BTC/USD: The trend is your friend

It was another impressive week for the major cryptocurrency pairing BTC/USD, adding nearly +10.0% and carving out a second straight weekly gain to reach a fresh record high of $70,198.

Traders eye dip-buying opportunities

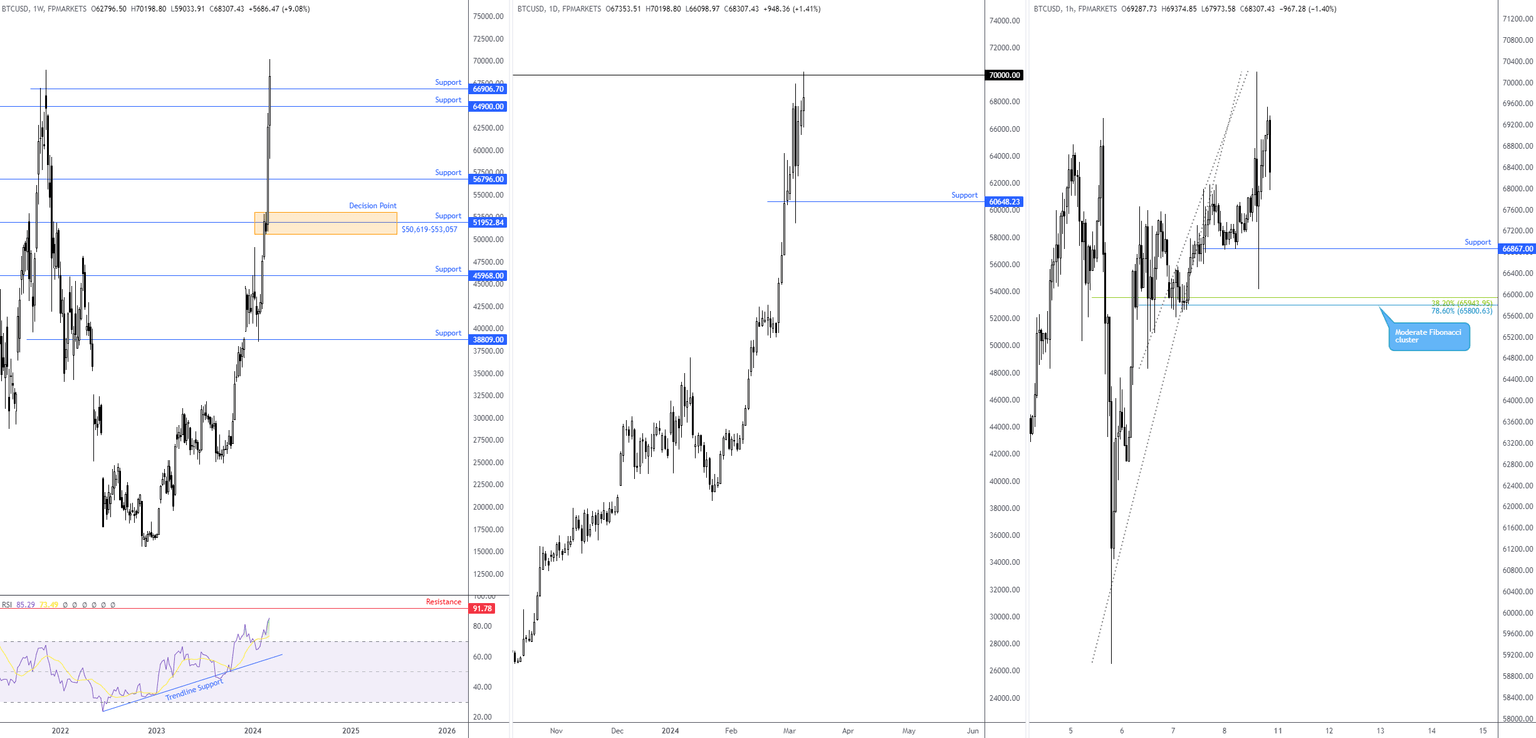

It is clear across all primary timeframes that the trend in this market is bullish, prompting traders and investors to seek dip-buying opportunities. Nonetheless, as a point of note, those who follow the Relative Strength Index (RSI) will acknowledge that the weekly chart’s RSI offers extremely overbought conditions at present. Yet, given the uptrend in this market, this indicator could remain overbought for a prolonged period (common view) and even reach as far north as indicator resistance at 91.78 (levels not seen since early 2021).

Moving forward, out of the weekly scale, support is now forged between $64,900 and $66,906. This will be a widely watched area this week and if tested, buyers may drop down to the lower timeframes to seek bullish scenarios. From the daily timeframe, you will note that $70,000 welcomed sellers at the end of the week, with the only obvious support calling for attention seen at $60,648 (located beneath the current weekly support zone).

Attention on weekly/H1 support

Albeit $70,000 serves as resistance now, the combination of the weekly support level at $66,906 and H1 support from $66,867 could provide sufficient technical evidence to have buyers commit at this point should a test of the area play out this week. An alternative scenario to keep in mind, nevertheless, is a whipsaw beneath H1 support to test the moderate H1 Fibonacci cluster just south of the $66,000 neighbourhood (positioned within the weekly support zone).

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,