BTC/USD: Interesting price action seen for the major crypto

Things have changed fast since the weekend!

Against the US dollar, Bitcoin (or BTC/USD) is poised to end another session on the front foot.

You will note that the Research Team pencilled in the following in the week-ahead post (italics):

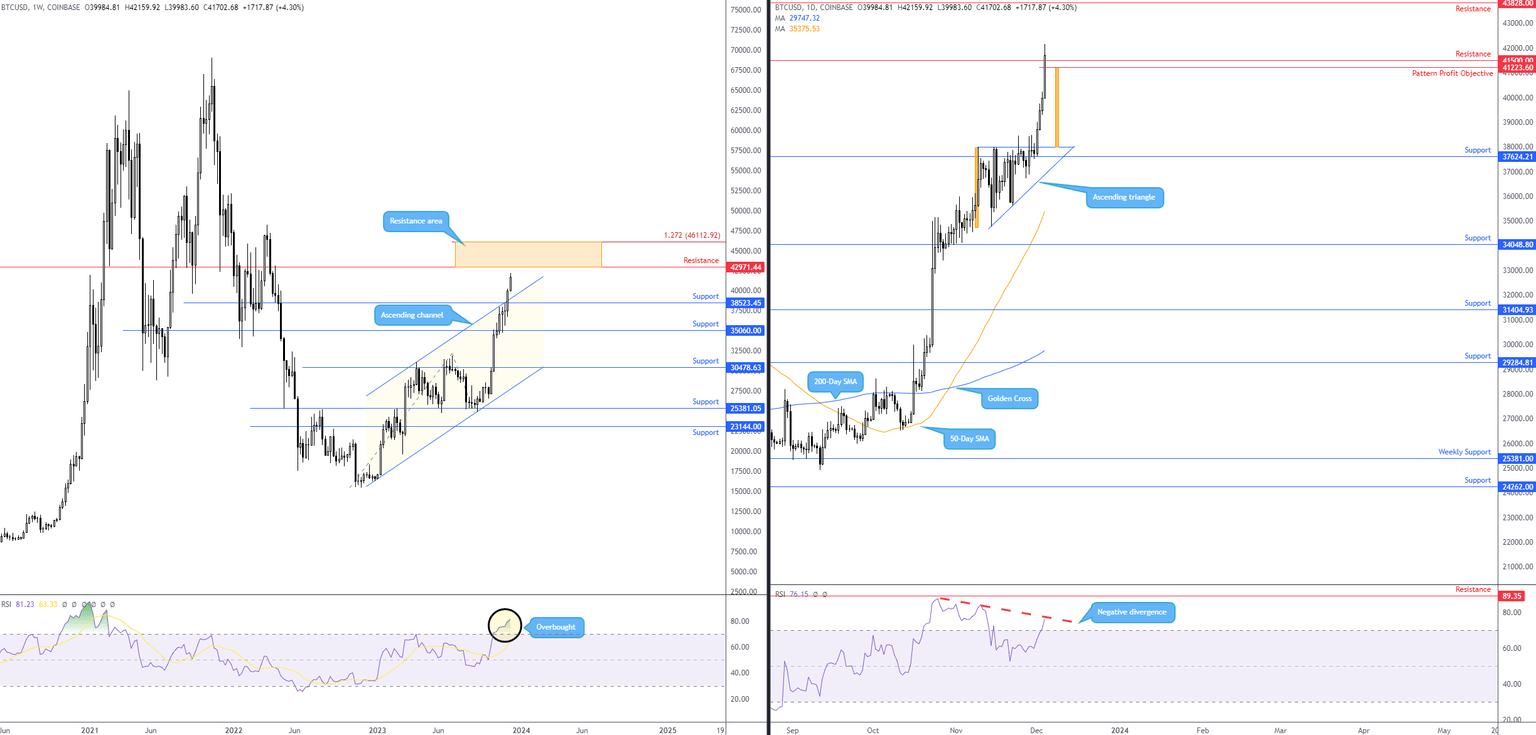

From the daily timeframe, the key technical observation, particularly for chart pattern enthusiasts, is the ascending triangle pattern formed between $34,758 and $37,999 in a market trending higher. Ascending triangles are recognised as continuation chart patterns within uptrends (traders tend to buy the breakout above its upper limit and project a profit objective using its base value, which, in this case, is $41,223). You will note that price tunnelled through the upper boundary of the ascending triangle last week, effectively handing the baton to breakout buyers. You will also see that support at $37,624 was recently retested (prior resistance), movement adding weight to the upside breakout.

As evident from the daily timeframe, the price tested the ascending triangle’s profit objective at $41,223 today and shook hands with neighbouring resistance on the daily timeframe at $41,500.

Where Next for the Major Crypto?

Is it time for a reversal?

Are we just taking a breather?

Are we heading for higher levels?

These are all valid questions.

According to the Relative Strength Index (RSI), the monthly chart is testing overbought levels not seen since early 2021 and the daily chart is demonstrating early negative divergence from oversold territory. This tells traders/investors that BTC/USD is overvalued at this point in time and could either chalk up a correction or consolidate (take a breather) from daily resistance at $41,500.

The caveat to the above, however, is that the weekly timeframe shows room to press higher until a resistance zone between $46,112 (1.272% Fibonacci projection ratio [‘alternate’ AB=CD pattern]) and horizontal resistance at $42,971. Adding to this, both the weekly and daily timeframes are trending higher.

BTC/USD Still Favours Bulls

Given the above, this market continues to lean in favour of buyers, and current daily resistance may be fragile. Therefore, a daily breakout beyond $41,500 could unearth a possible bullish scenario towards daily resistance coming in at $43,828 (sits between the weekly resistance area mentioned above at $46,112-$42,971). Following a possible breakout higher, conservative traders will likely seek at least a retest of $41,500 as a support level before considering committing.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,