Can altcoins rise faster than Bitcoin (BTC) for a long time?

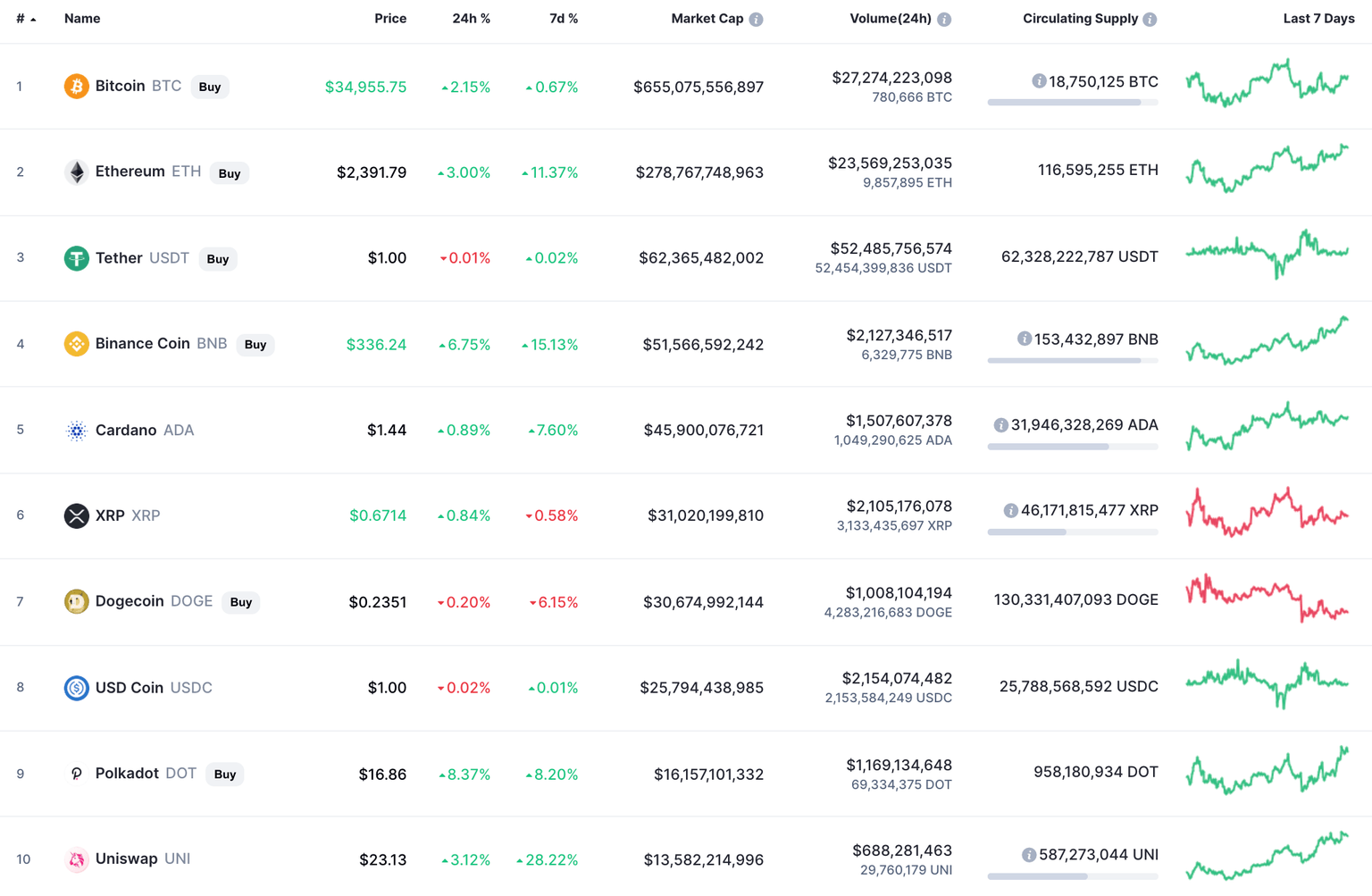

Bulls keep controlling the market, with the majority of the top 10 coins being in the green zone. DOGE is the only exception: the meme coin is currently trading in the red.

Top coins by CoinMarketCap

BTC/USD

Yesterday, buyers continued their attempts to push Bitcoin back into the channel. During the day, the Bitcoin price was able to test the top of the sideways range ($35,000).

BTC/USD chart by TradingView

However, the volume has not yet exceeded the average level, so the pair is consolidating sideways for the second week within the narrowing range. The Bitcoin price fell out of the channel again tonight, but it might be able to test its upper border again in the evening.

In the second half of this week, a false bullish breakout to the $37,150 level is possible. One believes that this level is able to bring the pair back to the support of $32,500.

Bitcoin is trading at $34,865 at press time.

XRP/USD

XRP is the smallest gainer on our list, with its rising by only 0.20 percent.

XRP/USD chart by TradingView

XRP has bounced off the support at $0.6525, which means that buyers are not going to give up. However, the price spike is not supported by high trading volume, and bears can come back to the game when the nearest resistance at $0.75 is about to be attained.

XRP is trading at $0.6698 at press time.

DOT/USD

Polkadot (DOT) is the top gainer today, rocketing by 9 percent over the last day.

DOT/USD chart byTradingView

Polkadot is trying to fix above the resistance at $17.15. The trading volume is going up, which is a good prerequisite for a possible price increase. If the daily candle closes above this level, there's a high chance that it gets to the mirror level at $18.73 soon.

DOT is trading at $17.11 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.