Bullish Crypto Forces Stir Under the Surface

A casual observer might think this week was quite dull in cryptoland, as leading coins like Bitcoin and Ethereum traded mostly sideways.

The sideways action is reflected in the Weiss 50 Crypto Index (W50), which posted only moderate gains of 2.19% on the week.

If we remove Bitcoin from the equation, the picture is somewhat better: The Weiss 50 Ex-Bitcoin Index (W50X) moved up a more respectable 4.91%.

This is our first clue that altcoins are again leading the way, after the important Oct. 23 low in Bitcoin.

But here’s where it really begins to get interesting …

The Weiss Mid-Cap Crypto Index (WMC) posted solid gains on the week, moving up 7.61% and ...

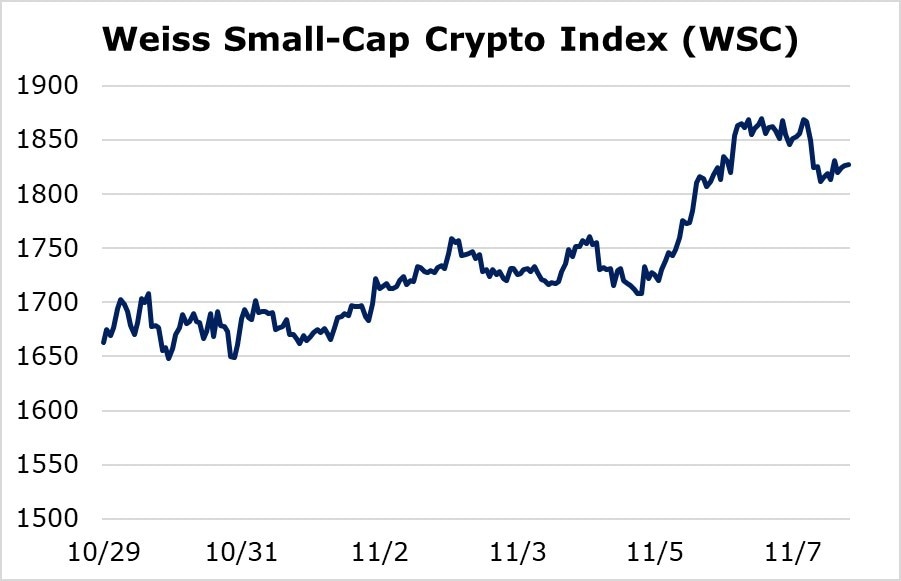

And the altcoin bullishness was most apparent in the Weiss Small-Cap Crypto Index (WSC), which jumped a healthy 9.88%.

By comparison, the Weiss Large-Cap Crypto Index (WLC) was basically flat, up 1.38%.

Overall, this is in sharp contrast with what we’ve seen throughout 2019, when Bitcoin and large-cap led the market higher. That was a sign of investor caution, as they focused mostly on top-tier projects.

But ever since the recent pro-blockchain China announcement, the picture has changed. Now, the small- and mid-caps have been leading the way, just as they did this week.

This is precisely the type of price action we see in secular crypto bull markets.As we’ve been pointing out, it adds credibility to the idea that Oct. 23 wasn’t just a temporary turning point in crypto markets. It was an important low.

So, while they might not be raging just yet, the mood is slowly shifting toward the bulls, step by step. I’ll be keeping an eye on how this development progresses.

Author

Juan Villaverde

Weiss Crypto Ratings

Juan Villaverde is an econometrician and mathematician devoted to the analysis of cryptocurrencies since 2012.