BLUR price holds up despite Blast users pulling over $1.4 billion in assets after mainnet launch

- Blast mainnet launched on February 29 and users pulled over $1.4 billion assets off the Layer 2 chain.

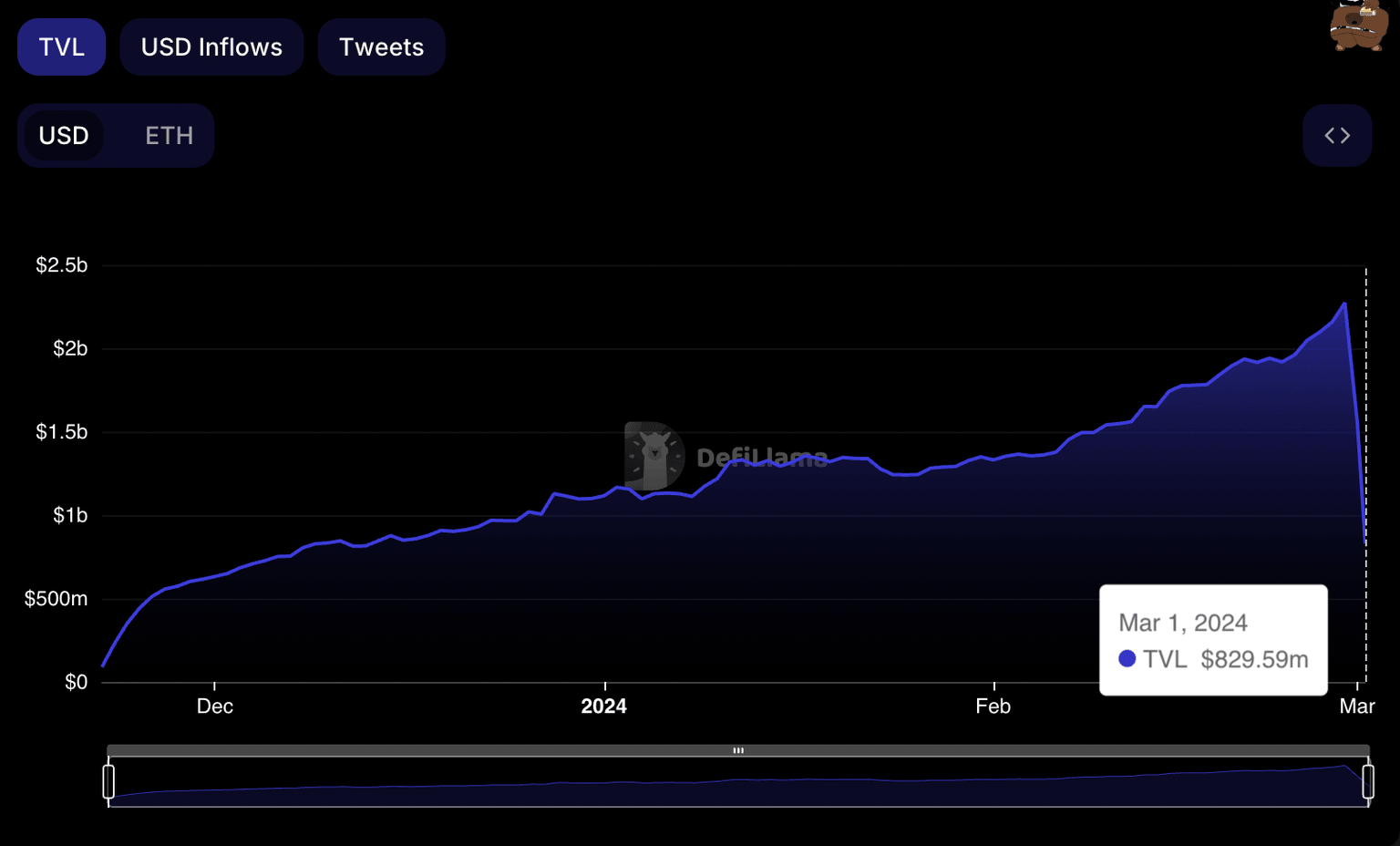

- The total value of assets locked in Blast has dropped to $829.59 million on Friday.

- BLUR price sustained above $0.7276 on Friday, up nearly 6% this week.

Blast, an Ethereum Layer 2 chain, launched its mainnet on February 29. Users that staked their cryptocurrencies on Blast were able to access the funds, move them to dApps within the Blast ecosystem or withdraw.

As of Friday, over $1.4 billion in cryptocurrencies have been withdrawn from Blast.

Also read: Blast gears up for February 29 mainnet launch, crosses $2 billion TVL

Blast loses TVL within 24 hours of mainnet launch

Data from DeFi intelligence tracker DeFiLlama shows that Blast’s TVL has nosedived from its peak of $2.273 billion on February 28 to $829.59 million, early on Friday. The key driver of the decline is the release of the protocol’s mainnet that opened access for users to unlock their staked assets or move them to dApps within the Blast ecosystem.

Blast TVL decline. Source: DeFiLlama

The network collected its staked assets from users like airdrop farmers that hope to qualify for the Blast token airdrop, likely in May. The team has previously stated that an airdrop is likely in May.

Blast users have also witnessed what is allegedly the first rug pull or exit scam in the ecosystem. The fraud took the form of a bogus gambling project called “Risk on Blast” that took off with 420 Ether, according to a Cointelegraph report.

Blast was launched to support Blur with Layer 2 solutions. BLUR price is $0.7276 on Friday. The token climbed nearly 6% in the past week.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.