Blockchain Beats Back Cybercrime

According to the FBI’s 2019 Internet Crime Report on cybercrime, U.S. businesses and individuals lost $3.5 billion to cybercriminals in 2019.

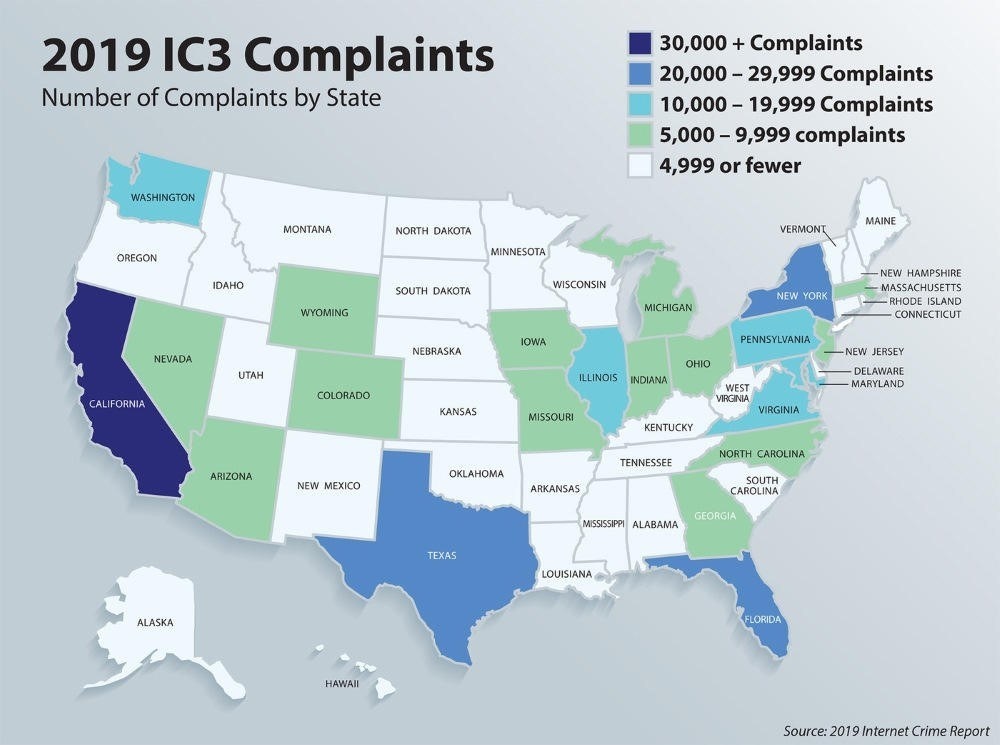

People reported 467,361 complaints of cybercrime to the FBI in 2019 — an average of nearly 1,300 incidents every day, and more than 100,000 more than in 2018.

Losses, too, have steadily increased over the six years of reporting. In 2018, $2.7 billion in losses were reported to the FBI, which was a sharp increase over the prior year, when people reported $1.4 billion in cybercrime losses.

Since the FBI began collecting cybercrime data in 2015, more than 1.7 million complaints have been logged by the bureau, resulting in $10.2 billion in losses.

“Criminals are getting so sophisticated. It is getting harder and harder for victims to spot the red flags and tell real from fake,” said Donna Gregory of the FBI.

2019 has been a year flooded with news about ransomware infections hitting left and right. Companies in the private sector, managed service providers, schools and municipalities have been hit the most.

- 113 state and municipal governments and agencies.

- 764 healthcare providers.

- 89 universities, colleges and school districts, with operations at up to 1,233 individual schools potentially affected.

What’s this got to do with blockchain or cryptocurrencies?

A lot, actually. That’s because blockchain is going to put cyber scumbags out of business. And, it’s going to create big opportunities for businesses and investors. Why?

Because NO ONE has ever hacked Bitcoin. That’s because Bitcoin is stored over blockchain, the most secure computing network in the world. And this security is exactly why the business world is rapidly incorporating blockchain technology into their corporate databases.

The key factor of blockchain security is its decentralization. There is no central location for cyber thieves to search for your personal data.

Instead, blockchain is a record-keeping digital technology based on a “distributed ledger,” which means that data is stored over millions of servers all around the world. A cyber scumbag would need to go from one data point to another, one at a time, as opposed to accessing a centralized database.

The result is that cyber thieves

- No longer have a single point of entry, and ...

- Can only access a small part of your information, even if they manage to break in.

And it can’t be overstated just how difficult it would be to access even one data point. We’re talking computing power that most people can’t comprehend, let alone have access to.

Your personal data, once confirmed on the blockchain, is part of the ledger forever. Fraudulently altering them is impossible.

No wonder that businesses all over the world are scrambling to incorporate blockchain technology into their security solutions.

Cybersecurity expert Cybersecurity Ventures forecasts that total global spending on cybersecurity will exceed $1 trillion cumulatively over the next five years.

$1 TRILLION!

I’m sure a big chunk of that $1 trillion jackpot is going to find its way into the coffers of the blockchain service providers ...

... and a piece of THAT action is going to find its way into the pockets of investors who are savvy enough to include those kinds of stocks in their portfolios.

Jump on the blockchain bandwagon ... NOW

Author

Tony Sagami

Weiss Crypto Ratings

Tony Sagami is one of the early pioneers in the application of technical and quantitative analysis to mutual funds and stocks. A veteran investment adviser and a leading expert on technology investing, he is the editor for Dr.