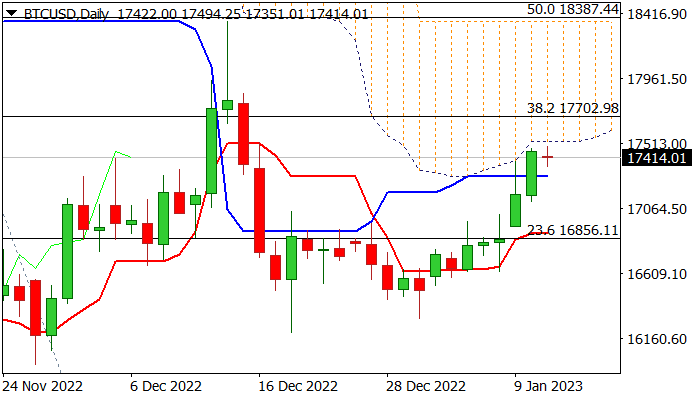

BTC/USD outlook: Bitcoin keeps bullish bias but daily cloud limits the action for now

BTC/USD

Bitcoin is trading in a quiet mode on Wednesday, after rally in past two days faced headwinds from the base of thick daily cloud (1752), reinforced by Fibo 61.8% of 1863/1620 bear-leg.

Overbought conditions on daily chart also contribute to current conditions, although near-term bias remains with bulls, as positive momentum is still strong and DMA’s (10/20/30) are in bullish configuration.

Bullish scenario requires firm penetration into daily cloud which would bring in focus next key barrier at 1836 (cloud top/Dec 14 high/50% retracement of 2128/1548 fall) and signal bullish continuation of recovery from 2022 low (1548).

Repeated failure under daily cloud would increase downside risk, but near-term structure should keep positive stance above rising 10DMA (1689) which today formed a bullish cross with 20DMA).

Res: 1752; 1770; 1810; 1838.

Sup: 1714; 1689; 1630; 1620.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.