Cahinlink Market Update: WEF names Chainlink a technology pioneer, drives LINK/USD recovery

- Chainlink is recognized as one of the leading innovator.

- LINK/USD has outperformed other altcoins out of top-20.

Chainlink (Link) is one pf the best-performing altcoins of the week. The price of the token bottomed at $3.64 on Monday, May 15 and hit $4.24 during early Asian hours on Thursday. At the time of writing, LIN/USD is trading at $4.18 having gained over 3.5% on a day-to-day basis. LINK is the 13th largest digital aset with the current market value of $1.46 billion and an average daily trading volume of $325 million.

WEF names Chainlink as a technology pioneer

Chainlink is a decentralized oracle network that connects smart contracts with data from the real world in a secure and reliable way. The techology introduced by the project has been much-in-demand recent;y due to the growing popularity of DeFi applications.

Chainlink is one of 100 startups recognized by the World Economic Forum (WEF) as the “technology pioneers” of 2020. The WEF included Chainlink in the list of leading emerging technology providers and innovators and acknowledged its potential.

Commenting the news, Sergey Nazarov, the co-founder of Chainlink, said:

Using smart contracts on the blockchain to bring enforceable guarantees to contractual obligations has widespread social and economic benefits. We’re proud to play a role in bringing accountability and automation to global and local economies, and we look forward to contributing to Forum dialogues on this challenge.

By joining the WEF’s Global Innovators community, Chainlink will be able to bring their technology to influencial conferences around the globe and foster transformations in dfferen industries.

LINK/USD: Technical picture

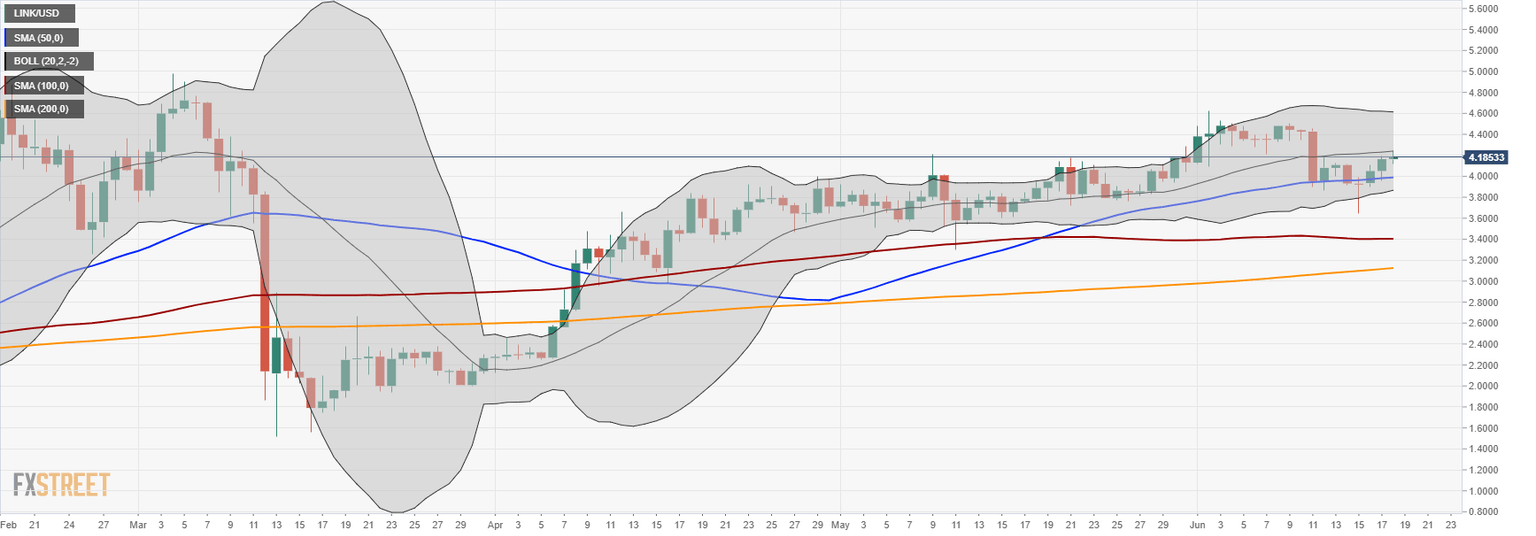

The news served as a bullish trigger for LINk and initiated the rally. On a daily chart, the price came close to the middle line of the risong Bollinger Band (now at $4.20). Once it is out of the way, the recovery may be extended towards $4.60. THis resistance is created by the previous recovery high, and it separates the coin from a stronger upside movement towarads psychological $5.00.

On the downside, the initial support comes at $4.00. It is followed by daily SMA50 at $3.60 and the lower line of the daily Bollinger Band at $3.20. A sustainable mov ebelow this area will open up the way to psychological $3.00 where a fresh buying interest is likely to appear.

LINK/USD daily chart

Author

Tanya Abrosimova

Independent Analyst