BTC, ETH gain ground and the top five Metaverse movers to watch

After the short bearish trend amid the Russia-Ukraine tensions, the crypto market has started to gain ground again. Bitcoin and Ethereum rose by about 1% and 5% respectively during the last week. Many other cryptocurrencies have followed. The popularity and market capitalization of the Metaverse tokens also continues to grow.

Many analysts link the fall and rise of the crypto market to the recent political events and fluctuations of the Russian ruble. When the currency suddenly started to pull back, so did most of the digital assets. Now that the rouble is slowly recovering, cryptocurrencies are shooting up in value again. Last week, Russia claimed that it would only accept rubles and maybe crypto for oil and gas. This statement may have led to the growth of the ruble and the surge in the crypto market.

BTC and ETH continue bullish run

For the first time in three months, Bitcoin surpassed the $47,000 mark on March 28. The number one crypto might not yet be close to its new ATH, but it might very well hit the new highest price of the year soon. In two days the BTC value jumped by more than $1,000, then retreated, and now continues to grow again. The move may have to do with Russia's consideration of accepting BTC for its natural resources mentioned above.

Source: Messari.io

BTC is currently trading at $45,502,80. It grew by 1.23%% during the past week and dropped by 3.16% in the last 24 hours.

Ethereum has been growing steadily for the last 10 days and just like Bitcoin saw a big jump on March 28. The price of ETH is still lower than it was in the beginning of the year, but it might reach that point again soon as it seems to be following the bullish trend.

Source: Messari.io

The currency gained 5.35%% during the past week and fell by 3.89% in the last 24 hours. At the moment of writing, ETH costs $3,296.23.

Top metaverse coins of the week

Decentraland (MANA)

Decentraland's MANA token is the top metaverse crypto by market capitalization. Created in 2017 and open to the public in 2020, the virtual reality platform quickly gained popularity. Users have many possibilities in the virtual world, from creating and exploring to buying and monetizing plots of land. Its native currency MANA is powered by the Ethereum blockchain.

Source: Messari.io

Even though the token was growing earlier this week it went down by 1.72% in the last 24 hours and by 2.88% in the last 7 days. The total market cap of MANA is $4,775,414,595. At the moment of writing, it’s trading at the price of $2.59.

Axie infinity (AXS)

Axie Infinity is a blockchain-based play-to-earn video game launched by Sky Mavis in 2018. Users get to breed and raise the creatures called Axies and receive rewards for them. Each Axie is a platform’s native NFT.

Source: Messari.io

The currency has seen a huge jump during the last 10 days going up by about $20 in 24 hours. However, it retreated significantly after. The AXS's value has dropped by 10.91% over the past week and grew by 1.38% over the last 24 hours. At this point, the price of the token is $63.66 and the market cap is $3,885,108,076.

The Sandbox (SAND)

The Sandbox is a NFT-based virtual world where users can create, buy, and sell plots of land in the form of a game. Players can use the virtual land to host events, concerts, or games and monetize their creations. The internal currency SAND is becoming very popular.

Source: Messari.io

This week SAND was growing steadily and saw a couple of big jumps until it suddenly went down yesterday. It dropped by 1.59% in the last seven days and by 1.91% in the last 24 hours. Despite its climbs the coin is still pretty far from its ATH of $8.40 it saw last November. SAND is now trading at $3.40. Its total market cap is $3,939,930,950.

ApeCoin (APE)

ApeCoin is a native cryptocurrency behind the NFT-famous Bored Ape Yacht Club project. Launched less than 2 weeks ago by ApeCoin DAO, the coin immediately gathered a lot of hype around it. ApeCoin is mainly used for purchases within the APE ecosystem.

Source: Messari.io

The total market capitalization of APE is currently $3,581,479,601. It lost 0.58% in value during the week but grew by 2.14% in the last 24 hours. Its current price is $12.77.

Theta Network (THETA)

Theta is a blockchain-based network focused on video streaming. Users of the decentralized platform share bandwidth and computing resources on a P2P basis. The project is advised by Steve Chen, co-founder of YouTube, and Justin Kan, co-founder of Twitch.

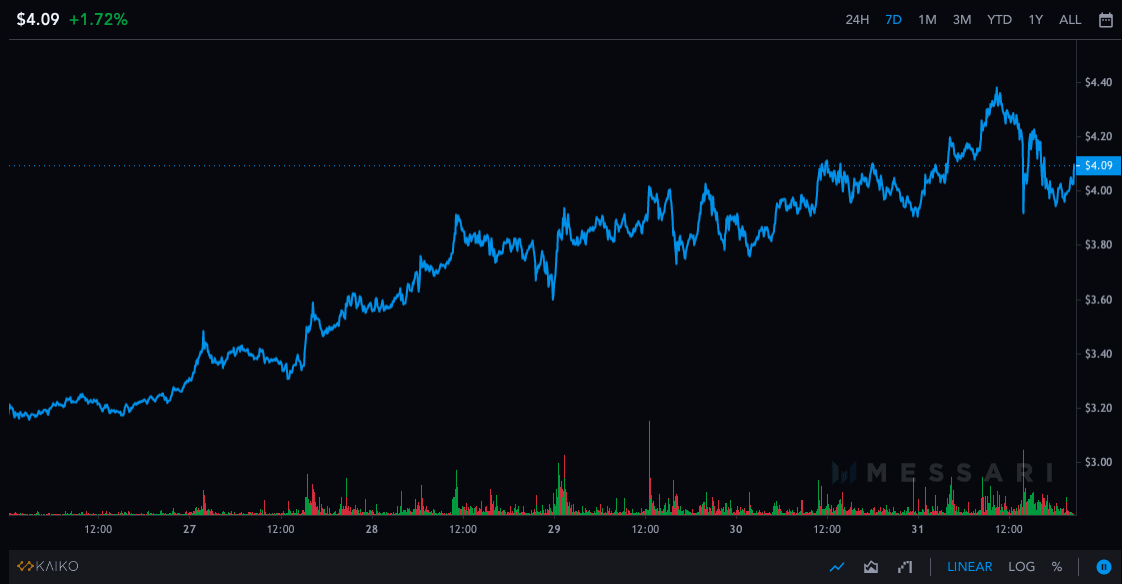

Source: Messari.io

THETA has seen strong growth and shooted up in value by 25.04% during the week. In the last 24 hours it rose by 1.72% and is now trading at $4.09. The total market cap of the currency is now $4,034,400,099.

All in all, even though there have been some drops in the last two days, we can see that most coins and tokens are on the rise and it seems that spring has finally come to the crypto market. There’s a big chance that cryptos will surge even more in the next weeks and months, especially if the political situation stabilizes and countries go ahead with the crypto adoption.

Author

Mike Ermolaev

Independent Analyst

Mike Ermolaev is the founder of Outset PR. The agency helps tech companies, especially blockchain and Web3 projects, get the desired recognition thanks to its wealth of media connections.