BTC/USD

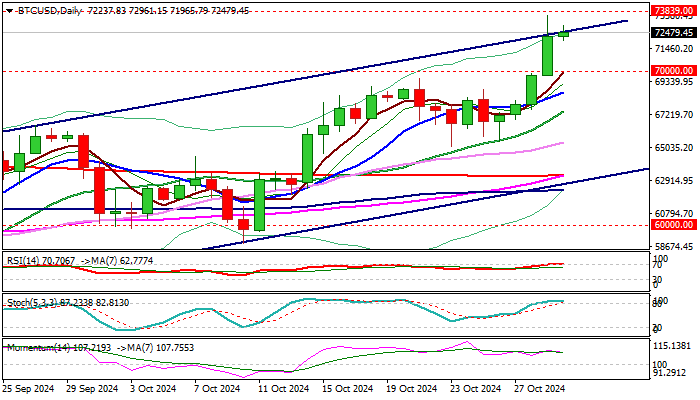

BTC/USD keeps firm tone and holding near new record high (73839 posted in March) after strong acceleration on Tuesday (up 3.6% for the day) rose above 73K for the first time in 7 ½ months and spiked to the levels near all-time top.

Bitcoin is moving within a larger uptrend for the two months after correction from the record high has bottomed, with subsequent rally signaling that corrective phase is almost over.

Bitcoin benefited from geopolitical and economic uncertainty, with the latest growing expectations from Trump’s victory on US presidential election (market see Trump’s stance towards cryptos as more favorable) providing strong tailwinds to the world’s largest cryptocurrency.

Technical studies on daily chart are bullish but overbought, adding to uncertainty as the price is attacking a critical resistance zone.

Bulls cracked the trendline (72725) which marks the upper boundary of larger bull channel and firm break (through trendline and record high) is needed to generate signal of bullish continuation.

However, Tuesday’s false break through trendline (daily candle with long upper shadow warns of growing offers) and the price continuing to struggle at this zone, requires caution.

Near-term bias is expected to remain with bulls while the price holds above 72000 zone (former tops) and guard lower pivot at 70000, loss of which to likely signal deeper drop.

US economic data (GDP, labor) will be closely watched, but stronger direction signal is expected from the results of the US election.

I assume that Trump’s victory will fuel fresh acceleration higher and join analysts who see Bitcoin rallying towards 100K in coming months.

On the other hand, Harris’ victory would likely spark fresh sell-off, but unlikely to be an ‘end of the world’ for Bitcoin, as platform of Democratic party is also friendly oriented to the cryptos.

Res: 72725; 73615; 73839; 74961.

Sup: 72960; 72000; 71000; 70000.

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

Uniswap Price Forecast: Technical outlook suggests a bullish breakout ahead

Uniswap is trading slightly below $8 on Thursday after rejecting a key resistance level on Wednesday. A successful close above this threshold could indicate a rally for the decentralized exchange.

MicroStrategy set to raise $42 billion over 3 years to buy Bitcoin

MicroStrategy released its third quarter financial report on Wednesday. The report revealed its 17.8% BTC yield year-to-date and discussed the company's plan to raise $42 billion to acquire more of the top cryptocurrency.

Celestia's TIA suffers nearly 10% loss following $900 million token unlock

Celestia is down about 9% following increased negative sentiment surrounding its cliff unlock, which is worth about 176 million TIA tokens. The token could see a correction if it fails to bounce off the $4.506 level.

Polymarket accused of conducting wash trades around Trump odds as election draws near: Fortune

Crypto research firms Chaos Labs and Inca Digital revealed that prediction market Polymarket is guilty of performing wash trading on its presidential election market.

Bitcoin: New all-time high at $78,900 looks feasible

Bitcoin price declines over 2% this week, but the bounce from a key technical level on the weekly chart signals chances of hitting a new all-time high in the short term. US spot Bitcoin ETFs posted $596 million in inflows until Thursday despite the increased profit-taking activity.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.