- Bitcoin breaks above $28,000 hit another all-time high at $28,250

- The correction may be gaining traction as several indicators produced bearish signals.

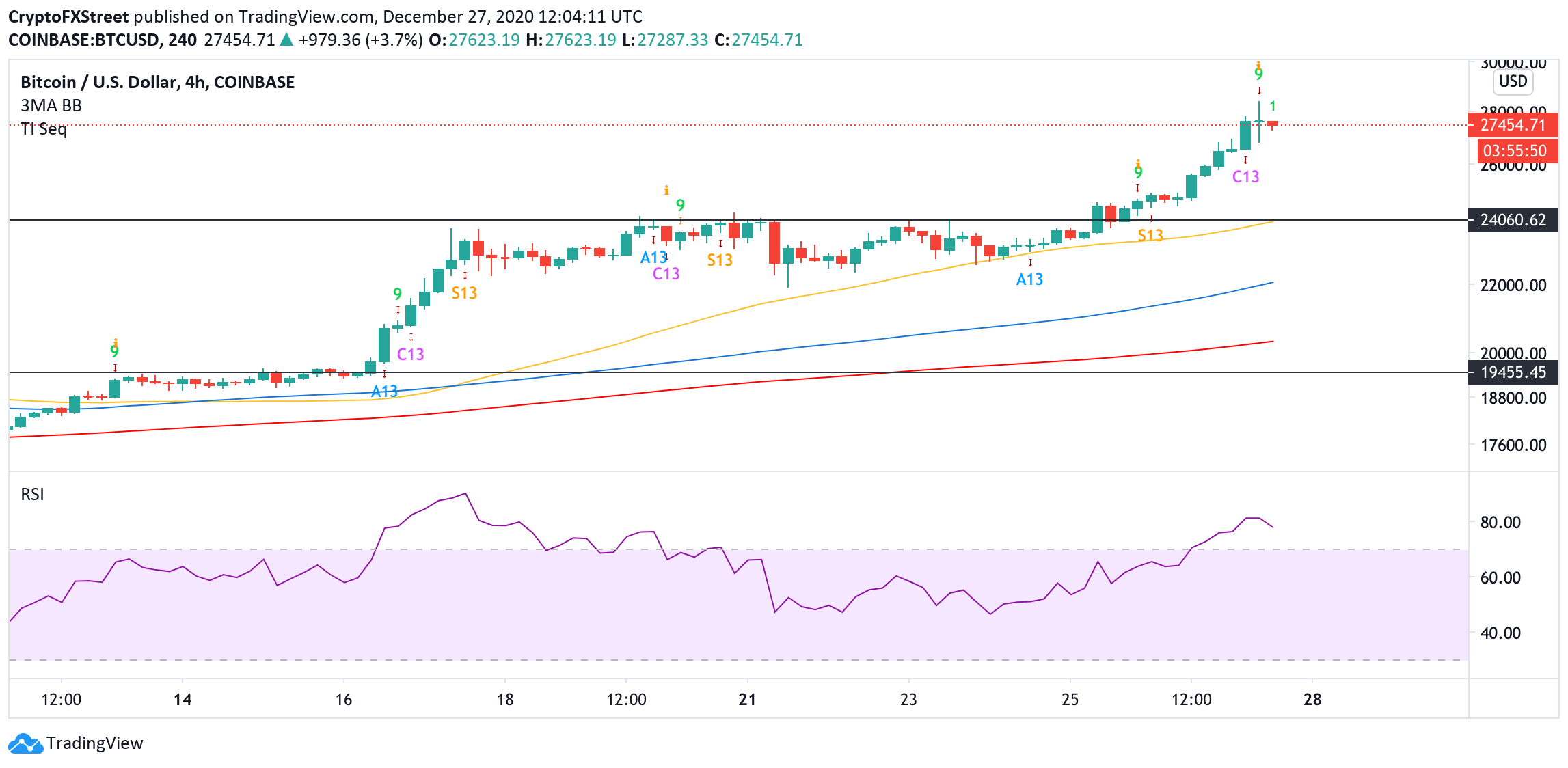

Bitcoin hit a new all-time high at $28,250 and retreated to $27,500 by the time of writing. The pioneer digital asset has retreated below the psychological $28,000 amid massive profit-taking by retail traders.

The technical picture implies that the coin is vulnerable to further sell-off, as an evening star candlestick pattern transpired on a 12-hour chart. This candlestick pattern consists of a large white candlestick, a Doji candle, and a red candle. Thus, the signal will be confirmed if the current 12-hour candlestick closes in a red zone.

BTC, 12-hour chart

Moreover, the TD Sequential indicator presented a sell signal in the form of a green nine candlestick on the 12-hour chart. This formation, coupled with the RSI reversal from overbought territory, gives credence to the short-term bearish forecast.

The first correction target is seen $27,000. Once it is broken, the sell-off continues towards $25,500. The critical support is created y a combination of a former resistance and the 4-hour SMA50 on approach to $24,000.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: Slow but positive start

Bitcoin edges slightly lower, trading around $96,500 on Friday after an over 2.5% recovery this week, with historical data showing modest average January returns of 3.35%. On-chain metrics suggest the bull market remains intact, indicating a cooling-off phase rather than a cycle peak.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

BTC, ETH and XRP eyes for a rally

Bitcoin’s price finds support around its key level, while Ethereum’s price is approaching its key resistance level; a firm close above it would signal a bullish trend. Ripple price trades within a symmetrical triangle on Friday, a breakout from which could signal a rally ahead.

Could XRP surge to new highs in January 2025? First two days of trading suggest an upside bias

Ripple's XRP is up 7% on Thursday, extending its rally that began during the New Year's Day celebration. If long-term holders (LTH) continue their recent accumulation, XRP could overcome the $2.9 resistance level and aim for a new all-time high.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.