Can altcoins recover faster than Bitcoin (BTC) after the recent dump?

The bearish mood has changed to a bullish one fast as all of the top 10 coins have returned to the green zone.

Top coins by CoinMarketCap

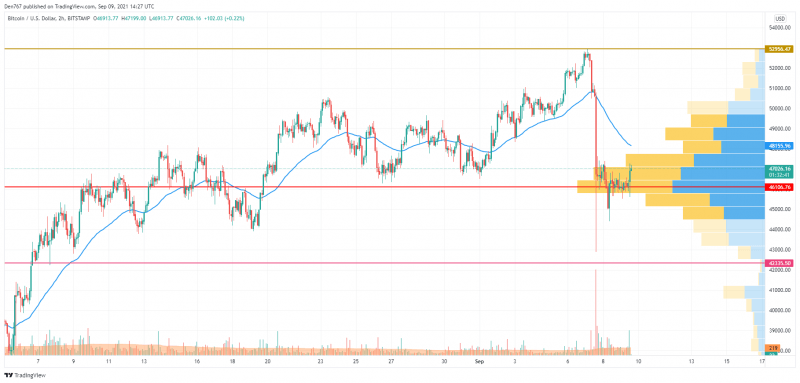

BTC/USD

Yesterday, in the first half of the day, there was pressure from the bears. They managed to push the Bitcoin price below $46,000, but sales volumes decreased and the daily low was recorded around $44,440.

BTC/USD chart by TradingView

In the afternoon, buyers returned the pair to the support of $46,000 and, by this morning, the price was trying to hold at this level in a narrow consolidation.

It looks like, today, bears may try again to test the $42,447 level. The most likely scenario is the further decrease in the rate of the decline.

Bitcoin is trading at $47,017 at press time.

ADA/USD

Cardano (ADA) is the biggest gainer from the list, rising by 7%.

ADA/USD chart by TradingView

On the daily chart, Cardano (ADA) is showing strength after a recent sharp decline. The rise is also supported by an increasing trading volume, which means that buyers are ready to restore the price to its previous positions.

If they manage to achieve it, there is a high chance to see a test of the peak around $3.10 soon.

ADA is trading at $2.573 at press time.

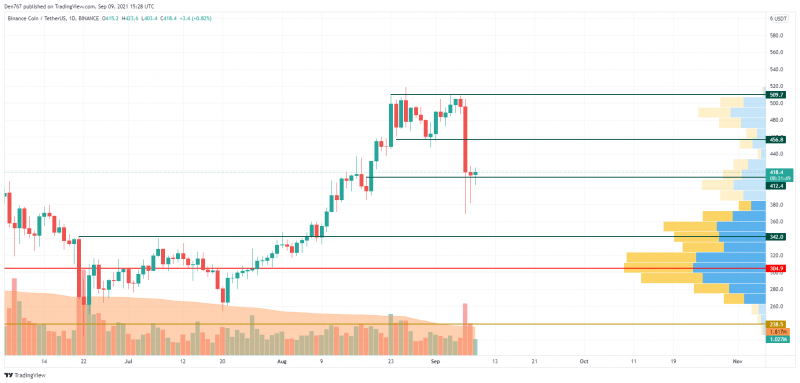

BNB/USD

Binance Coin (BNB) has gained the least from the list as the growth of the native exchange coin has been only 1.19%.

BNB/USD chart by TradingView

From the technical point of view, BNB has entered the bullish zone, and it seems that it is not going to fall. However, the volume is low, which means that traders are accumulating power for a further price blast. If they hold the price above $412, the resistance at $456 can be attained shortly.

BNB is trading at $418.40 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.