BTC hard fork tokens bank on Bitcoin price breaching $27,500, rallying nearly 20%

- Bitcoin price shot up over the past 24 hours following the court ruling in favor of Grayscale against SEC.

- Bitcoin hard forks and namesakes like Bitcoin Cash and Bitcoin SV led the crypto market recovery.

- The crypto market is still experiencing Fear, which would change only if these rallies are sustained.

Bitcoin price made a splash over the past 24 hours and inflicted a bullish impact on the rest of the market as well. While altcoins were expected to follow BTC’s lead, some particular tokens managed to sneak in significant rallies with just one common factor - having Bitcoin in their name.

Read more - “So long for crypto” - Bitcoin and digital assets might end as a fad if institutions allow

Bitcoin price rise brings relief to namesake tokens

Bitcoin price at the time of writing was trading well above $27,700, rising by more than 6% on August 29. Grayscale’s victory against the US Securities and Exchange Commission (SEC) was the reason behind this rally. The total crypto market capitalization rose by nearly $50 billion, and surprisingly, some of the biggest gainers were the ones that capitalized on Bitcoin.

Bitcoin hardfork and namesake tokens, specifically Bitcoin Cash (BCH) and Bitcoin SV (BSV), emerged as leaders of the day. BCH noted an 18.22% increase in 24 hours, pushing the price of the asset to $225, up from $190. BSV, although it did not note a similar run, still managed to chart a considerable rally of 8.36%, trading at $33.5 at the time of writing.

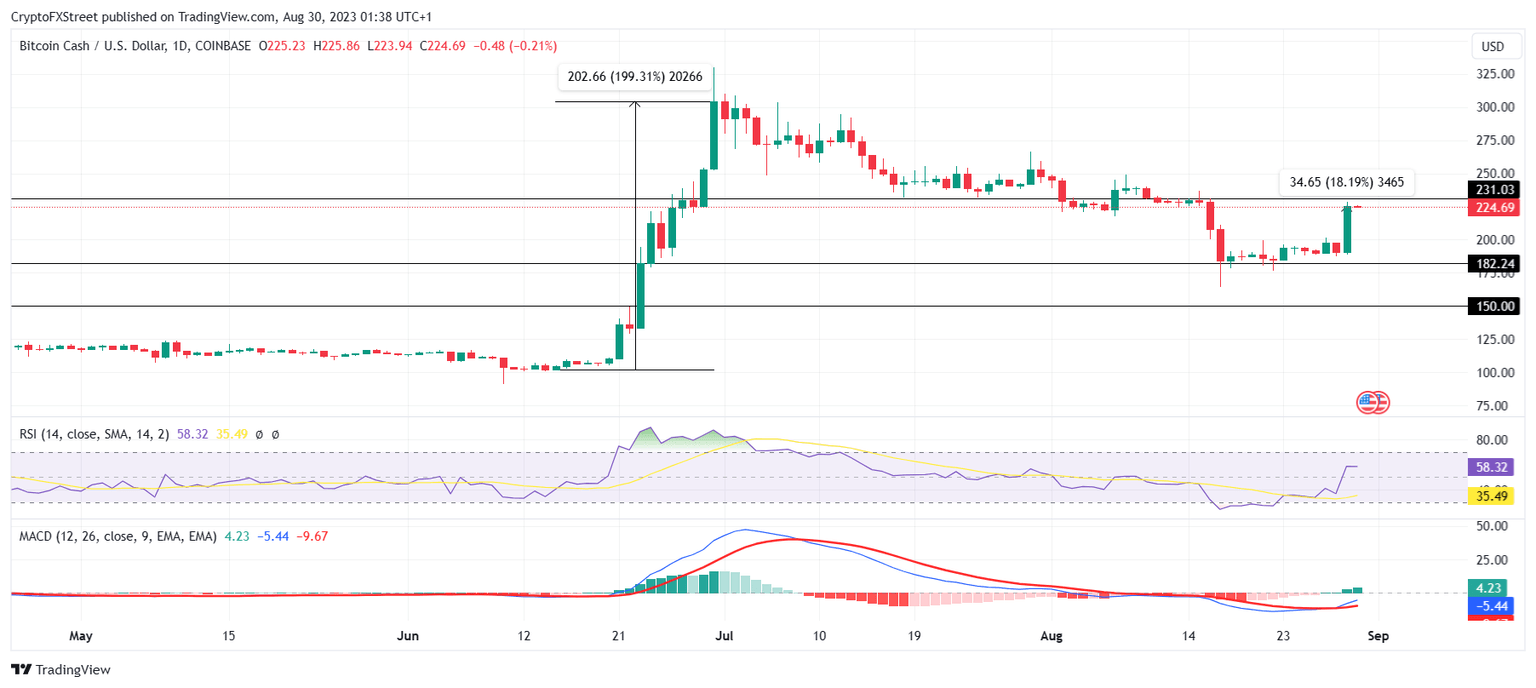

This is the fifth instance this year that Bitcoin Cash has recorded such a rise in a single day. Earlier during the mid-June rally, the altcoin shot up by almost 200% in the span of two weeks, which brought BCH up to $300 before the broader market bearish cues dragged it down to its current price.

BCH/USD 1-day chart

However, investors rejoicing about the rally should also keep in mind that the sudden rise could be followed by profit-taking. The Relative Strength Index (RSI) shows that the altcoin is observing rising momentum; however, a following bounce of the indicator above the neutral line at 50.0 is crucial in confirming a sustained rally.

Should corrections hit BCH, the Bitcoin namesake is expected to keep above the critical support at $182. Falling through this line could push the cryptocurrency down to $150 and lower. Those looking to jump into investing in BCH and BSV, as well as BTC, expecting further increases soon should note that the crypto market is still in Fear.

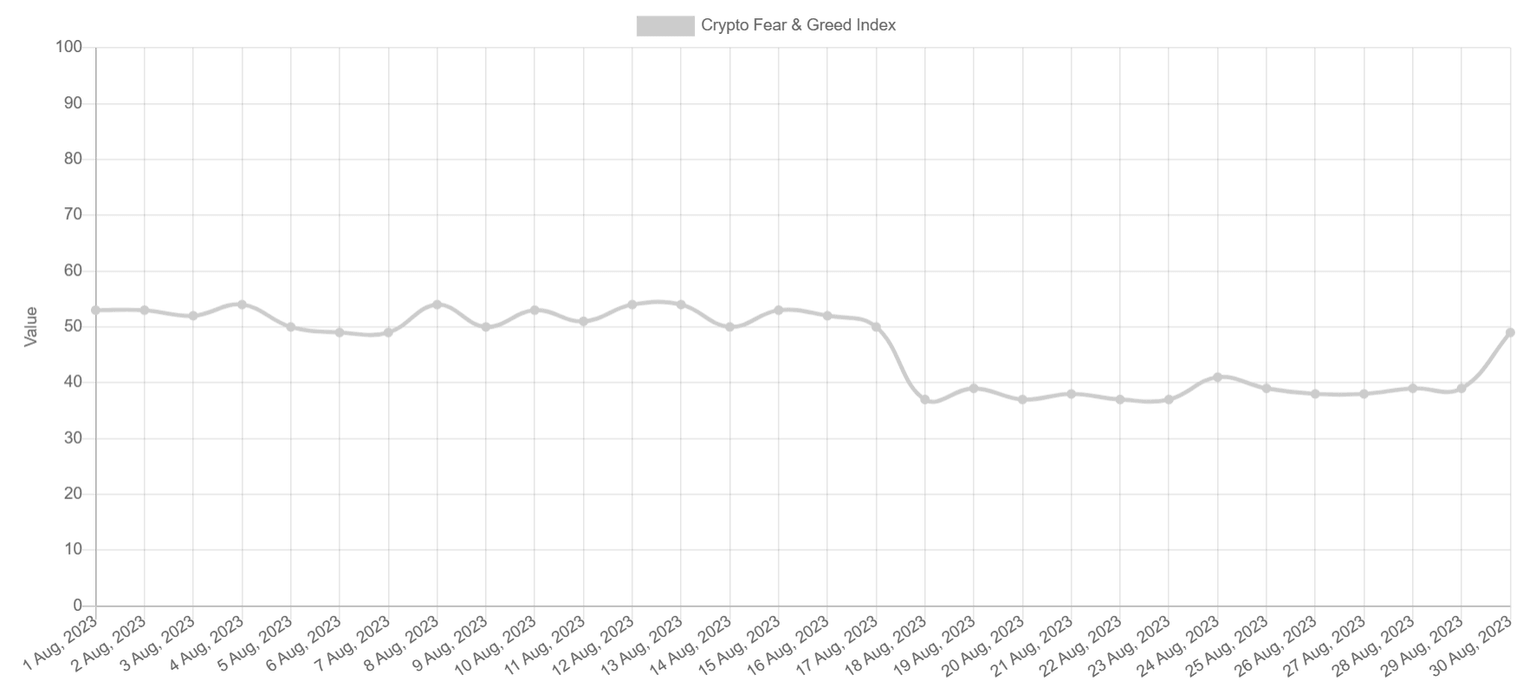

The Fear and Greed Index slipped below 40 this week, suggesting investors are spooked and could sell to take profits following the rally of the past 24 hours. This could result in a drawdown in cryptocurrencies’ prices.

Bitcoin Fear and Greed index

Thus, investors must observe patience and ensure they do their due diligence before making any move.

Read more - CRV price aims at 8% recovery as Whales rack up 20 million CRV in 24 hours

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.