BNB, ICP, ARB, SEI: Four tokens unstirred by BTC dip as markets record largest altcoin liquidations in 2 years

- Binance Coin, Internet Computer, Arbitrum and Sei token continue to surge as the market reels from Matrixport report inspired dump.

- The dump triggered the largest total market liquidations event since the uptrend from the $25,000 range began in August.

- It also provoked the largest altcoin liquidations event in 2 years, but BNB, ICP, ARB, and SEI prices survived.

Binance Coin (BNB), Internet Computer (ICP), Arbitrum (ARB), and Sei (SEI), these four tokens stood their ground during the January 3 trading session as the cryptocurrency market reacted to a concerning report from an analysts with Matrixport Technologies.

Also Read: Arbitrum price shows signs of exhaustion even as ARB TVL records new seven-month high

BNB, ICP, ARB and SEI survive a broader market crash

Binance Coin, Internet Computer, Arbitrum, and Sei token prices have surged 2%, 4%, 7%, and 10% respectively on the day, with double and triple-digit gains in trading volumes amid increasing investor attention for the tokens.

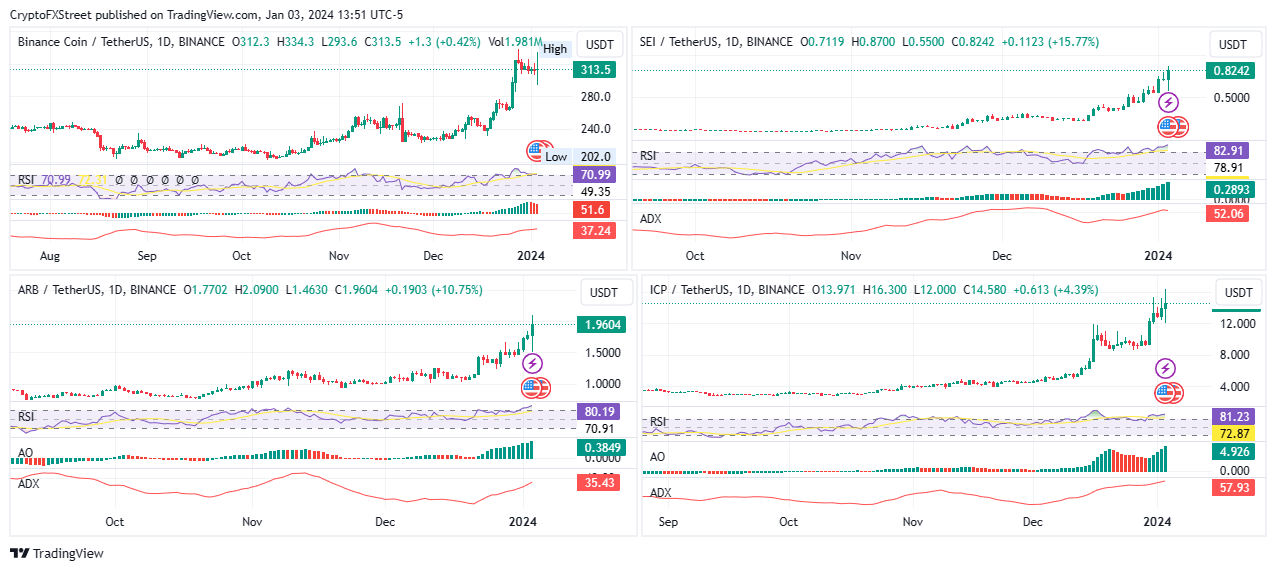

BNB/USDT 1-day chart, ARB/USDT 1-day chart, SEI/USDT 1-day chart, ICP/USDT 1-day chart

The four altcoins managed to survive the cascading effect of a bearish report from a Matrixport analyst, who opined that the US Securities and Exchange Commission (SEC) could reject the spot BTC exchange-traded funds (ETFs) applications.

Matrix on Target projects a January rejection for Bitcoin Spot ETFs by the SEC, cautioning traders to hedge long exposure. With #SEC Chair Gensler’s skepticism towards #crypto, a potential -20% #Bitcoin price drop is anticipated upon #ETF denial, though a positive end-of-2024… pic.twitter.com/IgaMhBJtiP

— Matrixport (@realMatrixport) January 3, 2024

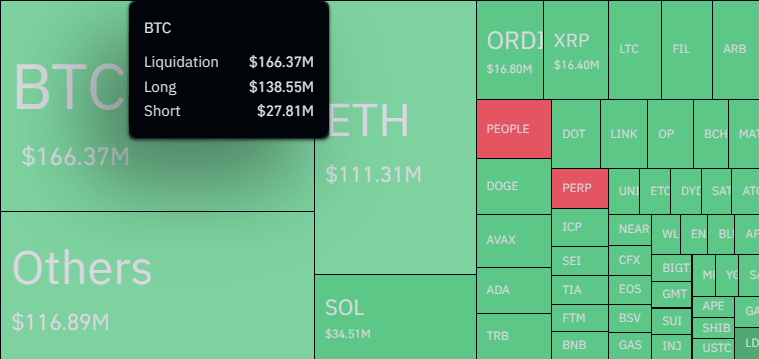

As news of the report broke, Bitcoin price retracted almost 7%, and with it, altcoins, causing up to $540 million in total liquidations across the market within a four-hour span. For Bitcoin, up to $166.37 million positions were liquidated, comprising $138.55 million longs against $27.81 shorts. This means that up to $373.63 million altcoin positions were liquidated, marking the largest altcoin liquidation event in two years.

Crypto liquidations

For BNB, ICP, ARB, and SEI prices, the upside potential remains plausible considering the Relative Strength Index (RSI) remains north bound, suggesting momentum continues to rise. The Average Directional Index (ADX) indicator, which quantifies strength also points to a continuation the uptrend.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.