The launch of new Ethereum exchange-traded funds (ETFs) encountered significant outflows, as almost $750 million exited the ETFs in four of five recorded trading days.

However, on July 30, Ether (ETH $3,321) ETF net inflows across all nine spot Ether ETFs totaled $33.6 million, marking the first positive daily flow since launch day.

According to Nansen data, this trend facing Ether ETFs is substantially different from the debut of the Bitcoin (BTC) ETFs, revealing a distinct regulatory difference.

Nansen told Cointelegraph that on July 30, Bitwise surpassed BlackRock in trading volume as Bitwise waived its 0.2% fee to “boost inflows” for the first six months of its ETF launch.

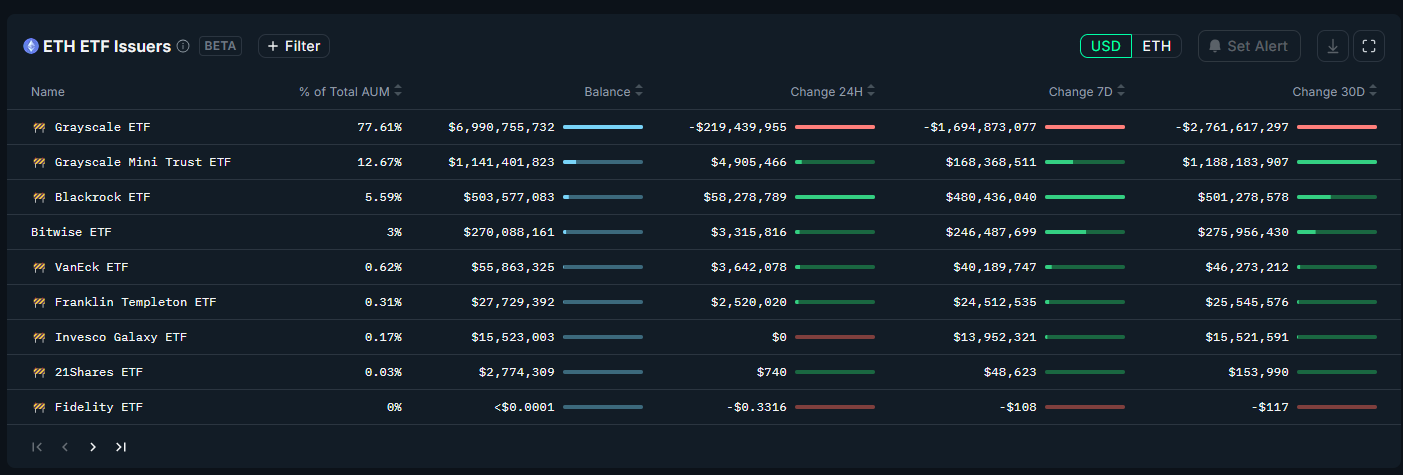

At the time of publication on July 31, BlackRock has taken back its position in trading volume while accounting for 5.59% of assets under management (AUM) per Nansen data.

Nansen data recording Ether ETF providers and AUM. Source: Nansen

Regulatory considerations

The United States Securities and Exchange Commission (SEC) has previously expressed concern for the staking elements behind Ethereum’s proof-of-stake (PoS) consensus mechanism.

Due to the complexity of Ethereum as an investment and the SEC’s decision against allowing staking rewards, Consensys was prompted to address the matter on March 31.

Consensys explained that the PoS mechanism “meets and even exceeds the security of Bitcoin’s proof-of-work (PoW),” which the securities regulator has already approved for trading.

BlackRock stance on future crypto ETFs

On July 25, the asset manager BlackRock stated that the firm sees “very little interest” among its clientele in crypto for ETFs beyond BTC and ETH products.

At the Bitcoin 2024 conference in Nashville, Tennessee, the firm’s head of digital assets, Robert Mitchnick, emphasized that the firm’s clients’ interest was “overwhelmingly” geared toward BTC.

He explained that this interest was also “somewhat” present for ETH, but the interest quickly tapered off beyond those two products.

Bitwise expects a bigger impact from Ether ETFs

On July 18, Bitwise chief investment officer Matt Hougan explained that US spot Ether ETFs could have a larger price impact on the asset than BTC ETFs.

Hougan detailed that the first few weeks could be “choppy” as Grayscale Ethereum Trust (ETHE) converted “to an ETP,” but he was “confident” that new highs would be in by the end of 2024.

The chief investment officer’s rationale was based on ETH’s widespread use, BTC miners forced sell-offs, and approximately one-third of all ETH (28%) being locked away through staking.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin price faces volatility amid ETF inflows

US Spot Bitcoin ETF experienced inflows of 2,129 BTC worth $140.33 million. A whale withdrew 1,300 BTC valued at $85.56 million from Binance on Wednesday. Lookonchain shows that Mt. Gox transferred 47,229 BTC valued at $3.13 billion to three unknown wallets on Wednesday.

Crypto Today: Bitcoin lags as Ethereum and XRP rally, Solana, Dogecoin and BNB trend among traders

Bitcoin trades sideways under $67,000 early on Wednesday, as BlackRock BTC ETF inflows are shadowed by Ether. Ethereum gears to test $3,500 resistance, extends gains by nearly 2%. XRP rallies 4%, hits $0.65 as Ripple holders await lawsuit ruling.

Ethereum trumps Bitcoin in BlackRock ETF inflow, eyes double-digit gains

Ethereum (ETH) hit its 2024 peak of $4,093 on March 12, and since then the altcoin has consolidated under this level. After weeks of struggling to make a comeback above key resistance at $3,500, Ether is primed for a recovery, per on-chain data.

Compound price poised for 20% rally following positive on-chain data

Compound price is encountering resistance at the 100-day Exponential Moving Average at $53.84. As of Wednesday, it trades slightly lower by 0.8% at $52.3. Meanwhile, rising daily active addresses and open interest in on-chain data suggest a bullish move may be imminent.

Bitcoin: Will BTC manage to recover from recent market turmoil?

Bitcoin recovers to $67,000 on Friday after finding support around $63,500 a day before. Still, BTC losses over 1.50% on the week as Mt. Gox persists in transferring Bitcoin to exchanges.