Breaking: FTX files for bankruptcy as Sam Bankman-Fried resigns as CEO

The embattled FTX exchange has reportedly filed for bankruptcy. FTX has been in the spotlight this week following allegations of mismanagement of funds.

FTX, the West Realm Shires Services and Alameda Research (Sam-Bankman-Fried's trading firm), including 130 affiliated firms have started proceedings under chapter 11 of the bankruptcy law.

The situation worsened when Binance, the largest cryptocurrency exchange by daily traded volume, announced its intentions to liquidate approximately $580 million in FTT, a native token to FTX exchange.

In other news, the founder and CEO of FTX exchange, Sam Bankman Fried (SBF), has resigned from the firm. This follows a move by FTX Australia, a subsidiary of FTX, to engage administrators who have been reviewing the books of accounts to determine whether customer funds are safe.

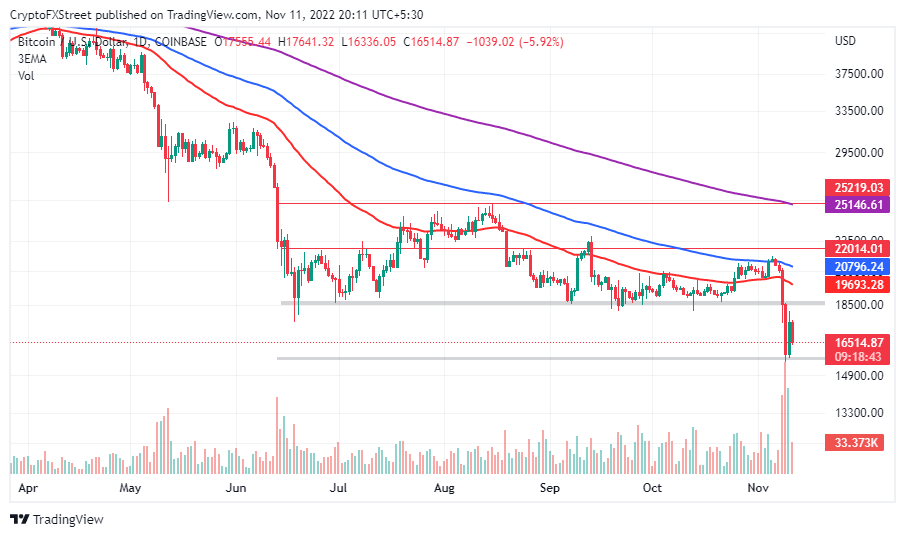

Meanwhile, the cryptocurrency market is back in the red after bullish sparks were put out by the bloody mess FTX keeps leaving behind. Bitcoin price is down 4.4% to trade at $16,808 while Ethereum price exchanges hands at $1,230.

The largest cryptocurrency could retest its mid-week support at $15,550 before bulls consider another attempt to recoup weekly losses. However, with the immense volatility in the market, declines could stretch to another yearly low.

BTC/USD daily chart

The key level to watch going forward is support at $15,550. A daily candlestick close below this level could be detrimental to Bitcoin, with analysts predicting a drop to $12,000. On the other hand, holding above $15,550 could see Bitcoin absorb the overarching selling pressure, allowing bulls to push for a trend reversal toward $20,000.

More to follow.

Author

FXStreet Team

FXStreet