DeFi: Is crypto's correction nearing its end? Top DeFi coins to watch in February

Although Bitcoin flirted with gains and clawed back some losses, it then plunged, failing to find momentum for sustained recovery. Many people are wondering where Bitcoin is headed now that it is 47 percent off its all-time high?

Source: Casebitcoin.com

I mentioned previously that the recent weakness has been caused by a combination of factors, including uncertainty regarding crypto regulations and the Federal Reserve's tightening of monetary policy. I also noted cryptocurrency's shift towards traditional risk asset classes and its close relation with stocks.

Additionally, I said that a bearish market scenario is unlikely and that it would unfold if the support line of $30-31K was breached and held. It seems that my initial assumption that we were witnessing the purest form of correction has proven true.

For the last 21 months, money printing by the Fed resulted in a relatively low-interest-rate environment, which made borrowing relatively easy and cheap. In part because of this, capital has flocked to riskier assets like cryptocurrency and equities. This also explains why these asset classes have had such extreme returns prior to slipping into the red.

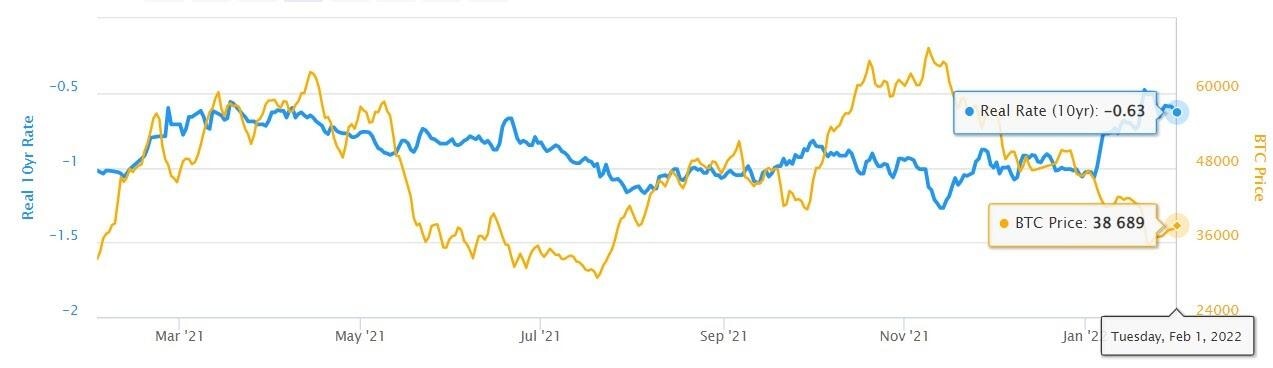

Let’s take a look at how Bitcoin's price relates to the inflation-adjusted real rate of benchmark 10-year debt. The real rate is calculated by subtracting the 10-year inflation breakeven rate, which gauges market-based future inflation expectations, from the yield on the 10-year Treasury note.

Why is this correlation important? The real rate is a measure of expectations of future purchasing power and, therefore, can determine whether safe assets like bonds are more economically attractive than risky investments. A rise in real returns on US bonds generally puts pressure on stocks and other risk assets.]

Source: Casebitcoin.com

Some analysts are skeptical the recovery will sustain since the Biden administration is expected to unveil its strategy on crypto regulation this month. Crypto markets remain highly volatile since it is difficult to predict the effects of new regulations.

Top 5 DeFi coins

I have selected my top 5 picks for DeFi coins worth over $100 million that have performed well during the past week despite general weakness in the crypto market, and I predict they will continue to do well throughout February.

IDEX

Idex was the best performing DeFi coin, currently trading at $0.23 with a market capitalization of $146.06 million. It gained 98.36% over the past seven days.

A hybrid liquidity exchange, IDEX combines off-chain trading with on-chain trade settlement. Combining traditional order book features with the security and liquidity of an AMM, it achieves the best of both worlds.

Using smart contracts, the platform decentralizes custody and settlement, limiting the movement of funds until a transaction is completed.

Source: TradingView

Telos (TLOS)

Telos gained 77% over the past seven days, making it the second-best performer. Currently, it's trading at $1.01, 21% off its all-time high set on February 2, 2022. TLOS current market value is $274.03 million.

Telos-based tokens, NFTs, and smart contracts are widely used in DeFi, gaming, and social media. Currently, over 100 decentralized applications (dApps) take advantage of Telos networks' speed and scalability that offer attractive on-chain services (voting, sentiment, decentralized storage, location and more), as well as the fastest network speed (0.5s block time).

Telos' upcoming Ethereum Virtual Machine will be the most efficient and least expensive EVM, making Telos the only blockchain to support both EVM and EOSIO. These two technologies together account for the majority of top decentralized applications on popular dApp tracking websites.

Source: TradingView

Tezos (XTZ)

Tezos is a blockchain-based network using smart contracts, similar to Ethereum. Tezos, however, aims to offer an infrastructure that can grow and improve over time without ever encountering a hard fork. This has always been a problem with both Bitcoin and Ethereum. By holding XTZ, users can vote on Tezos' proposals for protocol upgrades.

The Tezos price is currently at $3.76, making it the third top weekly gainer (+30.74%) with a market capitalization of $3.29 billion.

Source: TradingView

Maker (MKR)

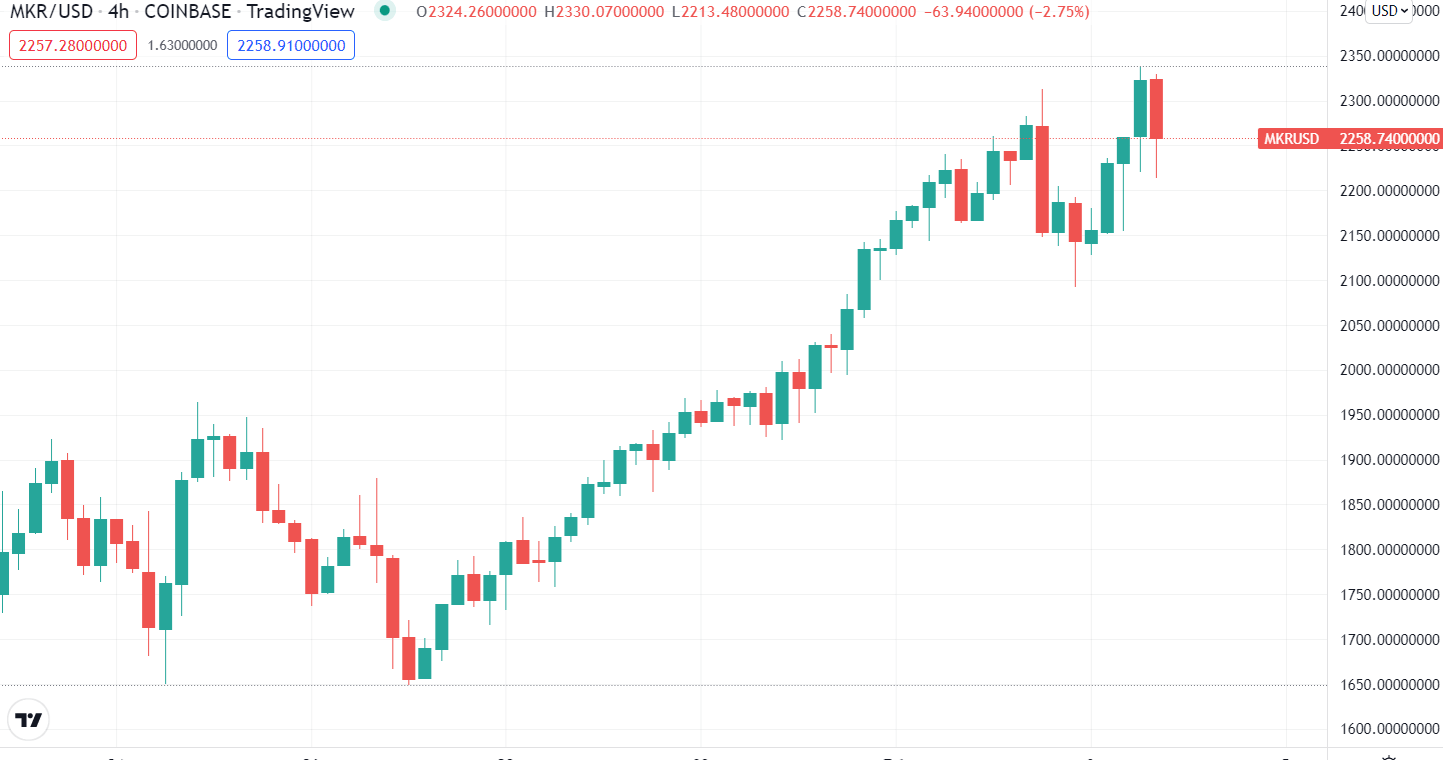

Powered by the Ethereum blockchain, Maker (MKR) is the governance token of the MakerDAO and Maker Protocol – a decentralized organization and a social network – that allows users to issue and manage DAI stablecoin. DAI is a community-managed decentralized cryptocurrency with a stable value linked to the US dollar.

Currently trading at $2,263.91, MKR gained 28.8% in the past week, and it has a market cap of $2.19 billion.

Source: TradingView

Beefy Finance (BIFI)

Beefy Finance is a decentralized, multi-chain Yield Optimizer that allows users to earn compound interest on their cryptocurrency holdings.

DeFi has developed a set of investment strategies secured by smart contracts that boost user rewards for various liquidity pools, automated market making projects, and yield farming opportunities available within DeFi's ecosystem.

With a market cap of $156.95 million, BIFI was up 18.74% for the last seven days at $2,179.90.

Source: TradingView

Author

Mike Ermolaev

Independent Analyst

Mike Ermolaev is the founder of Outset PR. The agency helps tech companies, especially blockchain and Web3 projects, get the desired recognition thanks to its wealth of media connections.