaming for traditional and web3 formats at a lower price than existing cloud providers.

LPT showed a weekly gain of 8.2% and outperformed Bitcoin by 16.77% year-over-year.

Source: CoinGecko

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ripple update: XRP shows resilience in recent crypto market sell-off

Ripple's XRP is up 6% on Tuesday following a series of on-chain metrics, which reveals investors in the remittance-based token held onto their assets despite the wider crypto market sell-off last week.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

Six Bitcoin mutual funds to debut in Israel next week: Report

Six mutual funds tracking the price of bitcoin (BTC) will debut in Israel next week after the Israel Securities Authority (ISA) granted permission for the products, Calcalist reported on Wednesday.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.