Coinbase Layer 2 based Magnet Finance rug pulls users for $6.4 million via price oracle manipulation

- Coinbase Layer 2 BASE-based Magnate Finance deployer, rugged users for $6.4 million in locked assets on its platform.

- A crypto expert issued a community alert informing users that the protocol is likely to exit scam.

- Magnate Finance website is now offline and the Telegram group has been deleted.

Coinbase exchange's Layer 2 chain, BASE witnessed another rugpull on Magnet Finance, a lending protocol hosted on the blockchain. The users of the protocol lost $6.4 million to the deployer, a scammer associated with exploits of Kokomo Finance and Solfire. Crypto expert ZachXBT identified the vulnerability and informed his 434,000 followers, nearly an hour before the exit scam.

Also read: Coinbase Layer 2 BASE hosts 500 scam tokens, amounting to $3.7 million in trade volume

BASE-based lending protocol deployed by exploiter

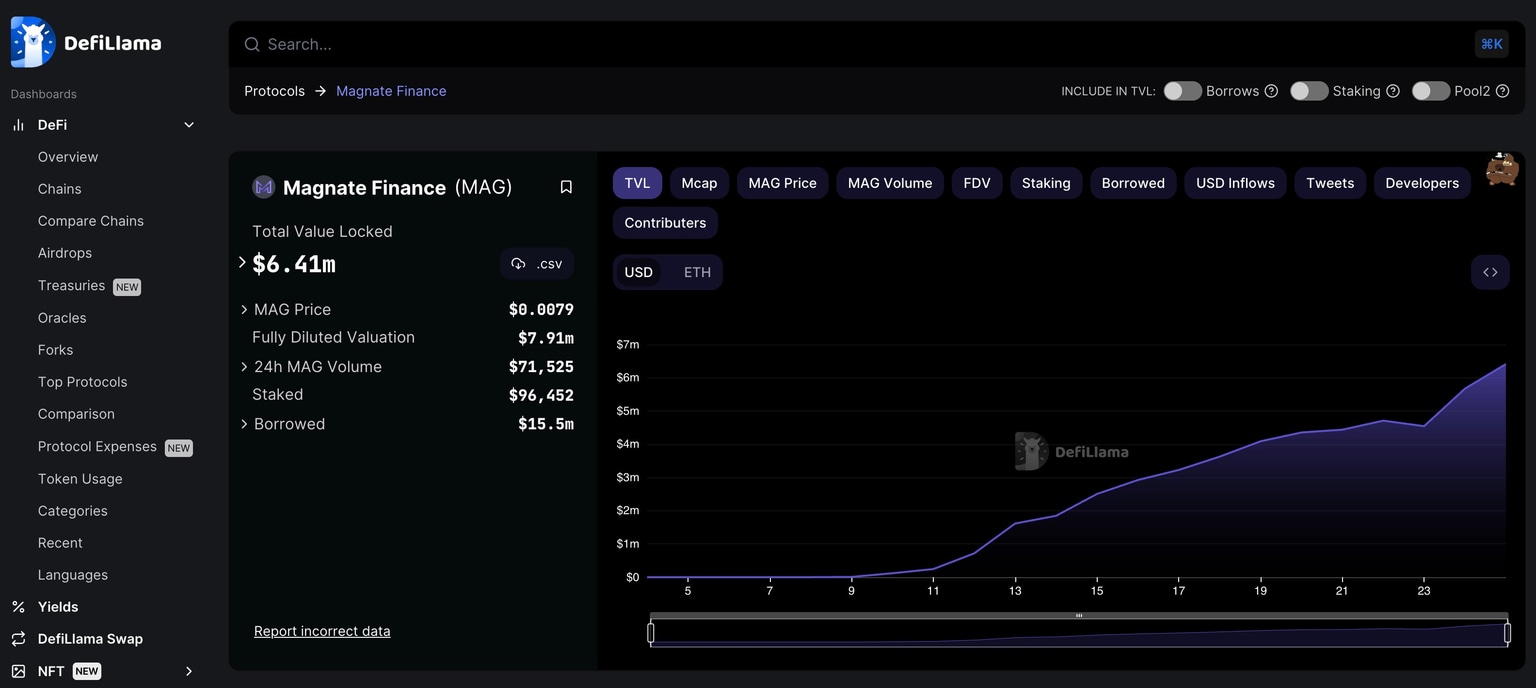

Magnate Finance refers to itself as a novel lending protocol on Coinbase’s BASE chain. The protocol amassed $6.4 million in crypto assets locked on its platform since its launch on August 4, according to DeFiLlama. ZachXBT identified links between the deployer of the project and the Kokomo Finance exit scam.

Magnet Finance TVL as of August 25 from DeFiLlama

Kokomo Finance was a project on the Optimism chain, and it stole $4 million in user funds, ushered a 95% decline in the price of the KOKO token and removed all its social media accounts, on March 27.

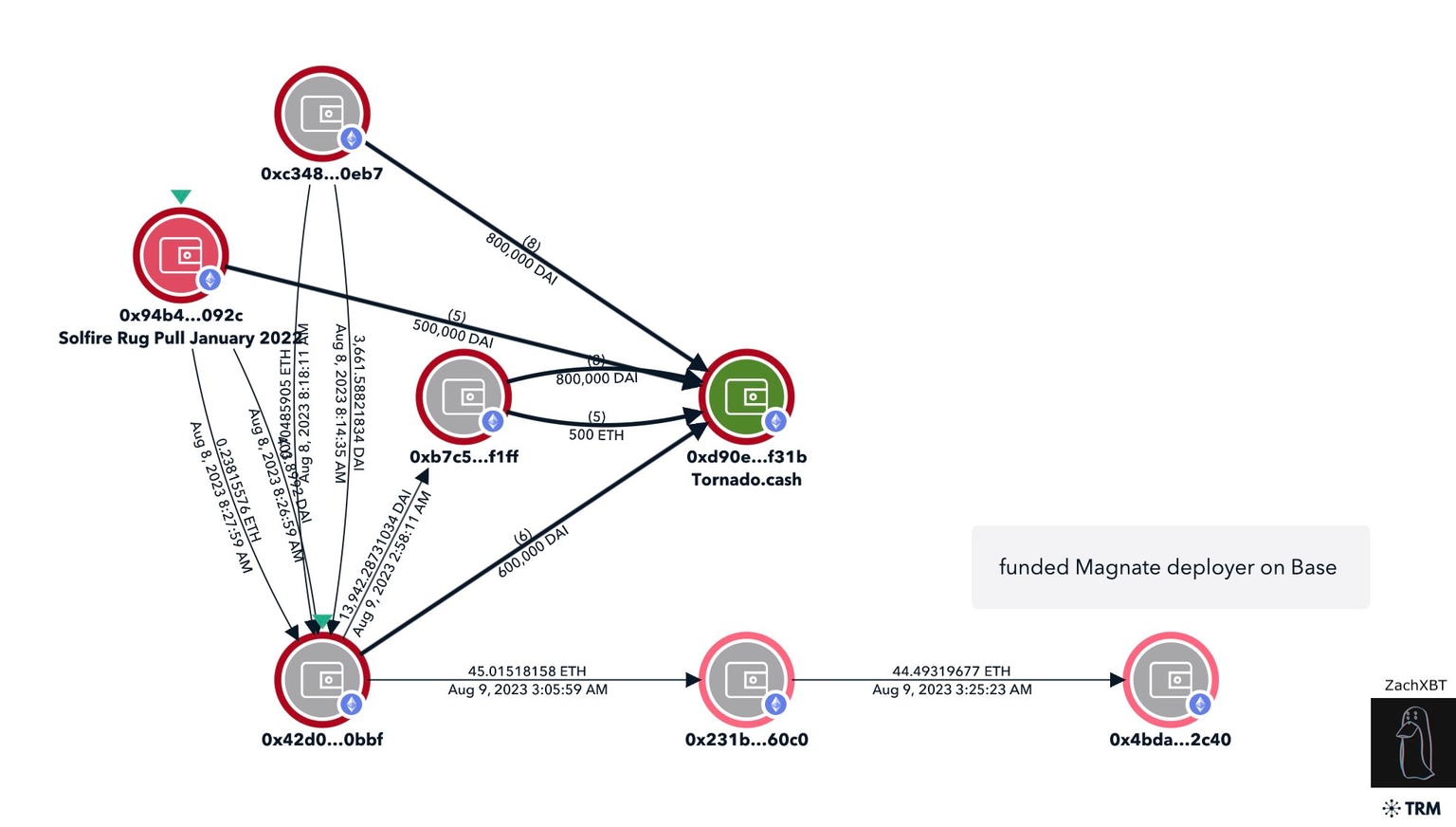

ZachXBT identified that Magnate Finance’s deployer’s address is the same as the Solfire exit scam. this finding was confirmed by blockchain security firm, SlowMist.

We have also received reports from users, please pay attention to the safety of funds. https://t.co/emzcyFACKv

— SlowMist (@SlowMist_Team) August 25, 2023

Link between Magnate Finance and Solfire Exit scam deployer

At the time of writing, Magnate Finance’s website and Telegram are offline and deleted, respectively, and DeFiLlama shows $2.8 in crypto assets on BASE remains locked in the protocol.

Blockchain security firm PeckShield explains the price oracle manipulation in its tweet:

#PeckShieldAlert #exitscam The TVL of Magnate Finance on #Base has dropped ~$6.4M

— PeckShieldAlert (@PeckShieldAlert) August 25, 2023

The developer modified the provider of the price oracle and removed all the assets. pic.twitter.com/cveB4jrrGc

The price of the protocol’s MAG token nosedived 86% in response to the news of the rugpull.

#PeckShieldAlert #rugpull Magnate Finance $MAG has dropped -86% pic.twitter.com/3U1shfH0uE

— PeckShieldAlert (@PeckShieldAlert) August 25, 2023

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.