Bloodbath in DeFi markets continue as YFI, BAND, and AAVE reach a point of no return

- Popular and successful DeFi projects have lost more than 50% of their value in the past two months.

- Statistics from Coingecko show that the market capitalization of the DeFi sector lost close to 50% of its value since September 1.

The DeFi industry had a crazy and significant boom in 2020, especially after the crash of March. Popular DeFi coins like Yearn Finance (YFI) reached a $1.27 billion market capitalization on September 12. Unfortunately, the digital asset has lost around $900 million since then.

Other DeFi projects have suffered from the same fate in the past two months. It seems that the new industry is starting to lose a lot of its hype and DeFi tokens are under a massive period of consolidation.

Yearn.Finance tries to find the bottom

After charting a high of $43,000 on September 12, YFI has been charting a series of lower highs. Currently, the price is trading for $10,830, having broken down from a descending triangle pattern. As per the technical analysis, the target for YFI lies at around $8,320. However, this level has no strong support while looking at the price history. As such, we can expect the price to drop further to $6,200 before it finds viable support.

YFI/USDT 4-hour chart

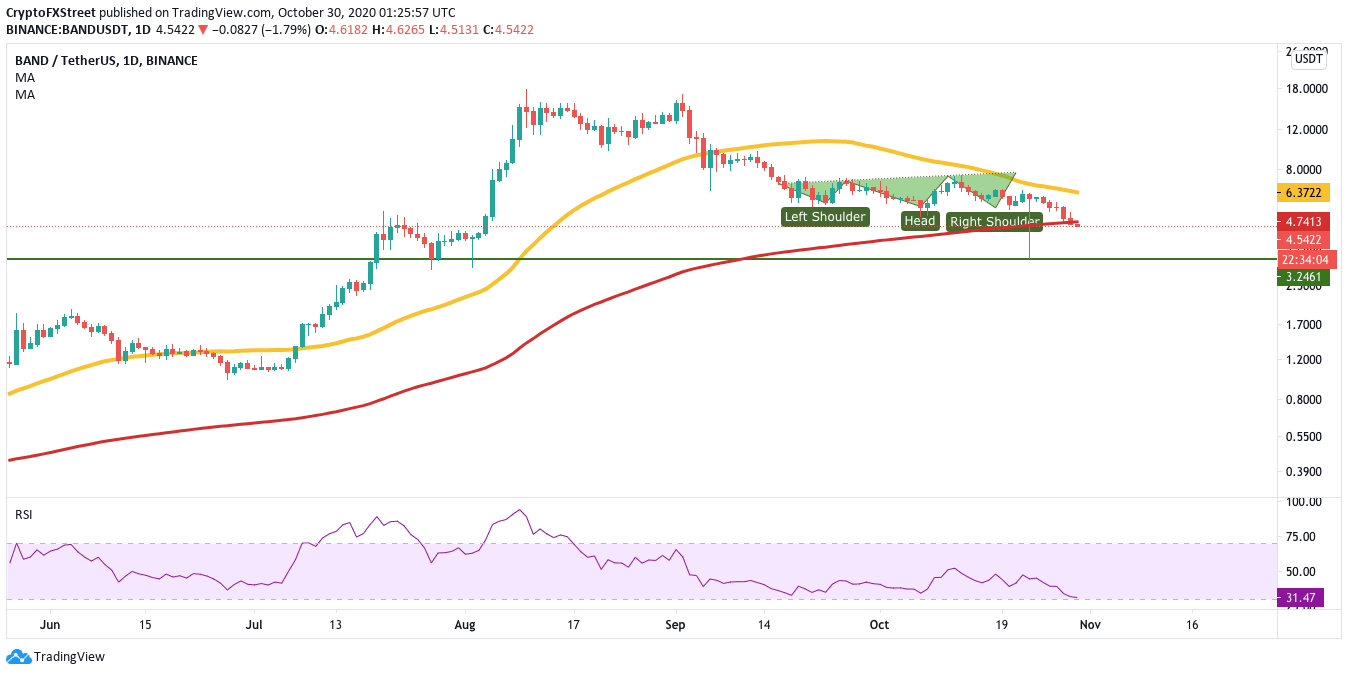

BAND fails to make the most out of inverted head and shoulders

After reaching a high of $15.50 on September 1, BAND has dropped to $4.50 at the time of writing. The price had a bearish break out from the inverted head and shoulders pattern and has dipped below the 200-day SMA ($4.75). The next viable support lies at $3.25. To make matters worse, the 200-day SMA is on course to crossing over the 50-day SMA to form the death cross pattern.

BAND/USDT daily chart

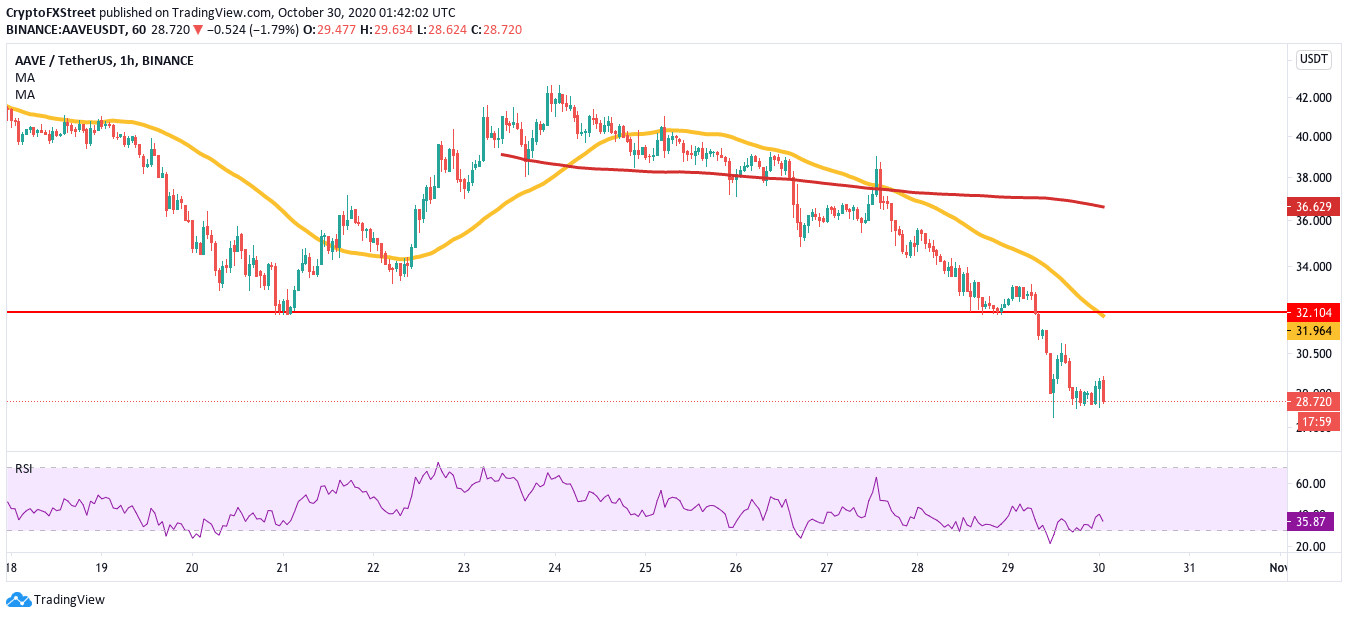

AAVE is charting new all-time lows

Looking at the hourly AAVE/USDT chart, one can see that the price dropped from $42.25 on October 24 to $28.75, at the time of writing. That’s a 32% drop over the last six days. Having dropped below the previous all-time low of $32, the DeFi lending protocol is charting lower lows than ever before. As of now, it’s hard to predict the bottom since the price is in uncharted territory as of now.

AAVE/USDT hourly chart

The overall outlook for the DeFi market is not looking good. However, with Ethereum soon upgrading to Ethereum 2.0, one can hope that the improved scalability and speed will bring more optimism into this space. Until then, the potential investors will probably be extremely cautious before retaking the DeFi plunge.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.