CAKE, UNI and Serum prices rally amidst DeFi boom in crypto

- PancakeSwap, Uniswap and Serum prices climbed on June 26 as the Total Value Locked in DeFi protocols surged over the past week.

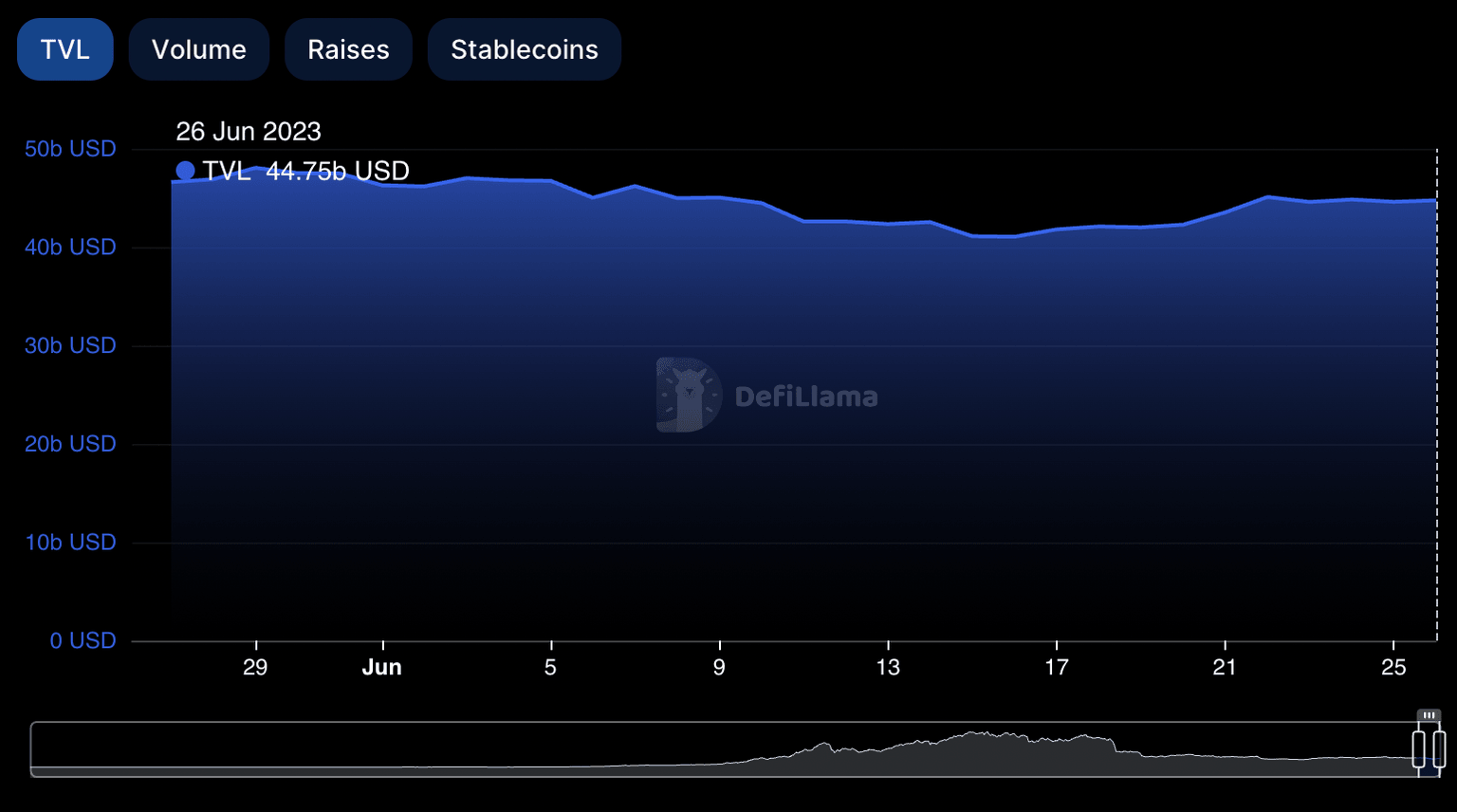

- DeFi TVL rose 6.5% between June 19 and 26, signaling rising interest among market participants.

- CAKE, UNI and Serum prices wiped out losses from the past week.

Cryptocurrencies in the DeFi segment have started their recovery as the combined value of assets locked in these protocols rises. Based on data from crypto intelligence tracker DeFiLlama, Total Value Locked (TVL) climbed 6.54% in the last week.

As the sentiment among crypto market participants improves, these tokens yielded gains for holders. Meanwhile, Ethereum Layer 2 scaling solutions and altcoins are reeling from the impact of the Securities and Exchange Commission’s (SEC) crackdown.

Also read: Arbitrum boosts Layer 3 network development as Polygon, BNB Chain lag behind

CAKE, UNI and Serum prices begin recovery

Pancake Swap (CAKE), Uniswap (UNI) and Serum (SRM) offered gains to holders over the weekend and the past week amidst a market-wide recovery in DeFi tokens. CAKE price rallied 14.28% from June 19, trading at $1.60 at the time of writing.

TVL of DeFi protocols

Pancake Swap started its recovery in the past week and yielded nearly 12% gains over the weekend. DEX’s token has been teasing a launch of a new bridge and this is likely a bullish catalyst. Moreover, sentiment among crypto market participants has improved as the SEC’s crackdown has been limited to altcoins and Ethereum Layer 2 scaling solutions like Solana (SOL) or Polygon (MATIC), among others.

Uniswap (UNI) price rallied 21% since June 19, climbing from June 19 open of $4.48 to $5.44 on Monday. Over the weekend, UNI yielded 11.7% gains. The DeFi token was one of the top performers among decentralized finance tokens ranked by market capitalization.

Despite recent decline in network growth and user activity, UNI price continued its upward trend on Binance. Find out more about Uniswap’s on-chain activity here.

In May, crypto intelligence tracker Santiment predicted that Serum (SRM) price is bottoming out, noting that altcoins continue flushing out as Bitcoin recovers. Since then, SRM price has nearly doubled, climbing from $0.080 to $0.124 between May 10 and Monday.

SRM price rally gathered steam over the past week, rallying 125%, from $0.055 to $0.124, rewarding holders with three-digit gains. The DeFi token ranks among top gainers while altcoins in the top 30 attempt a slow recovery on Monday.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.