Bitcoin: Set to become part of the financial tapestry

One of the tests for the longevity of Bitcoin’s long term viability is how usable it is? The more places that BTC can be used, the more point there is in owning it. In short, BTC needs to go from the realm of ‘techno-savvy only’ to ‘Mr & Mrs Smith’.

That tipping point looks like it is about to be reached. The news that helped push it over the edge was that Amazon might soon start accepting BTC payments. People may be able to use BTC to buy things on Amazon; this is big news. This builds on a number of important news stories. Ecuador has made Bitcoin legal tender and citizens have been using mobile phones to trade small fractions of Bitcoins for payments. PayPal allows users to buy, sell, and hold Bitcoin.

There are also other signs that cryptocurrencies are becoming part of the fabric of the world around us. Travala, the world’s biggest blockchain-based online travel agency, allow users to pay for flights and hotels with various cryptocurrencies. Pavilions Hotels and Resorts from Hong Kong announced this month that guests would be able to book a stay at its 14 properties worldwide and pay by cryptocurrency.

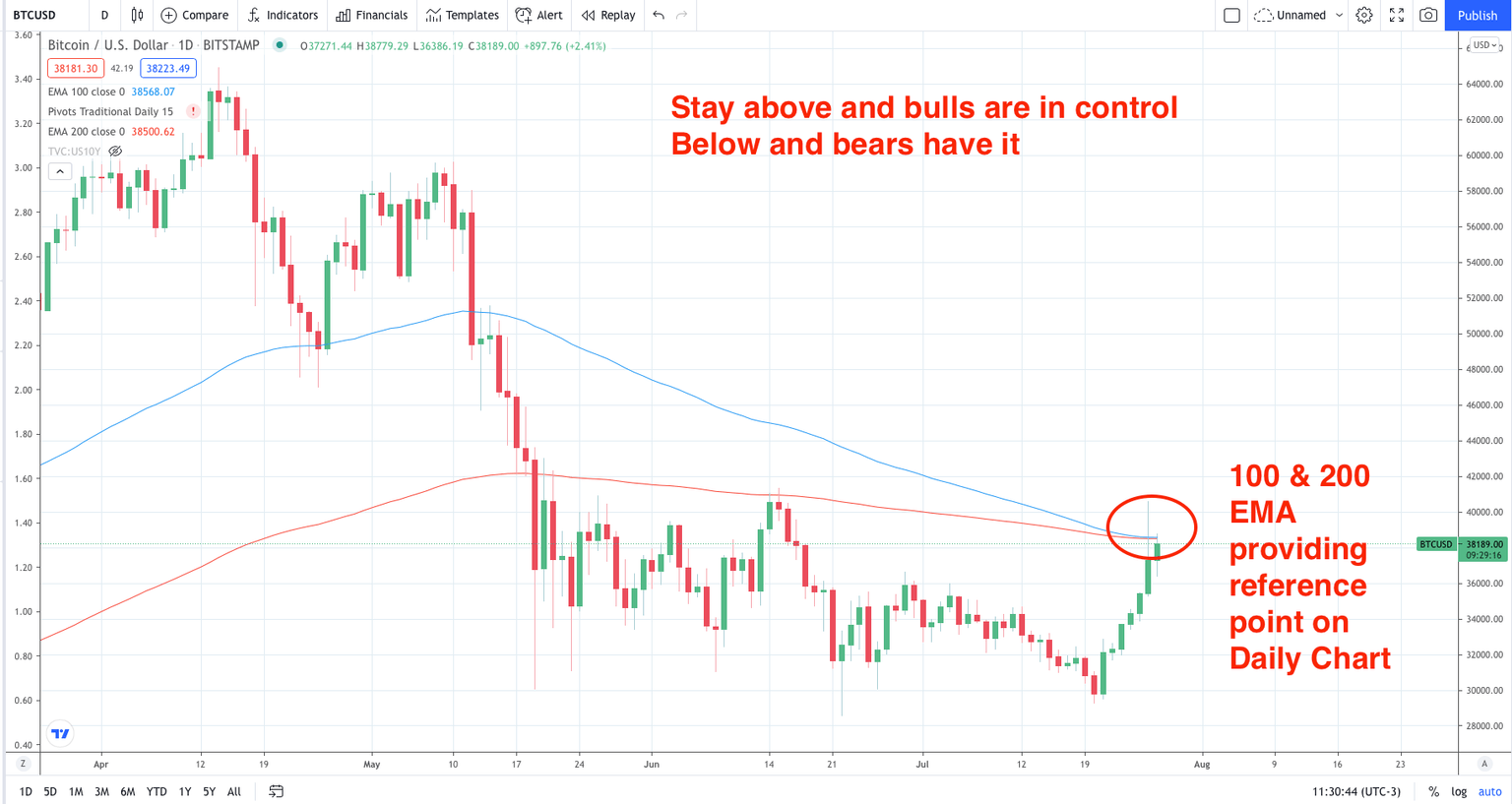

So, the longevity of BTC seems pretty stable now as the critical mass for adoption has shifted. Does this mean that BTC should just be purchased like any other currency? No. The volatility of BTC means that huge variations in price will hammer those who are using leverage. So, if you are relatively new to trading, you must always be aware of what your total ‘at risk’ amount is. Remember that BTC can move double-digit percentage-wise across a few days. So, although BTC looks like it is here to stay, it comes at the price of significant volatility.

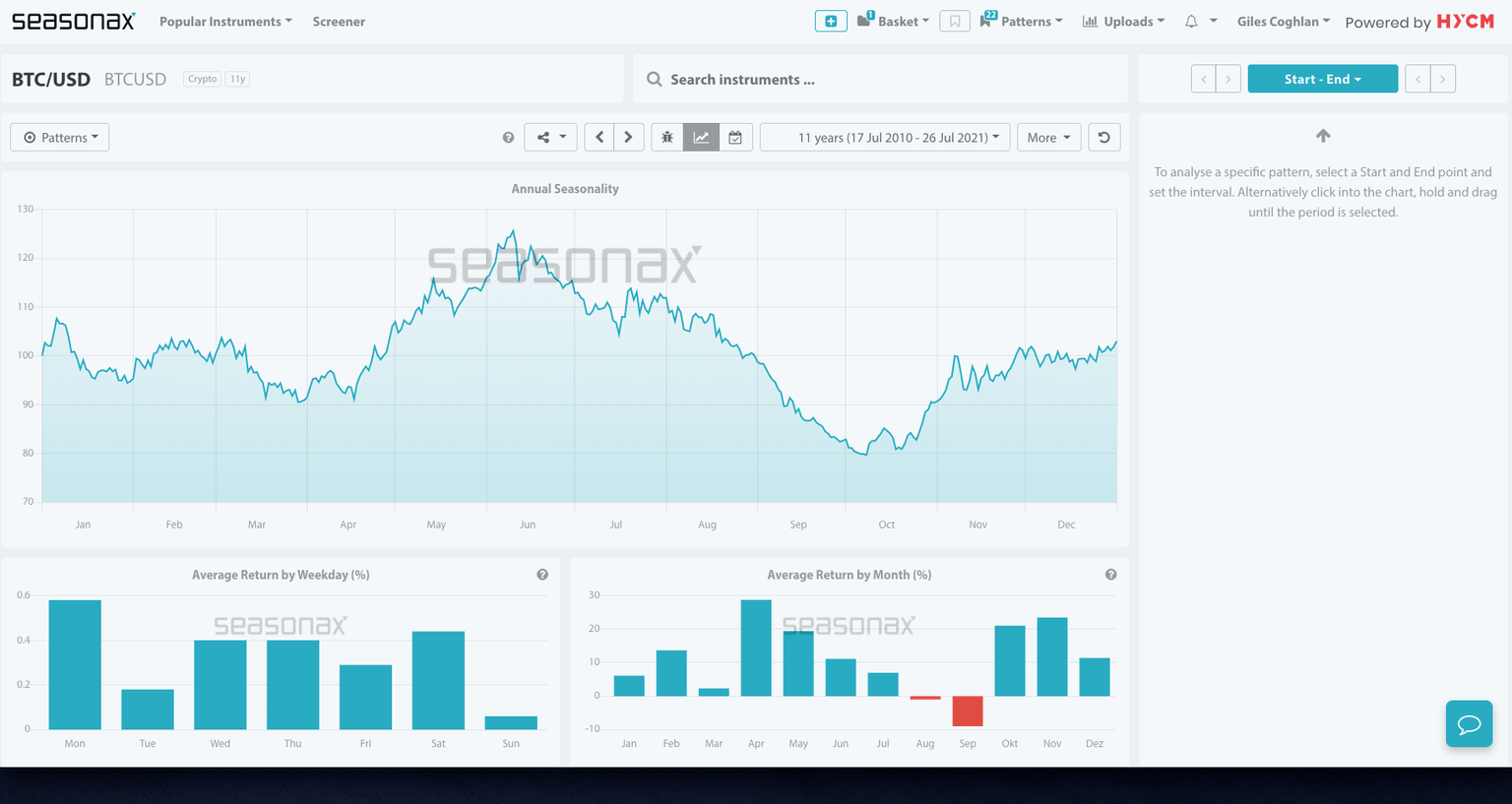

The seasonal pattern for BTC is also quite interesting. The average return by month shows that the only two months when BTC typically loses value are coming up in August and September. The strongest month is in November. The reasons for this seasonal bias are unclear and should not unnecessarily sway investors.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.