BNB open interest nears $400 million as bulls step in

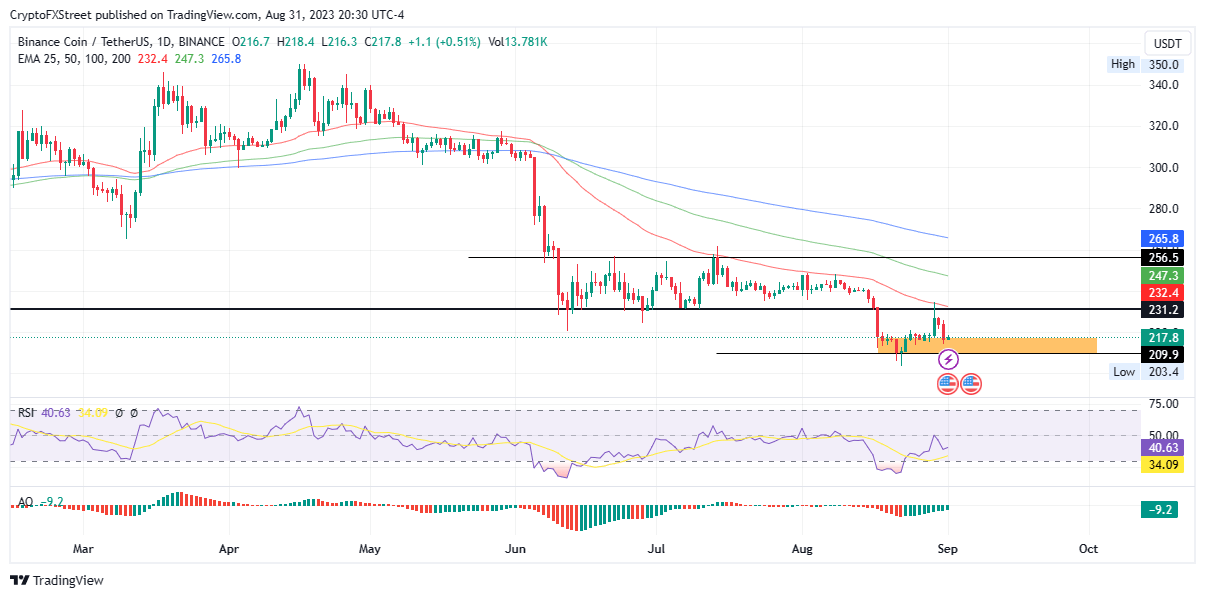

- Binance Coin price is at an inflection point, coiling up for its next move after an almost 7% downswing.

- The token is starting the month with up to $368.77 million in open interest as bulls step in.

- BNB could rise 5% if the demand zone successfully at $215.2 holds, with target at $231.2.

- Invalidation of the bullish thesis is a break below the $209.9 buyer congestion level.

Binance Coin (BNB) price shows signs of an impending short-term uptrend as the network continues to navigate uncertainties associated with regulatory clampdown. Noteworthy, the largest cryptocurrency exchange by trading volume continues to contend with the US Securities and Exchange Commission (SEC), Commodities Futures Trading Commission (CFTC), and the Department of Justice (DOJ).

Also Read: SEC resorts to rare tactic, files secret motion against Binance

Binance eyes short-term uptrend

Binance Coin (BNB) may be ready for a move north, steered by a resurgence by the bulls. Based on Santiment’s Weighted Sentiment metric, social volume for BNB has been on a steady rise over the last week, with the vast majority of positive messages concerning the token also improving at the same time.

BNB Weighted Santiment

Similarly, open interest for the token is significantly high at the start of the month, nearing the $400 million mark at $368.77 million at the time of writing.

BNB Open Interest

With a generally observable upward move, a rise in open interest means that the number of contracts is increasing. With both open interest and the price recording a steady rise, it signals an impending uptrend.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rate affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

BNB price forecast as Binance Coin nurtures an uptrend

After a test of the demand zone at $217.8, Binance Coin may be due for an uptrend, with the most logical move being a 5% climb to the $231.2 resistance level. This supplier congestion level is crucial as it acted as a multi-month support level before becoming a resistance.

While BNB price making a strong rise above the $231.2 mark would be ideal, the odds for an uptrend would only improve upon a decisive candlestick close above the $256.5 resistance level.

The Relative Strength Index (RSI) is tipping north, indicative of rising momentum. In the same way, the histogram bars of the Awesome Oscillator indicator are moving toward the midline and could soon turn positive. This adds credence to the positive side.

It is worth mentioning that BNB price remains submerged within a demand zone, an order block defined by aggressive buying, which increases chances for an upward move.

BNB/USDT 1-day chart

Conversely, if the order block fails to hold as support and Binance Coin slips through, BNB price could drop below the $209.9 support level, delaying the upside, or in the dire case, invalidate the current bullish outlook.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B03.40.49%2C%252001%2520Sep%2C%25202023%5D-638291290863310619.png&w=1536&q=95)