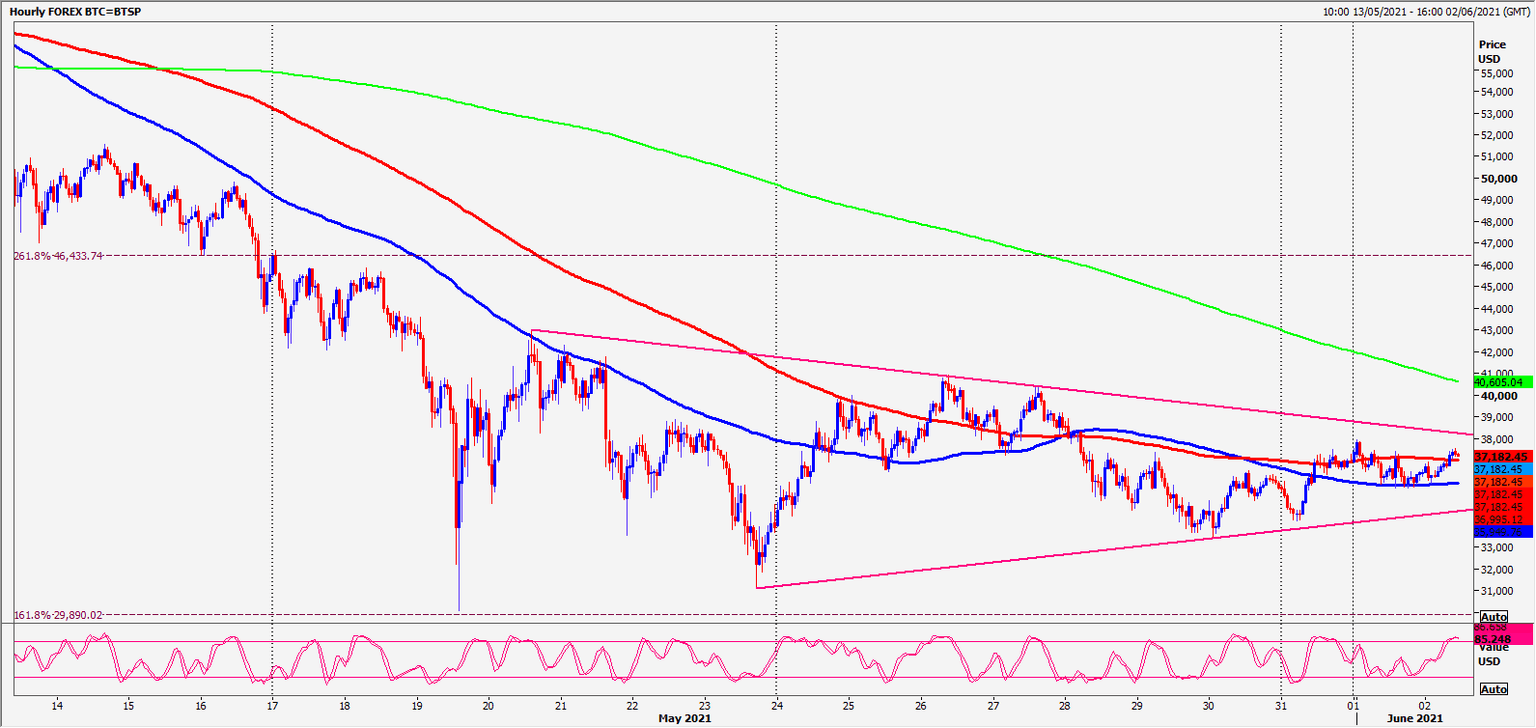

BTC/USD: A break below 34200 is a sell signal

Bitcoin appears to be forming a bear flag. This means we are consolidating in the short term bear trend & are likely to break lower for a sell signal.

Ripple XRP tests important 38.2% Fibonacci & short term moving average resistance at 1.0515/1.0545. Shorts need stops above 1.1100.

Ethereum still holding strong resistance at 2750/2800.

Daily analysis

Bitcoin in a bear flag from support at 34700/500 up to resistance at 38000/500. Try shorts here, stop above 39500. A break higher tests 200 day moving average resistance at 41300/500. Try shorts here, stop above 43000.

A break below 34200 is a sell signal targeting 31100/3000. Although I had us buying here last time, this time it is more likely we will break lower to my ultimate target for the head & shoulders sell signal at 27500/27000.

Ripple shorts at strong resistance at 1.0515/1.0545 re-target 0.9400/9300. On further losses look for 0.9000/0.8980 & 0.8050/30. Again expect very important 6 month trend line & 200 day moving average support at 0.7040-0.6558 to hold the downside. Brave bulls or longer term investors can try longs with stops below 0.6400. If prices hold below here then all is lost for the bulls & a further significant correction to the downside looks likely. Initially we can target 0.5100 – 0.4800.

We are testing important 38.2% Fibonacci & short term moving average resistance at 1.0515/1.0545. Shorts need stops above 1.1100. A break higher is a buy signal targeting 1.1700/1.1800, perhaps as far as 1.3000/1.3500.

Ethereum shorts at strong resistance at 2750/2800 need stops above 2900. A break higher is a buy signal targeting 3050/3100, perhaps as far as strong resistance at 3300/3400. Shorts need stops above 3500.

Holding first resistance at 2750/2800 re-targets 2550/2480, perhaps as far as minor support at 2380/2350. If we continue lower in the 3 week bear trend, look for 2140/30 before a retest of important 61.8% Fibonacci support at 1728.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk