Can altcoins grow as fast as Bitcoin (BTC)?

The cryptocurrency market is getting out of the correction zone as the top 10 coins are located in the green zone.

Top coins by CoinMarketCap

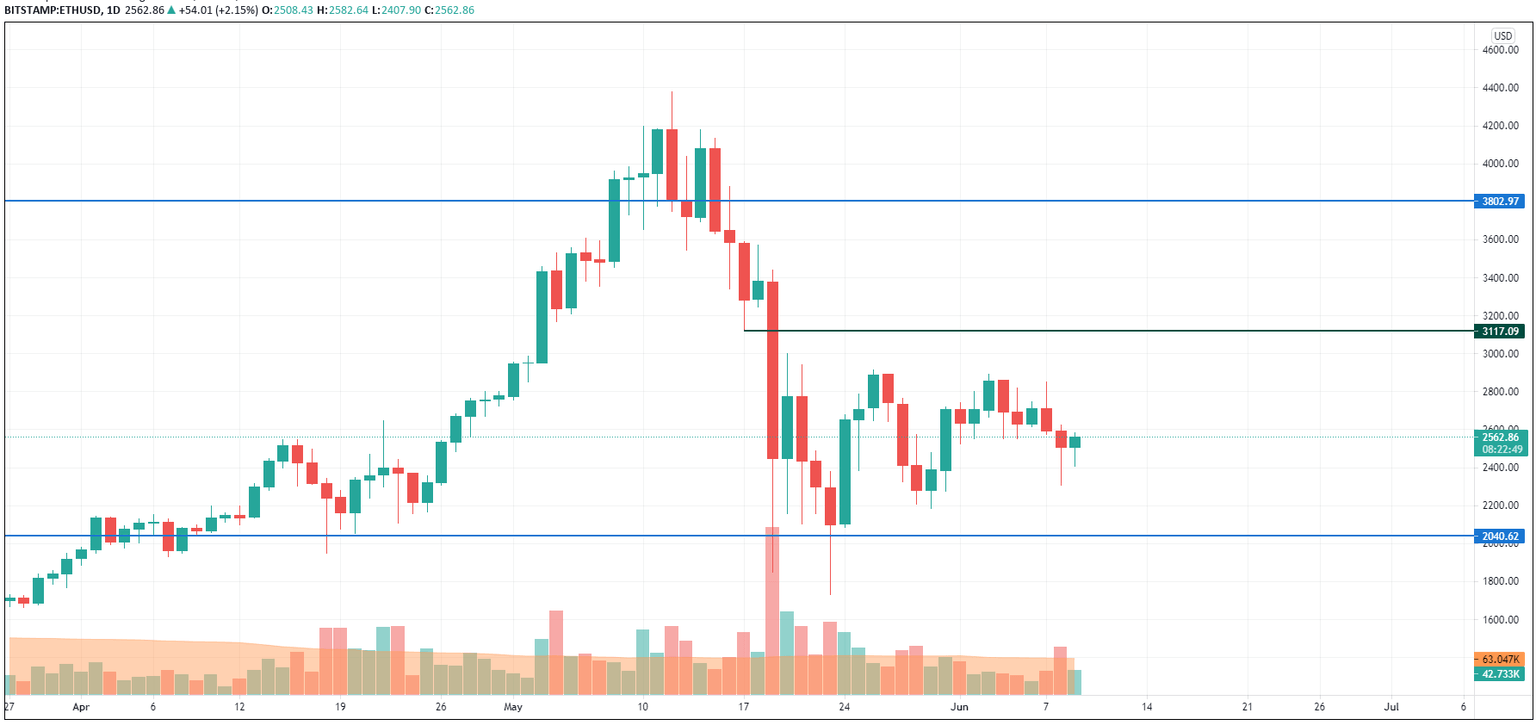

ETH/USD

Ethereum (ETH) is growing slower than Bitcoin (BTC) with a price rise of +9%.

ETH/USD chart by TradingView

Ethereum (ETH) keeps trading in the range, accumulating power for the next sharp move. Bulls have once again bounced back to the support at $2,400, having confirmed their power.

In this case, the more likely price action is ongoing growth to the vital mark of $3,000.

Ethereum is trading at $2,576 at press time.

ADA/USD

Cardano (ADA) is rising faster than Ethereum (ETH) with a growth of 12%.

ADA/USD chart by TradingView

Cardano (ADA) is looking bullish in the mid-term scenario after bulls have bounced back to the support at $1.50. At the moment, the altcoin is rising to the zone where most of the liquidity is focused. The potential level at which bears might seize the initiative is $1.70.

ADA is trading at $1.61 at press time.

XLM/USD

Stellar (XLM) has risen by over 7% over the past 24 hours.

XLM/USD chart by TradingView

Stellar (XLM) is no exception from the rule as bulls are accumulating power for ongoing growth. If they keep trading above $0.35, the next level at $0.39 might be achieved by the end of the week.

XLM is trading at $0.3515 at press time.

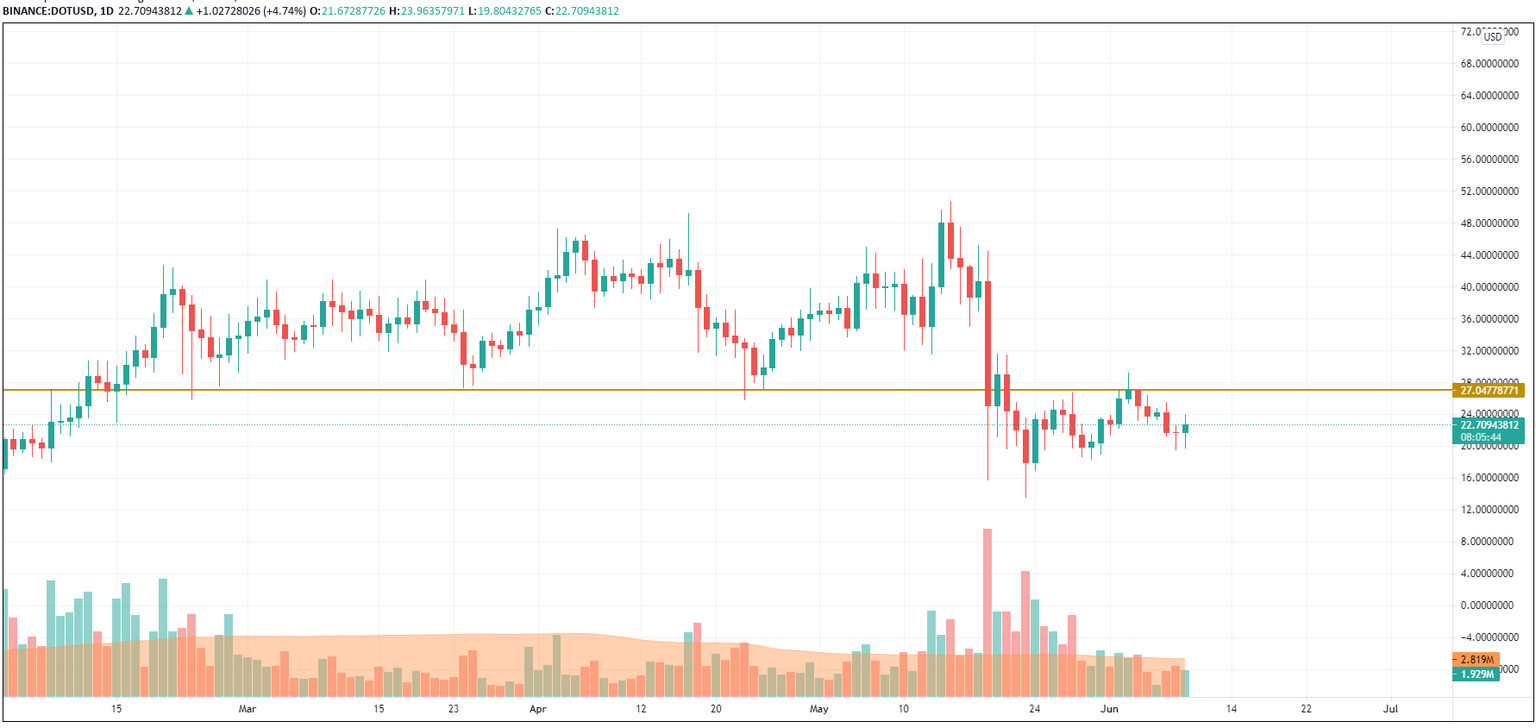

DOT/USD

Polkadot (DOT) has rocketed by 11% since yesterday.

DOT/USD chart by TradingView

The rise may not have ended yet as the altcoin is forming a double bottom pattern. The buying trading volume is going up slightly, which means that the resistance level at $27 can be attained within the next few days.

DOT is trading at $22.70 at press time.

LINK/USD

Chainlink (LINK) is the biggest gainer today, rising by more than 12%.

LINK/USD chart byTradingView

Chainlink (LINK) is about to break the resistance at $25.50. If bulls manage to do it, there are high chances of getting to the vital level at $30. However, buyers might find it difficult to do that from the start, as the rise is not accompanied by a high trading volume.

LINK is trading at $25.30 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.