BREAKING: Crypto market tumbles as the CFTC reportedly opens investigation into Binance

- The Commodity Futures Trading Commission (CFTC) is reportedly investigating whether Binance lets Amletscans buy derivatives.

- The cryptocurrency market saw an instant drop after the announcement, with BNB taking the biggest hit, down 10%.

- The CFTC is also investigating the exchange over KYC regulations and more.

The CFTC is investigating Binance on whether the exchange allowed U.S. residents to buy or sell derivatives as Binance isn't registered with the agency. However, it's important to note that the exchange hasn't been accused of anything just yet.

Additionally, Binance has always stated that it will not comment on communications with regulators. The exchange does block U.S. residents from the website and has created a specific exchange called Binance US for them.

In the past several months, the CFTC has been busy with cryptocurrency exchanges, most notably suing BitMEX for not registering as a broker. Coinbase also stated that it is working to respond to a wide CFTC probe.

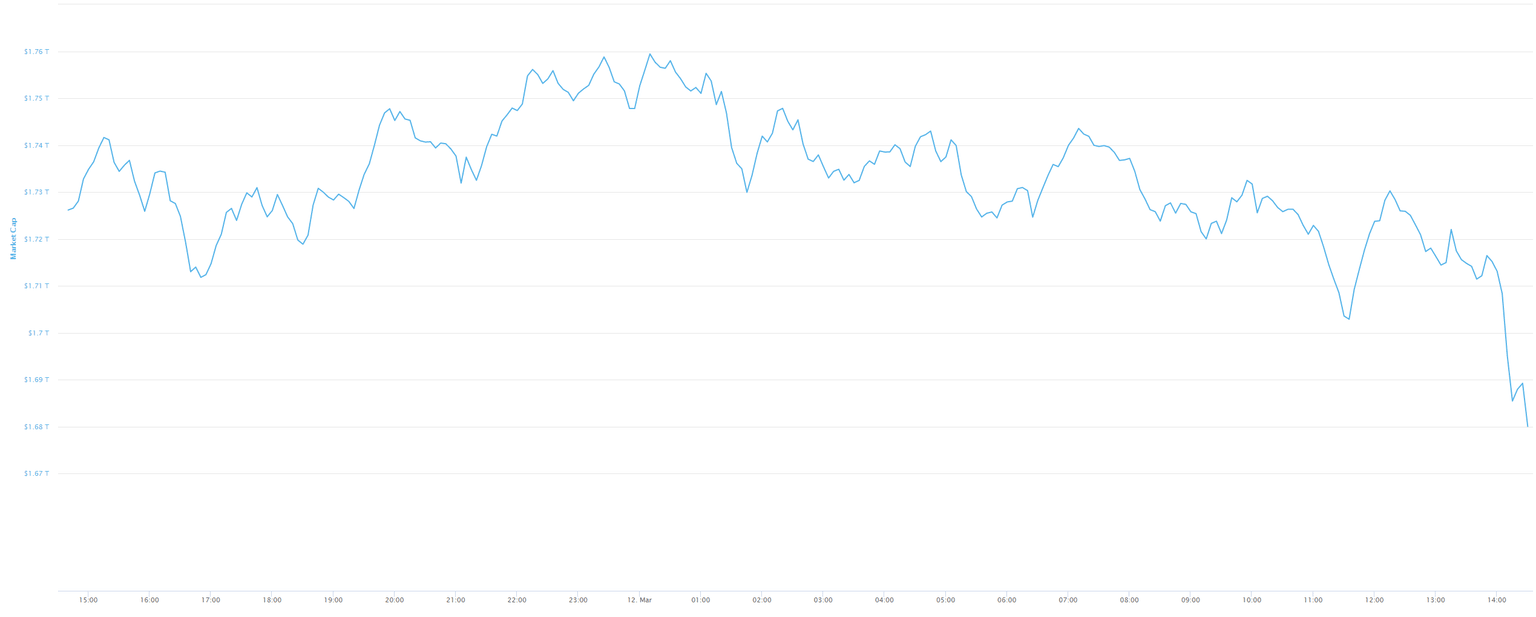

Cryptocurrency market plummets instantly after the announcement

Right before the announcement, the total market capitalization of all cryptos was about $1.73 trillion which quickly dropped to $1.68 trillion in just one hour. Bitcoin lost about 2% of its value but the most affected digital asset was BNB by far which dropped more than 10% instantly.

Total Market Capitalization

Similarly, other BSC-related projects like PancakeSwap also faced significant selling pressure. Surprisingly, Ethereum also fell by about 3% in the past hour.

It’s not a bull market without some FUD.

— CZ Binance (@cz_binance) March 12, 2021

Ignore FUD, keep BUIDLing.

The CEO of Binance, Changpeng Zhao only made a short statement on Twitter, indicating that the announcement isn't concerning to Binance and only intends to create panic in the market.

Author

FXStreet Team

FXStreet