Bitcoin shatters $63,000 as Jim Cramer posses a rhetoric on BTC value for mankind

- Bitcoin hit $60,000 after more than two years below this level.

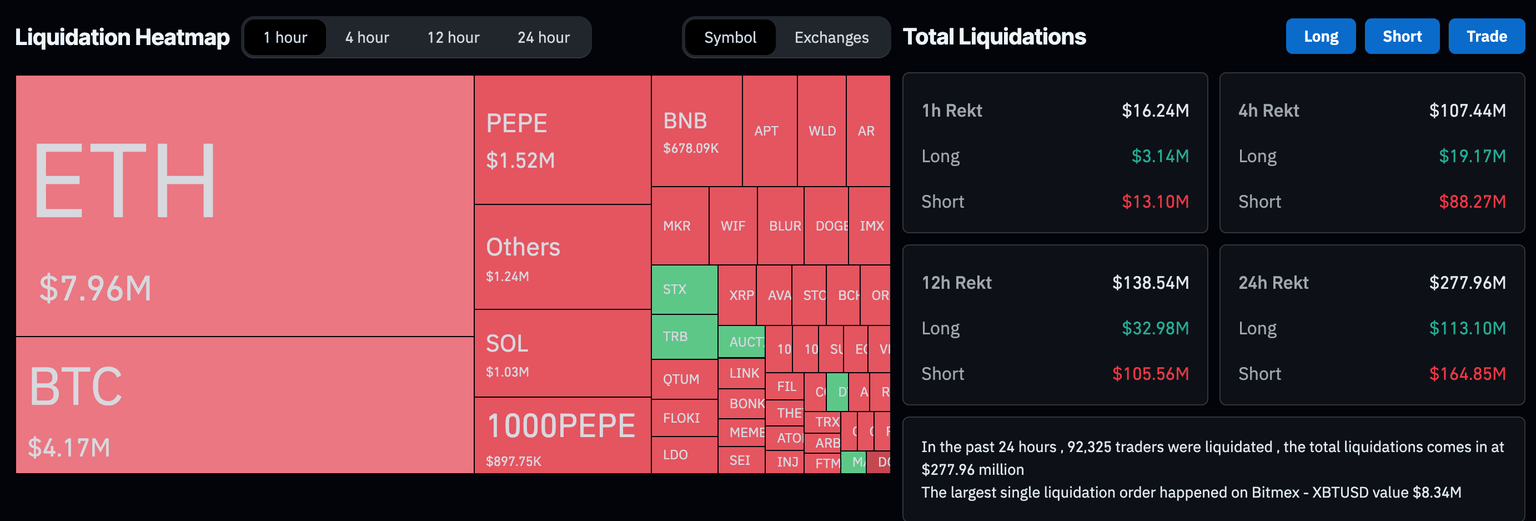

- BTC liquidations have surpassed $277 million in the last 24 hours.

- This massive rally in the pioneer cryptocurrency could be attributed to the spot ETF approval.

Bitcoin (BTC) price has shattered past the $63,000 threshold, with the bulls not showing any signs of stopping. The upside potential remains alive, with BTC now eyeing $65,000.

Meanwhile, CNBC Mad Money host Jim Cramer has posed a rhetoric, "What has Bitcoin ever done for mankind?" On January 22, Cramer indicated, "BTC is unlikely to find its footing."

Five weeks down the line and BTC is 55% up. Caution is advised even as BTC steadily advances towards its peak price.

Also read: Bitcoin price peaks at $54,910 as BlackRock spot BTC ETF, IBIT, trades above $1 billion on Thursday

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Bitcoin shatters $63,000

Bitcoin price has skyrocketed past the $60,000 mark for the first time since November 18, 2021. This move marks the end of an 832-day hiatus. The world's leading cryptocurrency surged nearly 16% in the past three days, reaching a peak of $60,800 on major exchanges before slightly sliding lower. The next level to watch is $65,000.

Speaking with FXStreet, crypto analyst Hansolar attributes Bitcoin’s retest of $60,000 to a combination of “strong spot flows” and “potential squeeze in the options market.”

The analyst further added that “the bitcoin options market, which is mostly made up of sophisticated institutional players (aka smart money), were betting on lower volatility before the break past $57,500 only to be caught off-guard by the persistent spot from Coinbase and the Korean market.”

%252010.34.07-638447242077100210.png&w=1536&q=95)

BTC/USDT 1-day chart

According to CoinGlass data, the Monday and Tuesday rallies in Bitcoin price have caused nearly $250 million positions to face liquidations.

BTC Liquidations

Bitcoin’s Open Interest (OI), which is the total number of BTC positions open at a given point in time, has hit $26.72 billion after being on an uptrend since September 2023.

BTC Open Interest

As Bitcoin price trades around $60,400, analysts are cautiously optimistic about the future of Bitcoin, with some predicting a potential for a further rise towards its all-time high of $69,138, which was also reached in November 2021. However, others warn about potential correction and urge investors to exercise caution.

Also read: BTC ETF AUM could surpass Gold, expert says, amid enthusiasm for new investment funds

While BTC/USD and BTC/USDT pairs are trading below their previous all-time highs, BTC/KRW pair is already trading at an all-time high of 84,700,000 WON, which is nearly 1% higher than the previous all-time high of 82,700,000.

BTC/KRW 1-day chart

(This story was corrected on February 28 at 13:37 GMT to say that BTC reached a peak of $60,800 on major exchanges before slightly sliding lower.)

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.