Terraform Labs founder Do Kwon arrested in Montenegro – Interior minister

- The Interior Minister of Montenegro, Filip Adzic, tweeted on March 23 that a person suspected to be Do Kwon was detained at the Podgorica Airport.

- The detained individual is said to be a South Korean national, was caught at the airport with falsified documents.

- Do Kwon and Terraform Labs were also charged with mobilizing a multi-billion dollar fraud by the Securities and Exchange Commission in the US last month.

Terraform Labs' founder Do Kwon is arrested, according to Minister of Interior of Montenegro Filip Adzic.

Adzic tweeted that "one of the world's most wanted fugitives was arrested in Podgorica. He added,

Montenegrin police have detained a person suspected of being one of the most wanted fugitives, South Korean citizen Do Kwon, co-founder and CEO of Singapore-based Terraform Labs

The now-defunct Terraform Labs was once a hotspot that attracted institutions and retail investors alike. However, the fateful collapse of the Terra-Luna ecosystem led to $40 billion in losses.

The minister further noted that the detained individual, according to them, is the former "cryptocurrency king" Do Kwon. The person suspected of being the former Terraform Labs CEO was detained at the Podgorica airport with falsified documents.

Do Kwon and Terraform Labs were previously charged by the Securities and Exchange Commission (SEC) of the United States for orchestrating a "multi-billion dollar" fraud and were also accused of misleading investors about the stability of its stablecoin UST. The hunt for the disgraced founder will come to an end if the detained suspect's identity is confirmed to be Do Kwon.

Authorities have been after Kwon for the latter half of 2022, with even Interpol issuing a red notice for his arrest in September last year. Apart from this, Do Kwon is also wanted by authorities in South Korea as well as Singapore, where the Terra founder was suspected of being hiding previously.

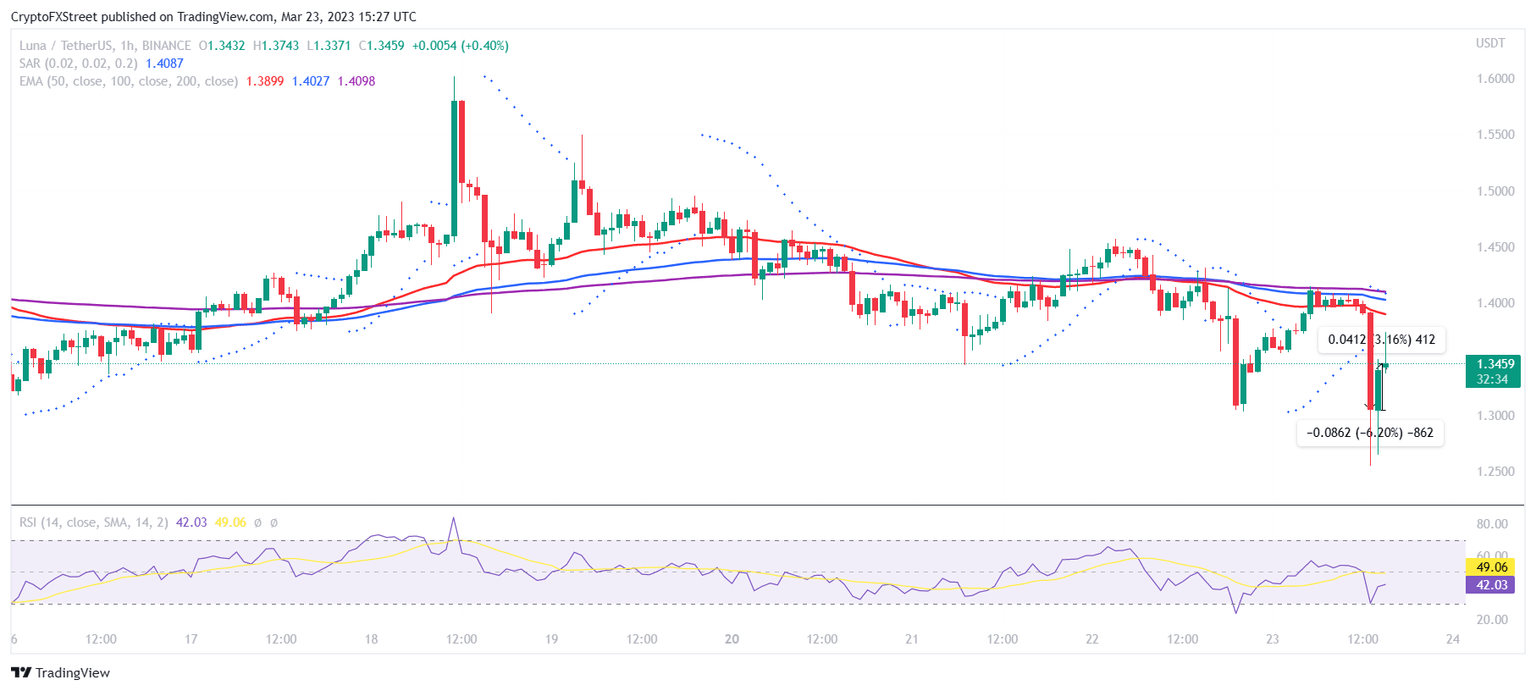

Following the announcement of the arrest, LUNA price noted a sudden drop in value initially. Over the hour, the altcoin fell by over 6.2%, slipping from $1.39 to $1.30.

LUNA/USDT 1-hour chart

However, the cryptocurrency recovered soon after and could be seen trading at $1.34 at the time of writing, up by more than 3.1% in the last hour.

This is a developing story and will be updated accordingly.

Author

FXStreet Team

FXStreet