BTC/USD: Downside pattern breakout towards $50,000

BTC/USD etched out its first weekly loss in four weeks.

However, is this enough to forecast a reversal to the downside?

Weekly Resistance Welcomes Sellers

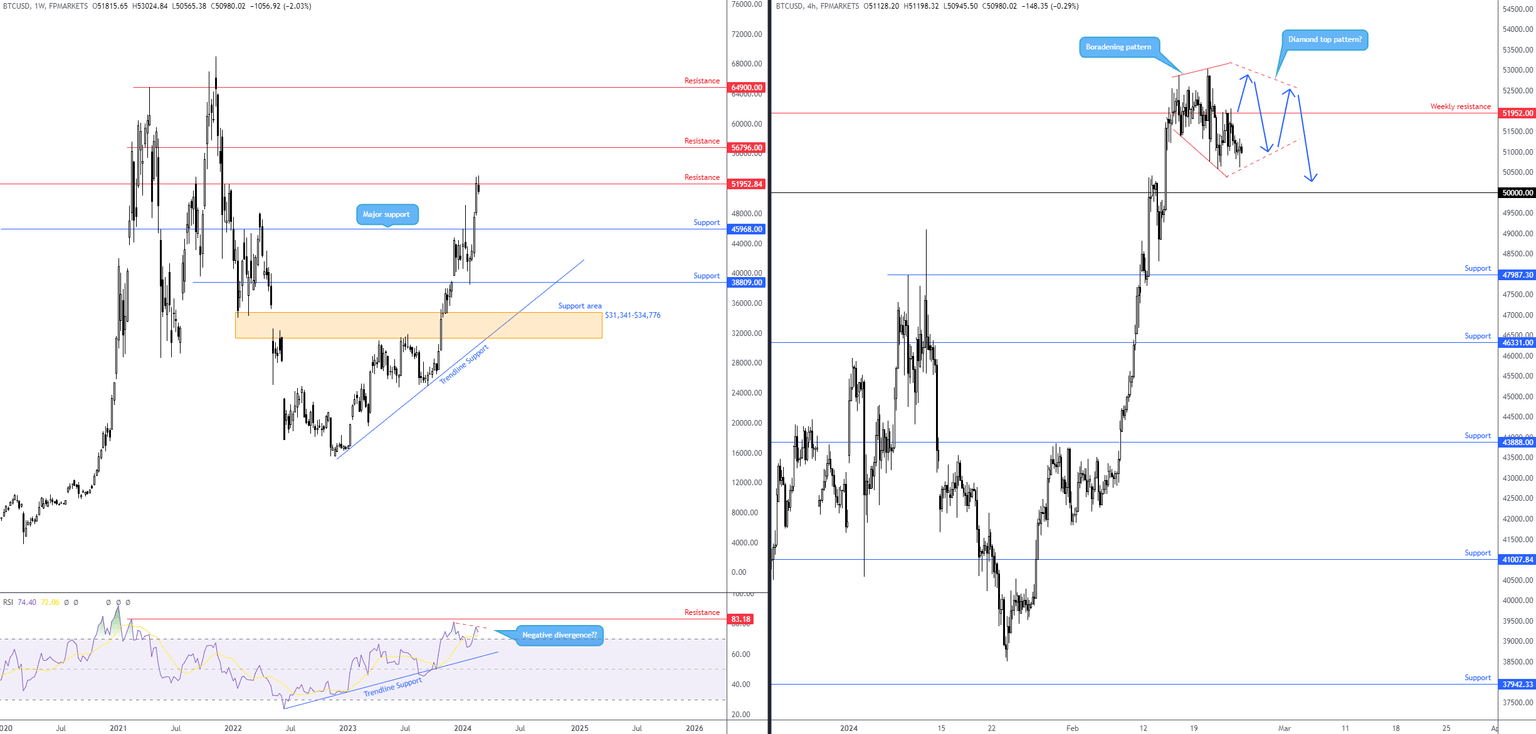

We have clearly seen the major crypto pairing bump heads with sizeable resistance on the weekly timeframe at $51,952, a level boasting strong historical significance and sponsored by the Relative Strength Index (RSI) demonstrating signs of early negative divergence within overbought territory (ahead of indicator resistance at 83.18).

Ultimately, though, through a series of higher highs and higher lows, the long-term trend remains resolutely to the upside, supporting the possibility of further buying. That does not mean a correction from weekly resistance could not come about over the coming weeks.

H4 Diamond Top Pattern This Week?

While an uptrend in this market remains evident, and while it is usually recommended to trade with the trend, there are times when a countertrend opportunity provides a viable trading opportunity worth exploring.

You will acknowledge from the H4 chart that buyers and sellers spent the week battling for position around the weekly resistance highlighted above at $51,952 and in the process carved out a broadening pattern between two diverging lines taken from $52,868 and $51,372.

Broadening patterns can form the beginnings of a diamond top pattern. As shown from the chart, the second part of the diamond top formation extends from the broadening formation in the shape of converging lines. Were pattern completion to unfold, this is considered a weighty bearish reversal pattern, and bearing in mind it is forming around weekly resistance, BTC/USD bulls may struggle to find acceptance at higher prices and prompt a retest of $50,000 (possibly even navigate south of the psychological base towards daily support from $47,987, closely followed by another layer of support coming in at $46,331).

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,