BTC/USDT: Crypto market is recovering

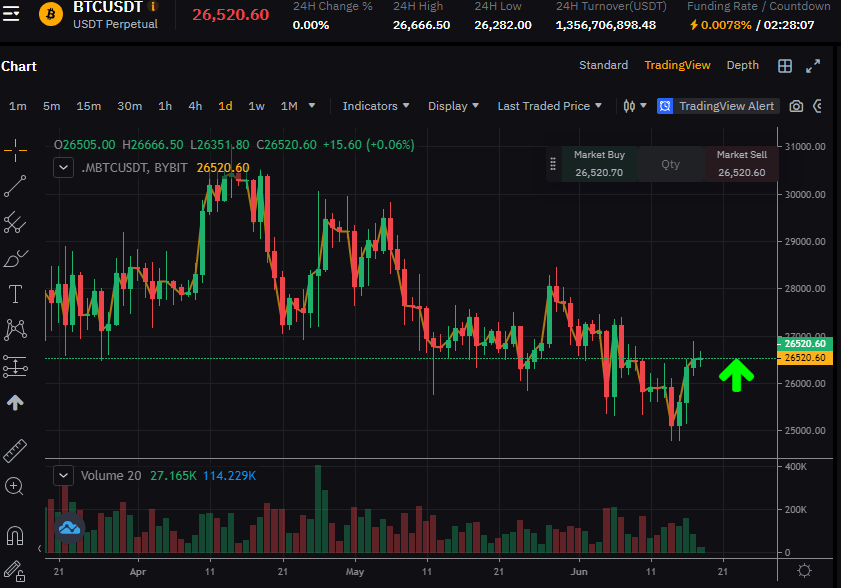

The cryptocurrency market seems to be recovering positive dynamics after a noticeable drop since the beginning of last month. The leader here again is BTC, which is currently holding near the 26500.00 mark.

Market participants and buyers of cryptocurrencies cheered up a little after the recent Fed monetary policy meeting, at which the interest rate was kept in the range of 5.00%-5.25% after ten consecutive increases.

In May, the annual consumer inflation rate slowed to 4.0% from 4.9% a month earlier, and the base value excluding fuel and food prices from calculations was 5.3% instead of 5.5%. Fed officials have declared their readiness to return to the "hawkish" course in case of risks of consumer price increases. But so far, inflation is declining, business activity is recovering, and the situation on the labor market remains stable.

Immediately after this decision of the Fed, cryptocurrencies almost did not react to it in any way, given the lawsuits against the largest crypto currency companies initiated by the US Securities and Exchange Commission (SEC). In particular, thirteen charges were brought against the Binance exchange, including distribution of unregistered BNB and BUSD tokens and illegal staking.

Some crypto market experts suggest that as a result, the American government will oblige American crypto platforms to register with the SEC as brokers, and tokens will be classified as securities, which, in turn, will put unprecedented pressure on the industry.

This situation and the resulting risks of losses in the crypto industry have become a catalyst for the withdrawal of investor funds from crypto funds. Here, a kind of record belongs to BTC (a loss of $ 52.0 million in a week).

Nevertheless, at the end of the week, an upward correction began on the crypto market, which may again develop into a stable bullish trend.

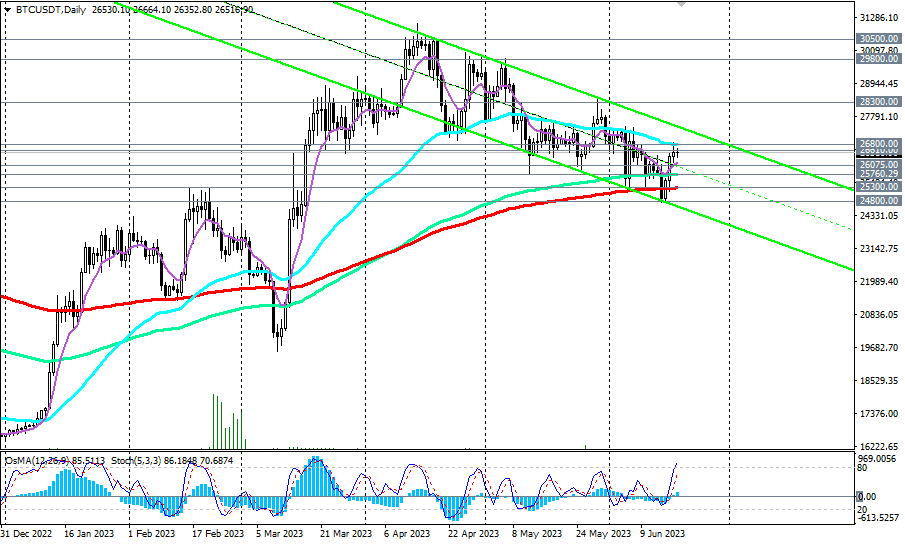

So, the BTCUSDT pair, having found support at the key level of 25300.00 (EMA200 on the daily chart), attempted to break through the resistance at 26800.00 (EMA50 on the daily chart) on the weekend, but then retreated to the current level of 26500.00.

If the second attempt turns out to be more successful, then the prospect of growth opens up to the levels of 28300.00, 29800.00, 30500.00. As you can see, now is a good time to resume long positions and buy.

An alternative scenario will be associated with a breakdown of the local support level of 24800.00. In this case, restrictive stops in long positions will be appropriate already below the important support levels of 26075.00 (EMA200 on the 1-hour chart), 25760.00 (EMA144 on the daily chart).

Support levels: 26075.00, 25760.00, 25300.00, 24800.00.

Resistance levels: 26610.00, 26800.00, 28300.00, 29800.00, 30500.00.

Author

Yuri Papshev

Independent Analyst

Independent trader and analyst at Forex market. Trade experience - more than 10 years. In trade Yuri Papshev uses a combination of fundamental and technical analysis.