- XRP/USD and ETC/USD will be available to personal trading accounts on Bittrex exchange.

- Ripple broke several support levels towards $0.30 but formed a low at $0.31.

- The trend is strongly bullish; the buyers have eyes on $0.350 in the near-term.

Bittrex cryptocurrency exchange has today announced the listing of US Dollar trading airs for both Ethereum Classic and Ripple’s XRP. However, the trading pairs will only be available to eligible personal and corporate accounts.

“Today, we’re adding XRP and ETC to our USD (Fiat) markets in addition to previously announced USD pairs for Bitcoin (BTC), Tether (USDT), TrueUSD (TUSD) and Ethereum (ETH),” Bittrex wrote on Twitter.

A couple of months ago, the exchange announced to the public that it intends to add crypto-to-fiat trading for Bitcoin (BTC), Tether (USDT) as well as TrueUSD (TUSD). The corporate customers in the states of New York, California, Washington and Montana already have access to the above trading pairs. Ethereum (USD) fiat pairs were later included as well, moreover, ETH trading pairs became available to personal accounts last month.

XRP and ETC fiat trading pairs have been added to personal trading accounts. This listing is very instrumental to both XRP and ETC. ETC was recently listed on Coinbase platforms, however, fiat trading pairs for XRP have become a bone of contention in the recent past.

Ripple price analysis

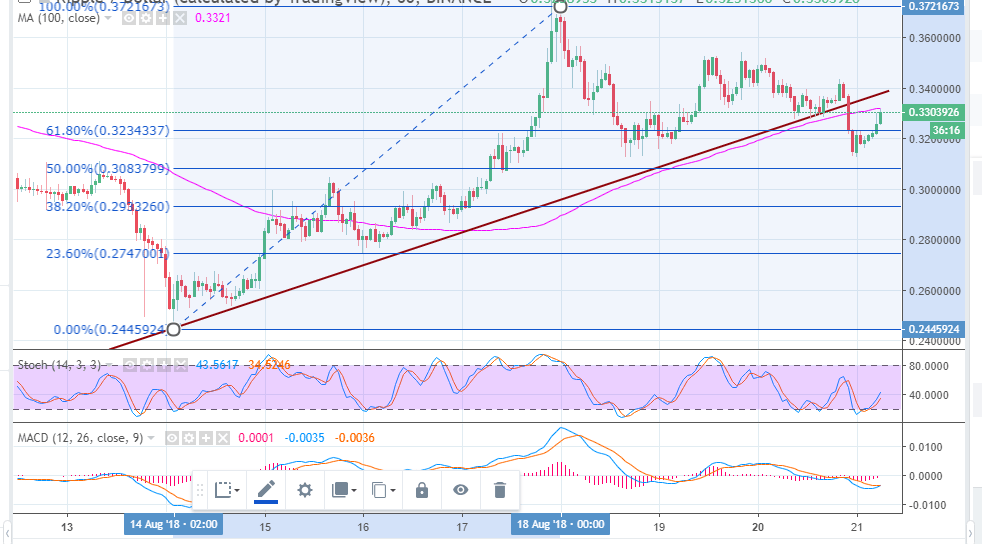

Ripple price was not spared by the brief bearish momentum that swept across the market yesterday. XRP/USD broke the trendline support, the 100-day hourly moving average support and the next support target at $0.320. While heading towards $0.30, it formed a low at $0.31 and embraced the support from the 50% fib level with highs at $0.372 and lows at $0.244 at $0.308.

Ripple appears to have welcomed the listing on Bittrex exchange positively, which explains the pullback from the support above. The crypto is currently testing $0.330 resistance. The indicators are sending bullish signals; the MACD is reaching towards the positive regions while the stochastic oscillator is heading upwards but still at the 40% mark. The 100 SMA is limiting the gains marginally above $0.330. The next resistance target is at the supply zone at $0.3419 and the next supply zone at $0.3525.

A look at the chart shows that the buyers are in control, and positive signals will continue in the near-term. A break above $0.330 is very vital to the buyers whose eyes are set on $0.350 in the short-term.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

BNB Price Forecast: Poised for a decline on negative Funding Rate

BNB price hovers around $696.40 on Thursday after declining 4.58% in the previous two days. BNB’s momentum indicators hint for a further decline as its Relative Strength Index and Moving Average Convergence Divergence show bearish signals.

Ripple's XRP eyes recovery following executives' dinner with Donald Trump

Ripple's XRP is up 2% on Wednesday following positive sentiments surrounding its CEO Brad Garlinghouse's recent dinner with incoming US President Donald Trump. If the recent recovery sentiment prevails, XRP could stage a breakout above the upper boundary line of a bullish pennant pattern.

Has Bitcoin topped for the cycle? Here's what key metrics suggest

Bitcoin experienced a 2% decline on Wednesday as the cryptocurrency market grapples with recent losses. On-chain data has indicated a shift in the accumulation of the leading cryptocurrency, suggesting that holders are increasingly selling their assets.

Ethereum Price Forecast: ETH could decline to $3,110 despite increased accumulation from whales

Ethereum briefly declined below the $3,300 key level, recording a 4% loss on Wednesday as short-term holders led the selling pressure. If the buy-side pressure of large whales fails to outweigh the bears, the top altcoin could decline to $3,110.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.