Breaking: Bitcoin price hits new all-time high near $63,000

- Bitcoin price has set up record levels at $62,741 after leaving the previous high in the dust.

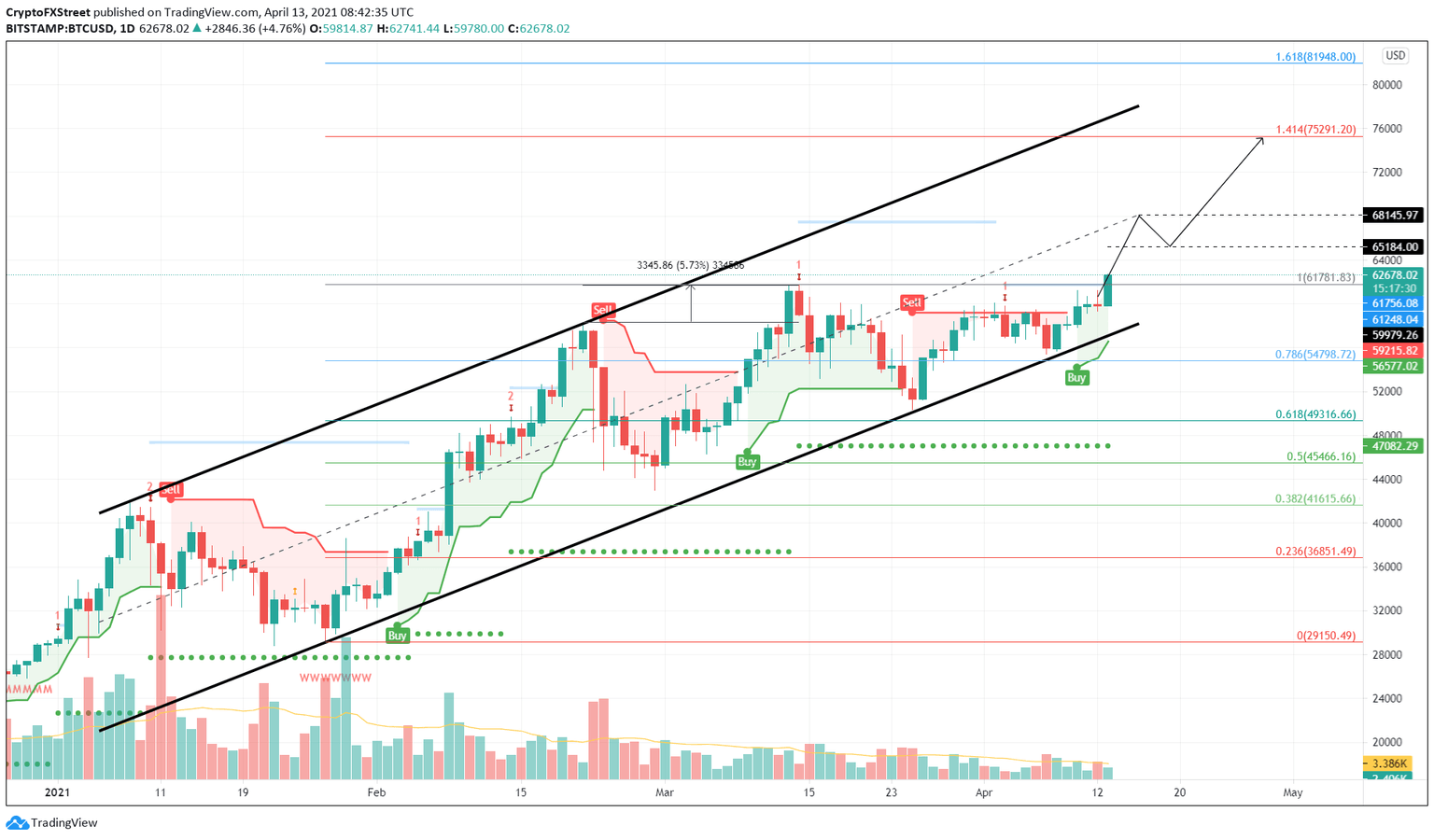

- A decisive close above the MRI’s breakout line at $61,780 will signal an upswing.

- The move higher is likely to create a temporary top at $68,145 before proceeding to $75,000.

Bitcoin price has finally ended its prolonged consolidation, indicating its journey into unexplored territory.

Bitcoin price embarks into discovery phase

Bitcoin price action has been contained inside of an ascending parallel channel for nearly three months. This technical is obtained by connecting the two higher highs and three higher lows using trend lines.

However, the recent spike in bullish momentum has created a new all-time high at $62,741.

In doing so, the Momentum Reversal Indicator’s breakout line at $61,185 was a crucial level preventing the pioneer cryptocurrency from venturing higher. However, the recent spike in buying pressure has undone this level, suggesting a sharp rise in the market value of BTC.

The potential targets that bulls are eyeing include the channel’s middle line at $68,145 and the 141.4% Fibonacci extension level at $75,291.

Supporting this optimistic outlook for the flagship cryptocurrency is the recently spawned buy signal from the SuperTrend indicator.

BTC/USD 1-day chart

If BTC fails to produce a decisive daily candlestick close above the breakout line at $61,780, a retracement to the ascending channel’s lower trend line at $58,640 seems plausible.

A breakdown of the said level might trigger a 6% sell-off to the 78.6% Fibonacci retracement level at $54,798.

Author

FXStreet Team

FXStreet