BTC/USD outlook: Bitcoin trades in a quiet mode, awaiting Trump's decision on tariffs

BTC/USD

Bitcoin holds under one-week high and in relatively quiet mode on Friday, as markets await decision of President Trump over imposing of 25% tariffs on imports from Canada and Mexico until February 1 deadline.

Compared to other alternative assets (Gold surged to new record high today) Bitcoin so far did not react, though imposing of tariffs, which will disrupt annual trade worth around $1.5 trillion, would send strong shockwaves through the markets and lift the largest cryptocurrency, also used as new safe haven asset.

Bitcoin regained traction in January and registered around 10% monthly gain, signaling that December’s pause, when strong upside rejection and close in red has been registered, was likely temporary.

Overall sentiment remains positive (Bitcoin hit new record high in January) as traders expect Trump’s administration to start working on overhauling crypto market regulations and create Bitcoin state reserves (one of Trump’s key promises) that would offer strong boost to the price.

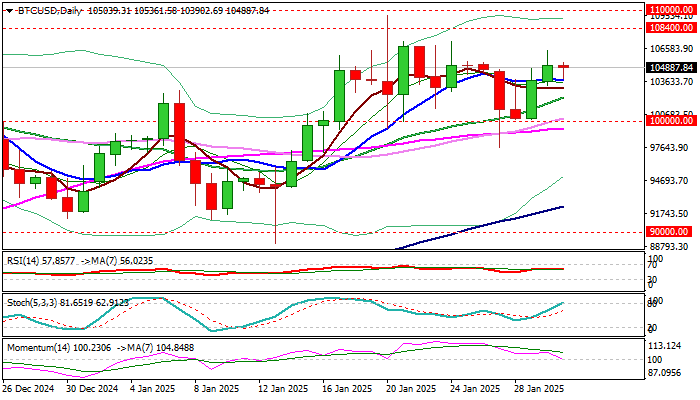

Round-figure 110K level marks initial target, break of which would spark stronger acceleration and risk test of 120K target.

Broken Fibo level at 103830 (76.4% of 108400/89038) offers immediate support, followed by 102419 (daily Tenkan-sen) and 101K (broken Fibo 38.2%), guarding psychological 100K support.

Res: 106440; 108400; 109582; 110000.

Sup: 103830; 102419; 101000; 100000.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.