Breaking: Ethereum breaks through $3,000 and now targets $4,000

- Ethereum price is picking off a new trend.

- Bulls are gaining momentum as trend angles become steeper.

- Only a break below $2,550 can invalidate the bullish thesis.

Ethereum price looks more bullish as the week progresses after breaking through $3,000. ETH price is likely to keep charging higher if bulls can maintain momentum.

Ethereum price targets $4,000

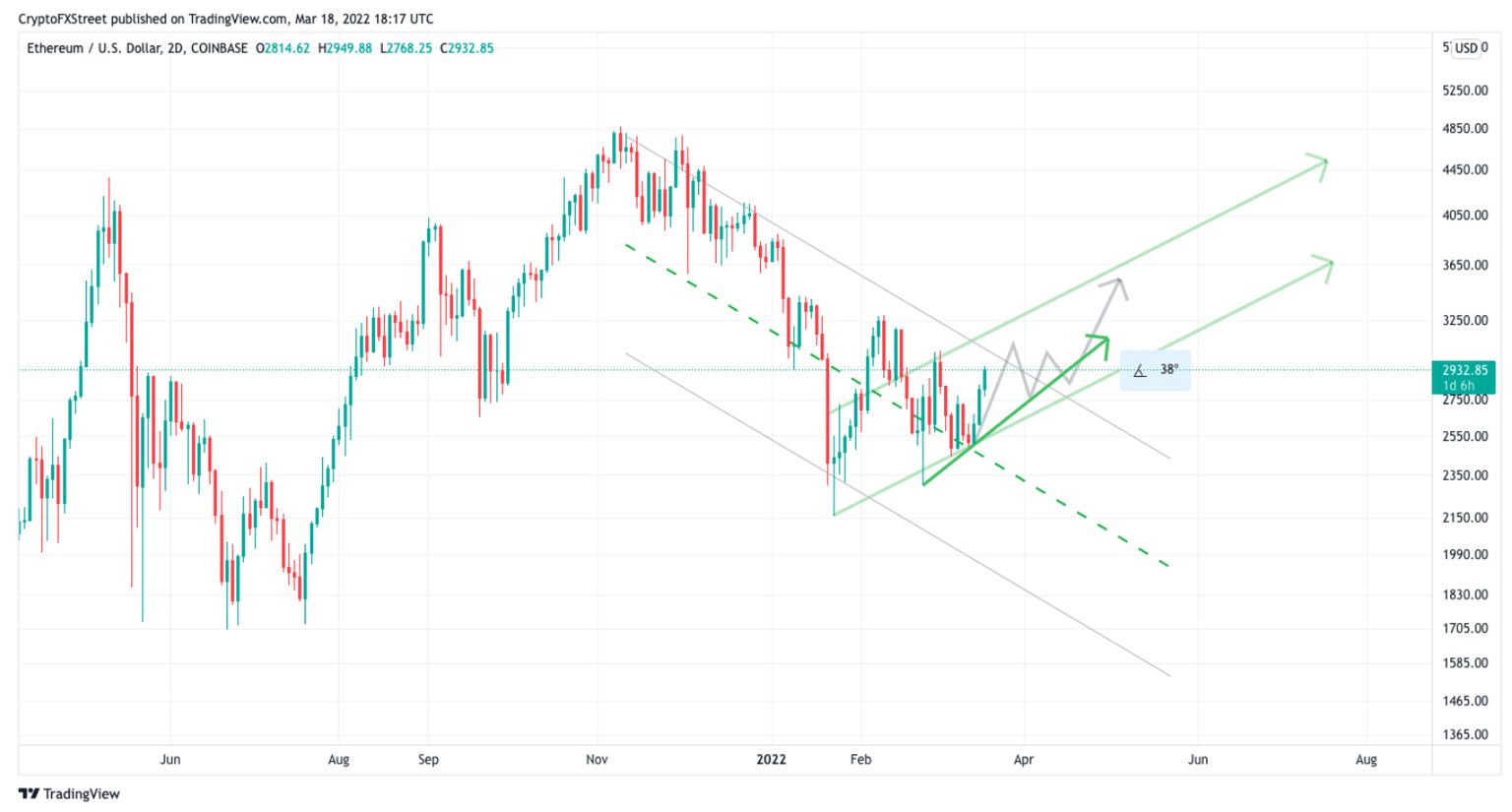

Ethereum price is trading on the upper side of this month's range today at around $2,943, and It does appear that bulls have regained some overall strength. For one, ETH price bounced perfectly on the median line six days ago and has gone on to print a large bullish engulfing candlestick on the 2-day chart. If market conditions continue, Ethereum price could see a spike towards $4,000 in the coming weeks.

ETH price 17% rally from the median line to current levels does appear to have two more barriers to breach before the bulls can confidently say they are in control of the trend.

For one, an Ethereum price of $3,000 is a psychological number in the crypto world and will likely continue to have participants on their toes. Secondly, ETH faces the upper resistance barrier on the daily trend channel. The technical price action suggests a decisive close above $3,100 and maintaining this level as support could lead to further gains.

ETH/USDT 2-Day chart

The bullish thesis could be invalidated if Ethereum price loses $2,550. If bears manage to push prices this low, the upward momentum will likely diminish. Investors could then expect to see ETH price sweep of the lows as the bears will aim to challenge support at $2,400 and $2,300, respectively.

Author

FXStreet Team

FXStreet