Breaking: Ethereum price shatters $4,000 to set up another all-time high

- Ethereum price created a new all-time high at $4,074.99.

- A continuation of this upswing could push ETH to the 127.2% Fibonacci extension level at $4,240.

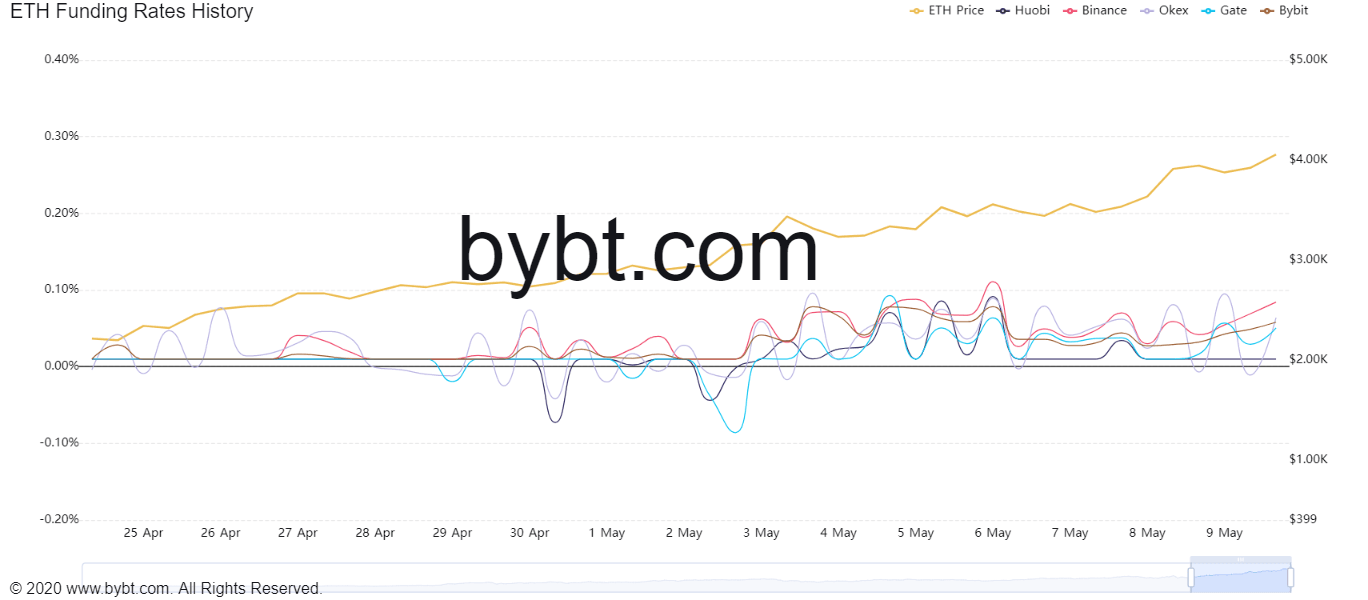

- Despite a slew of all-time highs, the funding rate for the altcoin pioneer seems to remain relatively low.

Ethereum price has been on a tear as it erected the second all-time high in May. The slow and steady ascent of ETH into the price discovery phase could continue.

Ethereum price shows no signs of slowing

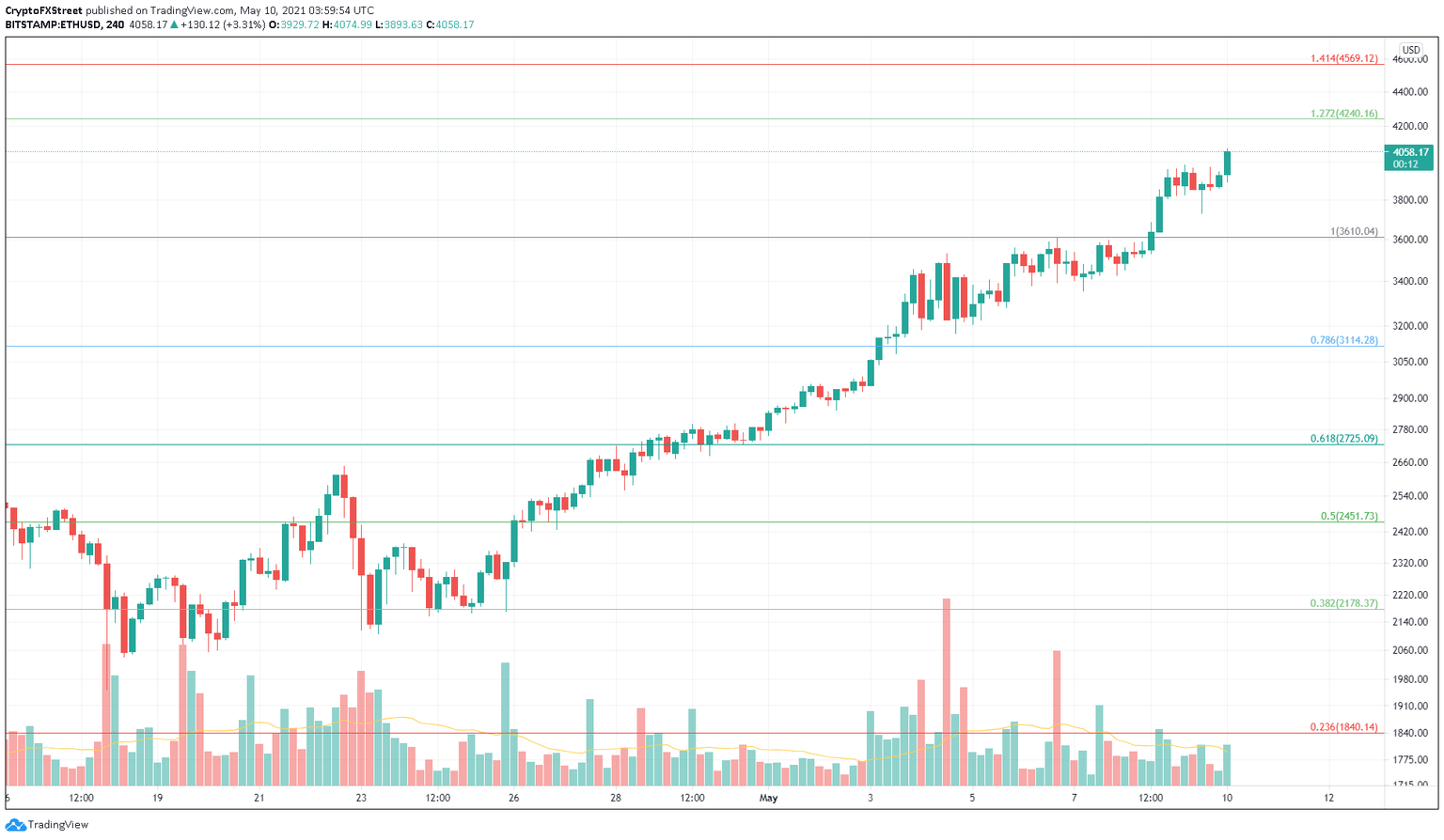

On the 4-hour chart, Ethereum price broke above the previous top at $3,610 on May 8. The resulting upward trajectory showed a steady growth that pushed ETH to its second all-time high in May at $4,074.99.

Institutional investors seem to have shifted their sights to the smart contract token, as Bitcoin remains lull. Moreover, the recent performance of Ethereum price might have also swayed the retail as well.

ETH/USDT 4-hour chart

Interestingly, Ethereum’s funding rates have remained relatively stable despite the recent onslaught of bulls.

At the time of writing, the funding rate for ETH stood around 0.08% on Binance and while other exchanges noted less than 0.06%. Usually, a sudden price surge will see the funding rate shift above 0.1%. However, the current funding rates instill confidence in the current upward trajectory.

ETH funding rate chart

If the buyers begin to book profits, Ethereum price could see a 3% correction to the support level at $3,817.

However, a breakdown of this barrier could see ETH drop another 6% to the previous local top at $3,610.

Author

FXStreet Team

FXStreet