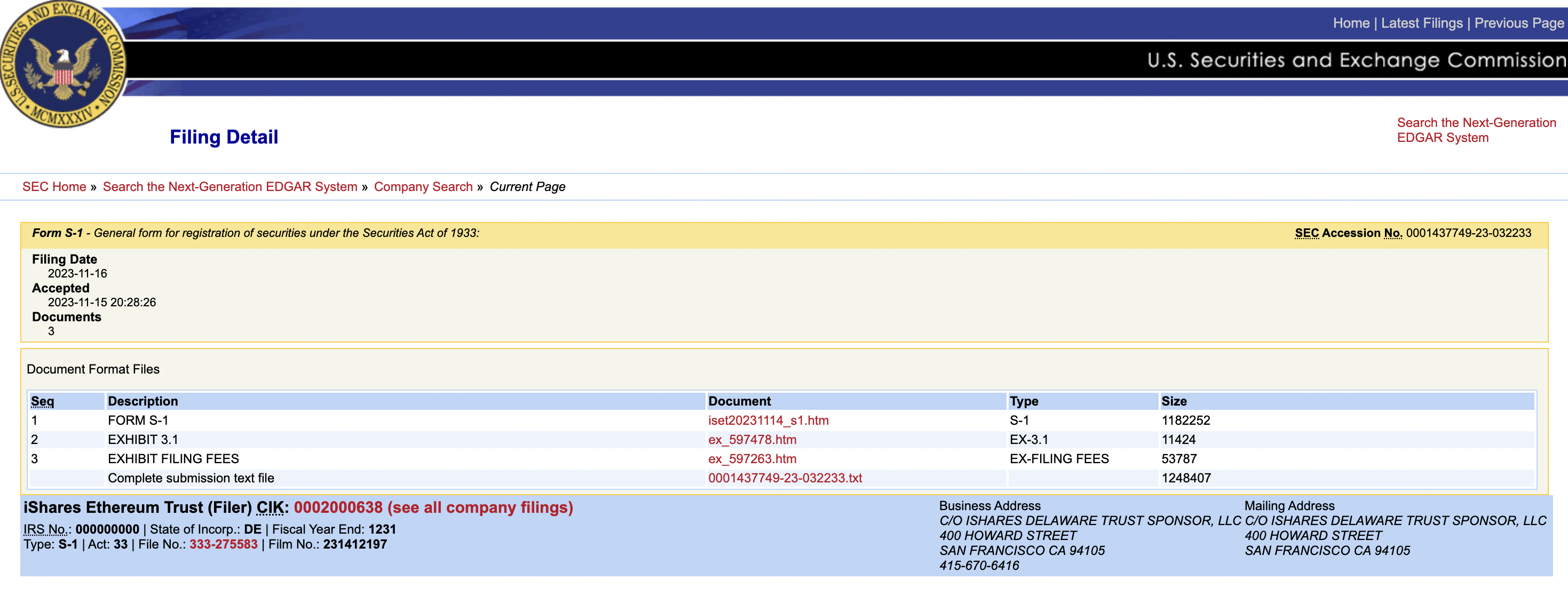

- BlackRock filed a form with the US SEC to issue a spot Ethereum ETF on November 15.

- The firm’s application failed to catalyze a sustained rally in Ethereum price, the asset traded at $2,048, early on Thursday.

- BlackRock is seeking to list a spot Bitcoin ETF, which is pending approval from the US financial regulator.

BlackRock, the largest asset manager in the world, filed for a spot Ethereum Exchange Traded Fund (ETF) with the US financial regulator, the Securities and Exchange Commission (SEC). The firm’s spot Ethereum ETF plans were confirmed with the registration of its ETF division iShares’ Ethereum Trust in Delaware last week.

Also read: Cosmos price rallies as community votes on ATOM halving proposal

Asset manager files for spot Ethereum ETF

BlackRock’s custodian for the Ethereum ETF is Coinbase Custody Trust Company, while Kraken subsidiary CF Benchmarks is the proposed ETF’s benchmark. BlackRock selected the two firms for its spot Bitcoin ETF filing as well.

The filing does not mention whether the Trust will actively stake Ether and distribute dividends to shareholders from the yield.

BlackRock Ethereum ETF filing

According to a report by The Block, trading firms Jane Street and Jump Trading are working on providing liquidity for BlackRock’s proposed Bitcoin ETF if the US financial regulator approves the product.

BlackRock CEO Larry Fink considers Bitcoin’s price rally as a sign of “pent-up interest in crypto.” The anticipation surrounding a spot ETF approval sent Bitcoin price soaring over the past four weeks. Market participants expected a similar reaction from BlackRock’s spot ETH filing, however, the update has failed to catalyze ETH price gains so far.

Ethereum price traded sideways above the $2,100 level early on Thursday. The altcoin hit a local top of $2,134 for the first time since April 2023. Since then, Ethereum price experienced a pullback to $1,900 and continued sideways.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.