Breaking: XRP price jumps almost 10% as SEC drops lawsuit against Ripple executives

The US Securities and Exchange Commission has dropped its charges against executives from Ripple Labs, including CEO Bradley Garlinghouse and co-founder Christian Larsen.

In a letter to Judge Annalisa Torres, the plaintiff, which is the US SEC, “respectfully notified the court of the stipulated dismissal of the SEC’s pending claims against defendants, Christian Larsen and Bradley Garlinghous.”

The regulator had levied charges against the Ripple duo, alleging that they had “aided and abetted” Ripple’s violations of US securities laws when they sold XRP to institutional clients.

The commission doubled down on the charges following the July 13 determination by Judge Torres that XRP was only considered a security when sold to institutional clients. This signified a landmark win for Ripple, sending XRP price up 70%.

Based on the announcement, the dismissal is totally voluntary, obviating “the need for the scheduled trial,” while at the same time mooting the October 3 scheduling order.

With this decision, the commission will meet Ripple executives for further deliberations before involving the court.

Ripple chief legal officer Stuart Alderoty has called the move a capitulation and “surrender” by the SEC. Garlinghouse on the other hand says the commission targeted them in a ruthless attempt to personally ruin us and the company

Today was an even better day.

— Brad Garlinghouse (@bgarlinghouse) October 19, 2023

Ripple: 3

SEC: 0

In all seriousness, Chris and I (in a case involving no claims of fraud or misrepresentations) were targeted by the SEC in a ruthless attempt to personally ruin us and the company so many have worked hard to build for over a… https://t.co/YsQxewFnj9

For clarity, this means there will not be a trial in April. It is also worth mentioning that the SEC could still appeal Judge Torres’s decision concerning the programmatic sales and other distributions of XRP.

Judge Torres had declined the SEC’s request for interlocutory appeal on October 3. She said the commission would have to wait until the trial concludes.

Given that there will not be a trial, the commission reserves the right to appeal following the penalty phase.

Meanwhile, lawyers anticipate a bit more litigation between Ripple and the SEC, according to Fox Business’ Eleanor Terrett, hence the penalty phase. This is concerning the appropriate penalty for the sale of more than $700 million worth of XRP in institutional sales.

According to legal experts, Ripple could negotiate a reduction of the penalty, although the SEC may insist on a significant amount for bragging rights. With this, “a big fight” could follow.

Ripple IPO

It comes after rumors on October 17 about Ripple’s IPO, with cryptocurrency influencer Alex Cobb raising the question in a post on Crypto X. Based on the post, Ripple was in the process of bringing in a “Shareholder Communications Senior Manager,” which is an important role when a company plans for listing.

Garlinghouse had hinted at the same in 2018, indicating that Ripple would explore the possibility of going public upon the successful conclusion of its ongoing lawsuit with the SEC.

The news could strengthen Ripple's plans with the initial public offering (IPO).

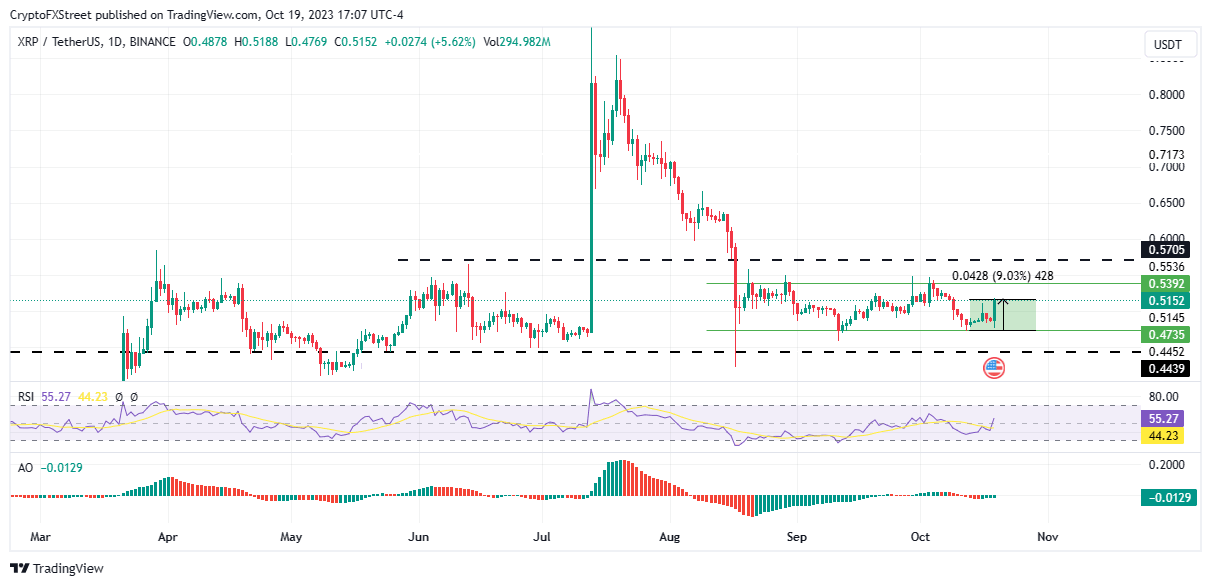

Around the news, Ripple price has peaked 9% to record an intra-day high of $0.52, with CoinMarketCap data showing a 45% increase in 24-hour trading volume.

XRP/USDT 1-day chart

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.