BRETT, FLOKI, WIF lead meme coin recovery

- BRETT jumped by more than 30% briefly after Binance Futures listing.

- FLOKI posted over 10% gains after an announcement that holders will receive CAT meme token airdrop.

- WIF and other top meme coins trade in the green as the meme market looks set to stage a recovery.

BRETT led the entire meme coin market on its path to recovery on Tuesday after the Binance exchange listed a perpetual futures contract for the Base Layer 2 meme token.

Meme coin market en route to recovery following recent gains

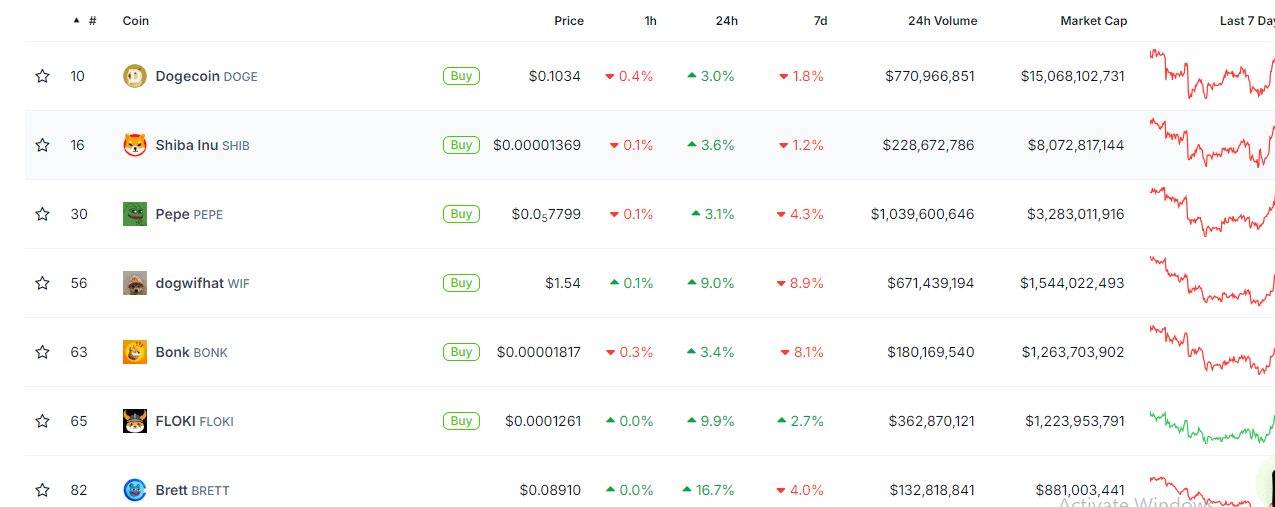

According to CoinGecko’s data, the meme coin market capitalization increased by over 4% in the past 24 hours after positive developments surrounding several top meme tokens sparked a green day for the sector:

BRETT rallied by 36% in the early hours of Tuesday after Binance announced it would launch a USD-Margined perpetual futures contract for the meme coin. Following the announcement, the social volume of BRETT spiked to its highest level since January. BRETT has seen a correction since the pump, settling around $0.088 with a 16% gain.

Crypto trader @MaxBecauseBTC believes BRETT can potentially hit >$10 billion in market cap if Ethereum sees a massive rally in the current cycle. This is likely due to BRETT's run to an all-time high of $0.193 in eary June after ETH rallied following news of the Securities & Exchange Commission's (SEC) U-turn to approve spot Ethereum ETFs.

FLOKI is the second-best performer among top meme coins, posting a spike to $0.0001318 after announcing that its holders will receive 20% of the supply of Simon's Cat (CAT) meme tokens. FLOKI is currently trading around $0.0001263, up nearly 10% on the day.

Top Meme coins

Solana meme coin dogwifhat (WIF) is also benefiting from the positive sentiment surrounding the meme market as its price is up over 9% on Tuesday. WIF's rise occurred despite a slight decline in Solana. This indicates that the meme coin may be crafting its own path, reducing its over-reliance on SOL's price movement.

Dogecoin (DOGE), Shiba Inu (SHIB) and PEPE also recorded gains above 3% each in the past 24 hours.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi