Breaking: Grayscale wins lawsuit against US SEC, Bitcoin price nears $28,000

Grayscale Asset Manager has won its longstanding case against the US Securities and Exchange Commission (SEC).

The lawsuit began in October 2022, with the asset management firm waiting for a decision from the D.C. Circuit Court.

The case made headlines amid ongoing spot Bitcoin Exchange Traded Fund (ETF) mania when Grayscale wrote an open letter to the SEC. Through its legal team stewarded by Davis Polk, the asset manager attempted to convince the SEC why approving all the spot BTC ETF applications would be the better decision.

According to the court, the SEC's denial of Grayscale's spot ETF proposal was "arbitrary and capricious" given the commission's failure to explain why similar products are treated differently.

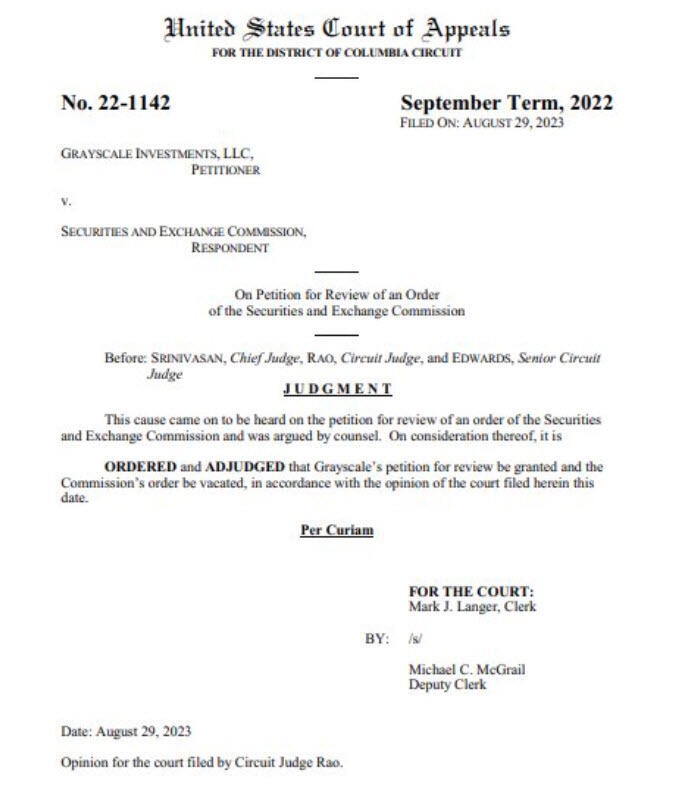

The victory means the SEC must review the rejection, which could lead to the approval of the first spot Bitcoin ETF in the United States:

ORDERED and ADJUDGED that Grayscale's petition for review be granted and the Commission's order be vacated, in accordance with the opinion of the court filed herein this date.

Still, the SEC has 45 days to appeal the ruling – in which case it would either go to the Supreme Court or an en banc panel review – or could still reject the application on other grounds.

Regardless, the outcome is a massive win for Bitcoin, miners, and the several defendants currently fighting the US SEC. It is also a big break for the cryptocurrency industry in general. While it does not mean that a Grayscale spot ETF and the rest of the applications will be approved immediately, it tilts the odds in favor of positive outcomes. The most important concern now remains whether a green light from the financial regulator will come in 2023.

Meanwhile, crypto markets have pivoted around the development, providing the much-needed impulse to break consolidation.

Bitcoin price is steadily approaching the $28,000 range, after rising approximately 7% to exchange hands for $27,940 at the time of writing.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.