Ethereum 2.0 is finally live; is it time to sell the news?

- Ethereum developers successfully launched Phase 0 of the ETH 2.0 update.

- ETH/USD started the downside correction after hitting the highest level of 2020.

The ETH 2.0 Beacon Chain went live. ETH/USD hit the new 2020 high at $636 and started the downside correction. At the time of writing the coin is changing hands at $609.

The Beacon Chain goes live

The Ethereum 2.0 went live today, on December 1, 12 PM UTC, as per schedule. The deposit smart contract attracted 524,288 ETH on November 24, setting the stage for the Beacon Chain launch seven days later. At the time of writing, 877,249 ETH (worth $500 million) is staked in the deposit contract.

According to the official announcement, validators have started finalizing the data.

At the moment, validators are only finalizing empty Beacon Chain slots (similar to blocks) and epochs in order to test the stability of the network in mainnet conditions. The Beacon Chain is the heart of the ETH 2.0 system and will be responsible for coordinating the validation of 64 shards once ETH 2.0 is fully launched.

Read our in-depth article about what is Ethereum 2.0 and why it is essential.

ETH is ready for a sell-off

At the time of writing, ETH/USD is changing hands at $573, down from the recent high of $636. Obviously, the coin has entered a "sell the fact phase" and may extend the decline as several technical indicators send bearish signals.

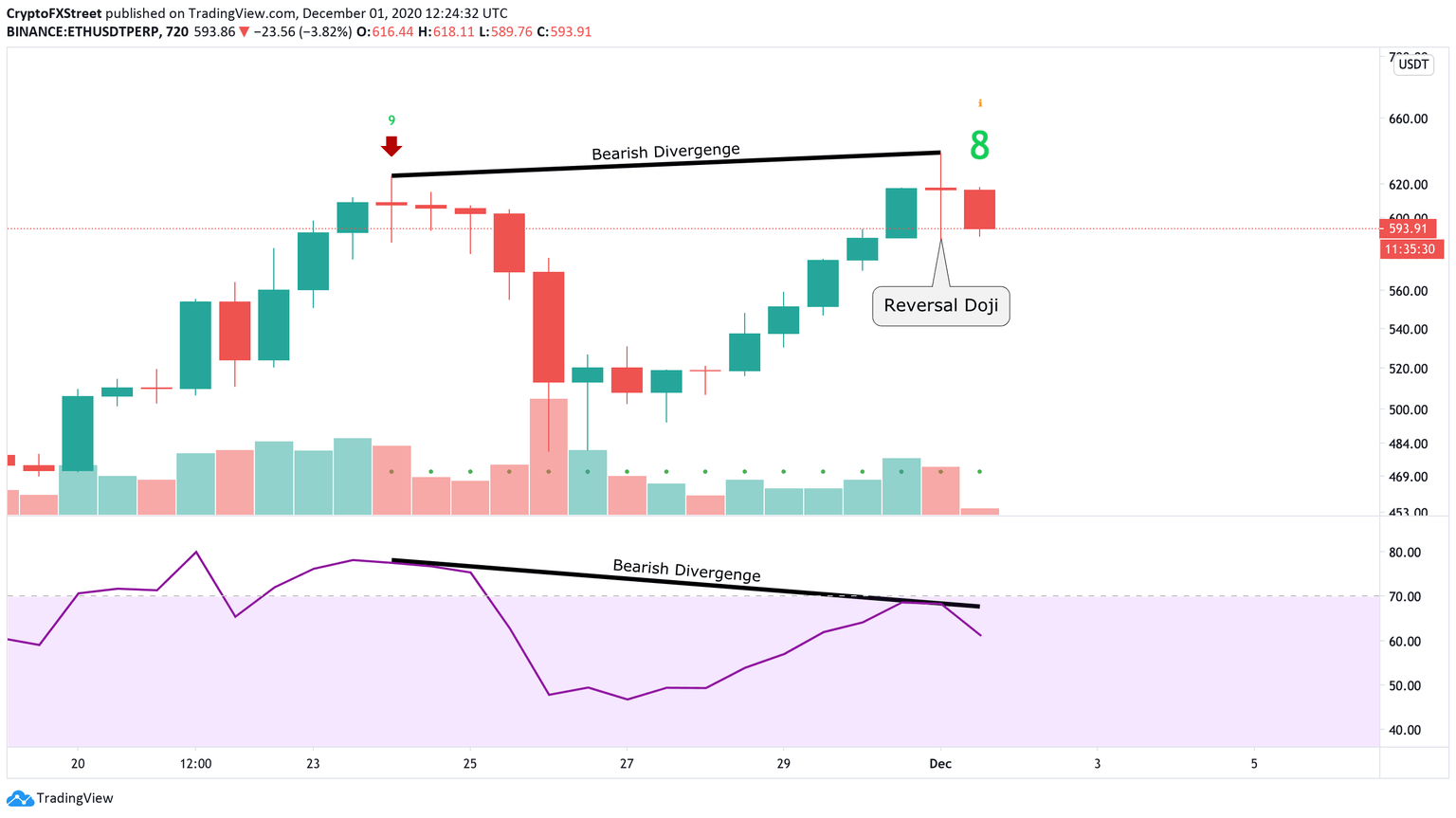

ETH/USD, 4-hour chart

Thus, TD Sequential indicator is ready to present a sell signaling the form of red eight candlestick on a 4-hour chart. The RSI's bearish divergence confirms the negative outlook. If the signal is confirmed, ETH/USD may extend the decline to $530.

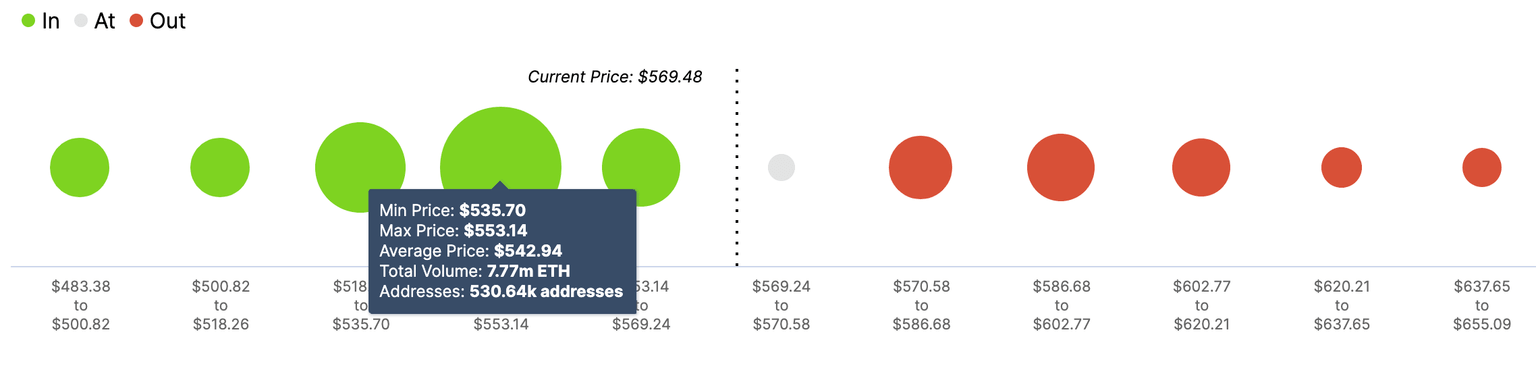

In/Out of the Money Around Price" (IOMAP) model shows that there is significant support around $550. About 535,000 addresses bought over 7.8 million ETH between $530 and $550. It means that the bears might have a hard time pushing through this barrier. Once it is out of the way, psychological $500 will come into focus.

Author

Tanya Abrosimova

Independent Analyst