BNB price recovery rally threatened as Binance trustworthiness is questioned

- Binance has been accused of breaching US financial rules that require customer money to be kept separate.

- Allegedly, the exchange commingled billions of dollars of customer funds with company revenue in accounts held at collapsed Silvergate Bank.

- On Feb. 10, 2021, Binance mixed $20 million from a corporate account with $15 million from an account that received customer money.

- While Binance has denied the claims, BNB price is dented with the RSI showing a waning buyer momentum.

Binance Coin (BNB) price, which had kick-started a promising recovery rally, has been impeded by a new bearish development in the Binance ecosystem. According to a Reuters report, the largest exchange by trading volume faces charges of breaching US financial rules requiring customer money to be kept separate.

Also Read: Ethereum price inches closer to $1,900 even after losing the daily DeFi battle to Binance

Binance denies claims of commingling customer funds

Binance exchange has denied claims by three anonymous persons who alleged that the exchange commingled billions worth of customer funds in 2020 and 2021. The allegation cites interviews with the three unnamed individuals, with one among them claiming to have first-hand knowledge of Binance group’s finances.

Reportedly, Binance used Silvergate Bank (now defunct) to commingle billions of dollars on a daily basis. Notably, while there has not been any tangible proof about the allegation, it is not the first time Reuters has released incriminating material about the flagship exchange. In June, the news site said Binance was involved in money laundering and unexplainable financial transfers. Nevertheless, as is the case currently, Binance denied the claims.

Binance’s Chief Communications Officer, Patrick Hillman, has discredited the claims, citing desperation among journalists.

Let me explain just how desperate a journalist @Reuters is to publish a negative story. The whole base of their story this morning, is that when users purchased BUSD (Paxos) from Binance, they were taken to a transaction page that had the term “deposit” on it. Users were making a…

— Patrick Hillmann (@PRHillmann) May 23, 2023

In Hillman’s words:

We’ve been very public about where the company had regulatory shortcomings in the past,” he wrote, “there’s no reason for a respected news outlet like Reuters to continue making stuff up.

Notably, Reuters has been unable to verify the figures or transactional frequency independently. At the same time, they have also not found any evidence Binance lost that supposedly commingled funds. Based on the report, however, the exchange’s stablecoin, Binance USD (BUSD) is also linked to the controversy, with reports saying it was used to credit customers’ accounts when they were really depositing USD.

The threat of commingling customer funds

The commingling of customer funds is indeed a threat to the exchange’s users, considering customers would then have no way of knowing where their funds actually are. According to three former US regulators, it puts the capital and assets at risk. Among the three, former chief of the US Securities and Exchange Commission’s (SEC) enforcement team, John Reed, told Reuters that Binance customers should not need a forensics accountant to track their money.

Binance Coin rally threatened

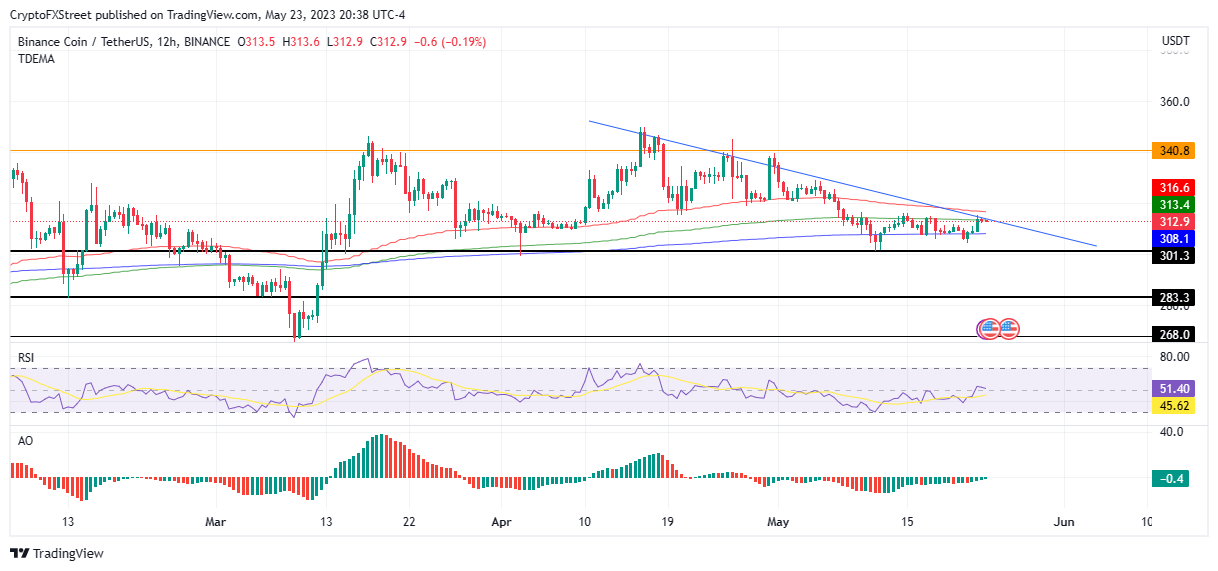

The news has had a bearish impact on Binance Coin, presenting a bump on what had been a clear attempt to break above a downtrend line. As selling pressure from the 50- and 100-day Exponential Moving Averages (EMA) continues to weigh down on BNB, Binance Coin price could plummet.

A retrace of the May lows around $301.3 could happen, or in the dire case, Binance Coin price could break below this support level to tag the $283.3 support level before a potential trend reversal.

This bearish outlook draws vigor from the Relative Strength Index (RSI), which was losing positive ground as it eased toward the midline. A crossover into the negative zone would confer authority to the bears.

BNB/USDT 1-Day Chart

Conversely, if bulls disregard the negative fundamentals and increase their buying pressure, Binance Coin price could break above the downtrend line and confront the 50-day EMA hurdle at $312.9. A decisive flip of this barricade into support could invalidate any bearish claims in the meantime. In a highly bullish case, BNB could rally north to tag the $340.8 resistance level, denoting a 10% ascent from the current position.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.