Caitlin Long's Wyoming Crypto Bank takes a step toward Fed membership

It's no guarantee of Fed approval, but Avanti Bank now has a routing number through the American Bankers Association.

Wyoming-based crypto bank Avanti is one step closer to potentially acquiring a master account with the Federal Reserve, the U.S. central bank.

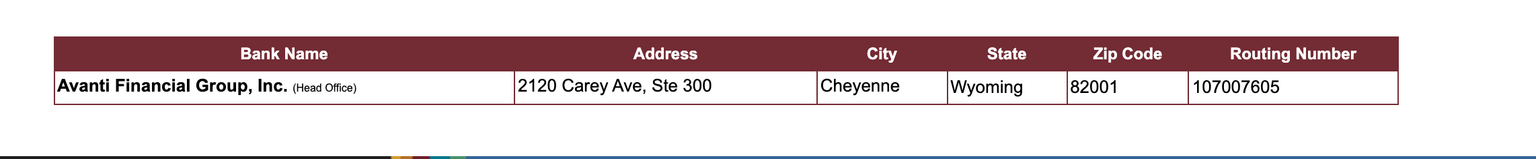

Avanti Bank now has a routing number issued by the American Bankers Association (ABA), a key milestone in the process to receive a Fed account. Routing numbers are used to identify banks for checks and other transactional purposes, and are only issued to federal or state-chartered financial institutions that are also eligible to have a Fed account, according to the ABA’s website.

CoinDesk confirmed that a routing number was issued on the ABA website. An ABA spokesperson did not immediately return a request for comment.

Avanti routing number

A number of Wyoming special purpose depository institutions (SPDIs), including Avanti and Kraken, have long sought master accounts with the Fed. Any bank that has such an account is eligible to deposit funds at the Fed, as well as tap the global payments system.

University of Alabama School of Law professor Julie Hill noted on Twitter that Avanti had received a routing number. A routing number in and of itself is not confirmation that a bank has a master account, however, she told CoinDesk.

Any bank trying to secure a master account needs to have a routing number. Often the ABA will ask for an opinion letter from the Fed confirming the entity in question is eligible, Hill said. Usually this happens if the ABA "believes it is unclear" if the applicant is eligible, she said. Once the number is issued, the Fed will begin processing the application.

The Fed can still reject an application after a routing number is issued, Hill cautioned.

“I don’t think that just because Avanti has a routing number necessarily means they'll get a master account, but it’s typically a first step. You have to have a routing number before you can get a master account,” she said.

In November, members of a Fed advisory council made up of executives from banks, thrifts and credit unions voiced concern about the prospects of institutions with novel charters accessing the Fed payments system.

"If the access is granted, these institutions may introduce increased risks to the financial system," according to the minutes of the meeting. SPDIs, the document noted, "hold uninsured dollar deposits. The deposits will be backed by 100% reserves, and the funds on deposit cannot be loaned by the bank. This structure allows those SPDIs to avoid Federal Deposit Insurance Corporation (FDIC) and Bank Holding Company Act (BHCA) supervision."

Caitlin Long, the founder and CEO of Avanti, said she was “optimistic that the Fed will grant its applications for a master account and membership” in a statement emailed to CoinDesk by a spokesperson.

“Avanti meets or exceeds the legal and prudential regulation requirements, and has been purpose-built to create a safe and sound bridge between the US dollar financial system and digital assets,” said Long, a Wall Street veteran who has lobbied to make her home state of Wyoming a blockchain industry hub.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.