BlackRock's IBIT investors throw $329M into ETF as Bitcoin dips 3%

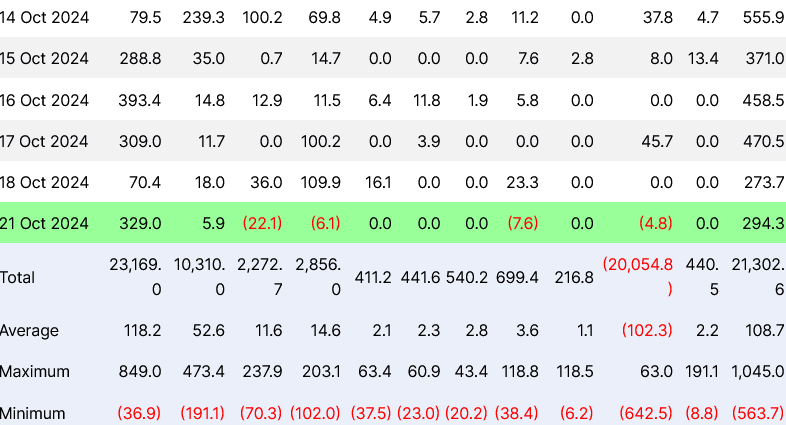

Investors in BlackRock’s iShares Bitcoin Trust (IBIT) bought the dip, sending $329 million in inflows to the fund on Oct. 21 after Bitcoin slipped 3% in a day.

The Fidelity Wise Origin Bitcoin Fund (FBTC) was the only other United States spot Bitcoin ETF to record an inflow, with $5.9 million on Oct. 21, while others recorded zero or negative flows.

Flows for the US spot Bitcoin ETFs on Oct. 21 (Green). Source: Farside Investors

It was the third time in four trading days that BlackRock’s spot Bitcoin BTC $67,522 exchange-traded fund received over $300 million in inflows, Farside Investors data shows.

BlackRock’s IBIT continues to lead all spot Bitcoin ETF products — crossing the $23 billion mark in total net inflows on Oct. 21.

Bloomberg ETF analyst Eric Balchunas noted IBIT has posted the third-largest ETF inflows in 2024 — trailing only Vanguard and BlackRock’s S&P 500 index funds, tickered VOO and IVV.

It comes as Bitcoin’s price dropped 3.25% to a daily low of $66,975 on Oct. 21 after failing to break the $70,000 price resistance. It cut into a 10-day price surge that saw Bitcoin rise from $59,000 to $69,130, CoinGecko data shows.

“Market selling off slightly today, as expected - and thats okay,” crypto trader Jelle said.

Other crypto traders like Emperor said a price pullback to the $62,000 range may be in the cards this week after Bitcoin posted its highest weekly close in five months on Oct. 20.

Bitcoin’s price surge between Oct. 11 and Oct. 21 had been primarily attributed to traders speculating on the upcoming US election.

Meanwhile, total net inflows across all spot Bitcoin ETFs currently amount to $21.2 billion, which includes over $20 billion in outflows from GBTC.

Bitcoin is currently trading at $67,360, down 2.2% over the last 24 hours.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.