A forty-year high US inflation rate, skyrocketing energy prices, and indications that the US economic recovery may be damaged by the effect from sanctions against Russia over its invasion of Ukraine point to much-feared stagflation, a precursor to recession.

To address these issues, the Federal Reserve raised interest rates a quarter point at its meeting on March 15-16, 2022. This is the first rate increase since December 2018, with six more expected in 2022 and a hike cycle to last through 2023.

Why do interest rates matter?

Interest rates are on everyone's lips, and not without reason. Interest rates have a direct impact on the cost of borrowing and spending decisions made by businesses and households.

This is how it works for businesses:

-

The federal funds rate is the interest rate that banks, savings and loans, and credit unions charge each other for overnight loans.

-

Higher interest rates raise the cost of getting money, which negatively affects earnings and stock prices (except financials). It may be easy to finance a new project when interest rates are low, but if the expected interest payments double, the same project wouldn’t be financially successful.

-

The above factors determine what products and services are available and how investments are structured, which in turn affects global economic growth.

When thinking of it from the consumer's perspective, consider how much more money you would keep in your savings account if it earned 10% instead of 0.06%. Or, you might open a credit card at 3%, but you wouldn't borrow at 30% unless you had no other choice.

What does it have to do with Bitcoin?

Interest rates ripple across financial markets, most notably impacting risk assets.

There are varying opinions about which asset class Bitcoin belongs to. There are some who believe Bitcoin is the ultimate store of value and protection against inflation, comparable to gold. There is a definite reason for the rise in interest in Bitcoin in light of uncertainty surrounding the traditional financial system.

Yet, not just crypto fans are excited about Bitcoin's potential as a safe-haven investment. Zach Pandl, Goldman Sachs' co-head of foreign exchange strategy, said cryptocurrencies could continue to dethrone gold.

“Bitcoin may have applications beyond simply a ‘store of value’ – and digital asset markets are much bigger than Bitcoin – but we think that comparing its market capitalization to gold can help put parameters on plausible outcomes for Bitcoin returns,” Pandl explained.

The majority of crypto experts assert, however, that Bitcoin is following the same pattern as the stock market.

As evidence of this trend, the 60-day correlation between BTCUSD and the S&P 500 benchmark reached 0.54 on March 29, the highest level since October 2020.

Source: CoinMetrics

In this scenario, the rise in the Fed's rate would negatively affect the price of BTC just as it has historically affected stocks.

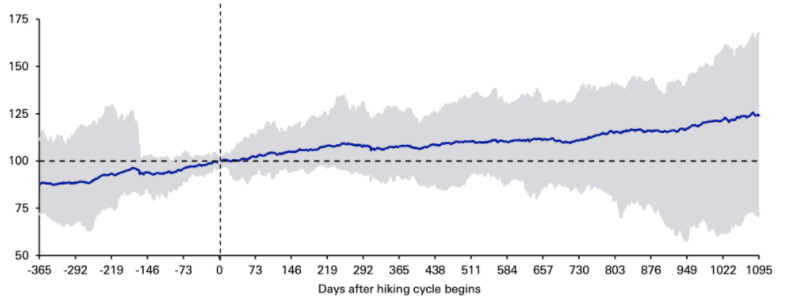

The study by Deutsche Bank analyzed the performance of the S&P 500 over 13 hiking cycles since 1955 and found that the index returned 7.7% after 365 days following the first hike, with the weakness beginning after 9-10 months and lasting a year or so.

Therefore, the negative effects of increasing interest rates on stocks and therefore Bitcoin may not be felt for some time. It is possible both markets will trend upward through at least December 2022 after the first rate hike on March 16.

Source: Deutsche Bank, Bloomberg Finance LP, GFD

However, investors are concerned this year will be out of the ordinary in light of the Russia-Ukraine war with unprecedented inflation and a potential recession.

Would Bitcoin survive a recession?

The markets are skeptical that the Fed can engineer soft lending by letting inflationary pressures cool without triggering a recession.

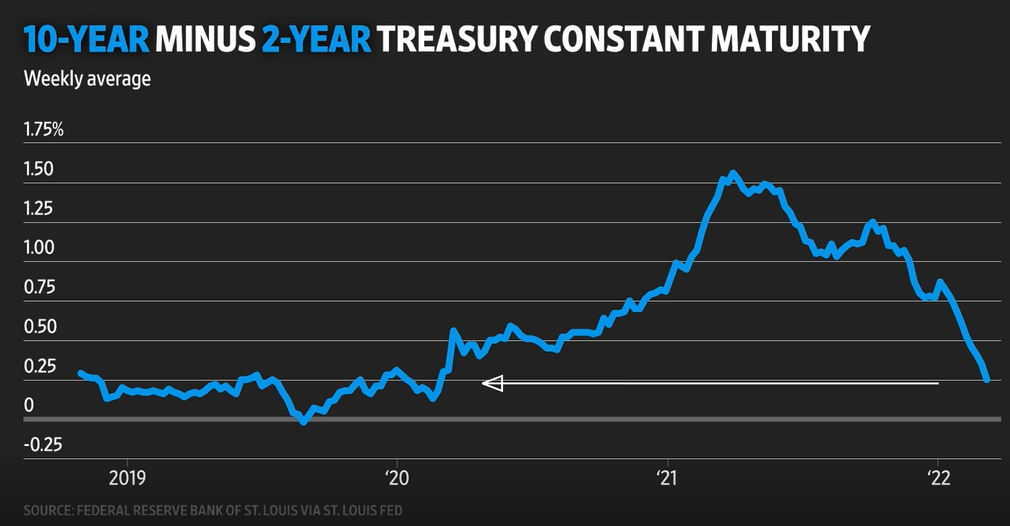

Yet this seems highly unlikely especially as the US Treasury yield curve nears inversion – a reliable recession warning indication for decades.

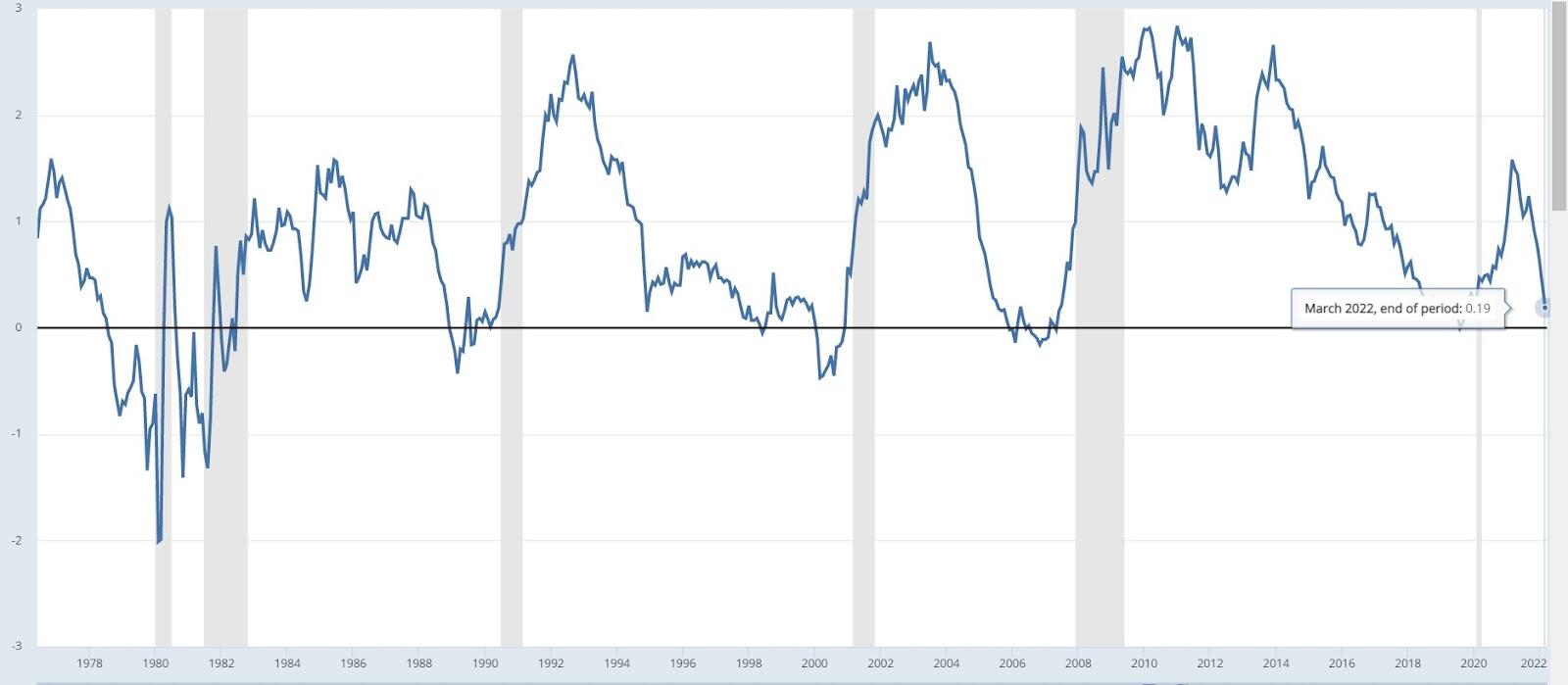

The US Treasury yield curve – the difference between 10 year treasury yield and its 2-year equivalent – typically invert to signal recession, while positive yield curve indicates stronger economic growth and an improving stock market. Currently, it is at its lowest level since July 2020.

Shaded areas indicate US recessions. Source: Federal Reserve Bank of St. Louis

The chart above shows that an inversion doesn’t coincide with a recession. Experts estimate that a recession typically follows an inversion within six to 24 months.

“And we now see the risk that the US enters a recession during the next year as broadly in line with the 20% to 35% odds currently implied by models based on the slope of the yield curve,” Goldman Sachs chief economist Jan Hatzius wrote to investors.

Historically, recessions and losses in the S&P 500 have gone hand-in-hand. The index dropped by 35.0% during the Great Recession.

Is Bitcoin doomed to the same fate? Possibly not. Even though there is a strong correlation, we can't say Bitcoin is the same as the S&P 500. Here’s why:

-

Long-term, Bitcoin outperforms major assets

|

Bitcoin |

Gold |

S&P 500 |

|

|

1 year: |

-19% |

+15% |

+17% |

|

2 year: |

+635% |

+18% |

+78% |

|

3 year: |

+1053% |

+51% |

+63% |

|

4 year: |

+586% |

+47% |

+76% |

|

5 year: |

+4,417% |

+57% |

+96% |

|

6 year: |

+11,299% |

+59% |

+124% |

|

7 year: |

+19,164% |

+63% |

+124% |

|

8 year: |

+10,181% |

+52% |

+145% |

|

9 year: |

+42,385% |

+23% |

+195% |

|

10 year: |

+975,748% |

+17% |

+227% |

Bitcoin & Traditional Assets ROI vs USD.

Source: Casebitcoin.com

-

Bitcoin was created for it

With the launch of Bitcoin in the midst of the Great Recession, the idea was to provide people with a currency they can use when conventional financial institutions fail.

-

Bitcoin is driven by other factors as well

Aside from macro trends, the price of Bitcoin can fluctuate because of regulations, changes in institutional adoption, or a host of other factors.

Bottom line

Considering how closely Bitcoin correlates with risky assets, it is likely that its price is also affected by macroeconomic trends and decisions made by the US Federal Reserve. We can look at the correlated asset's behavior to get an idea of what to expect. However, it would be incorrect to assume that Bitcoin works exactly the same way as a particular traditional asset class. It still retains its own class with its own history, goals, and association with a much broader technological revolution.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Chainlink looks at $14 resistance as outflows from exchanges signal continued demand

Chainlink exchange outflows exceed $120 million in the last 30 days, hinting at increasing accumulation. The breakout from a falling wedge technical pattern and an uptrending RSI indicator signal stronger bullish momentum.

Bitcoin extends gains toward $90,000 as ETFs inflows exceed $381 million

Bitcoin is extending its gains, trading above $88,000 at the time of writing on Tuesday after rising nearly 3% the previous day. Institutional demand seems to be supporting BTC’s recent price rally, with US spot ETFs recording an inflow of $381.40 million on Monday.

Top 3 gainers Fartcoin, POL, DeepBook: Altcoins surge as Bitcoin nears $90,000

Investors in select altcoins like Fartcoin, POL and DeepBook welcome double-digit gains. Bitcoin inches closer to $90,000, potentially waking up as digital Gold amid uncertainty in the macro environment.

Hyperliquid updates validator to 21 permissionless nodes, HYPE price breaks out

Hyperliquid’s validator update allows anyone to register, with the 21 largest stakes forming the active set. Validators must lock up 10,000 HYPE for one year, whether in the active set or not.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.