BitMEX kicks out Arthur Hayes amid collapsing open interest in Bitcoin futures

- BitMEX reshuffles its top-management amid regulatory issues.

- Traders take their money from the troubled cryptocurrency derivatives platform.

The BitMEX founders, Arthur Hayes and Samuel Reed resigned from their top positions amid CFTC charges. According to the information posted on the trading platform's official website, Ben Delo and Greg Dwyer will also be moved from management positions in 100x Group.

Vivien Khoo, Chief Operating Officer of 100x Group, is appointed as an Interim CEO. She will assume additional operational responsibilities. Before joining BitMEX, she worked on various positions in the Securities and Futures Commission in Hong Kong.

Commenting on the decision, David Wong, Chairman of 100x Group, said:

These changes to our executive leadership mean we can focus on our core business of offering superior trading opportunities for all our clients through the BitMEX platform while maintaining the highest standards of corporate governance. We have an exceptional senior leadership team who are well-placed to continue the growth and development of the 100x Group, including completion of the BitMEX User Verification Programme. It is business as usual for us, and we thank all clients for their continued support.

Something went wrong in BitMEX

As the FXStreet previously reported, one of the world's largest platforms for trading cryptocurrency derivatives and its CEOs was accused of offering unregistered securities to the US citizens and violating the Bank Secrecy Law.

Even though the company is registered in an offshore jurisdiction, the US regulators tend to be very aggressive in pursuing their interests internationally, meaning that it will hardly escape the law enforcement action. The Commodity Futures Trading Commission (CFTC) claims and the Department of Justice (DOJ) are very serious and may lead to a jail term.

Traders run on BitMEX

Right after the claims, traders withdraw over 50,000 BTC (over $500 million at the current exchange rate). The traders are scared by the potential legal actions against the trading platform and prefer to rake their money before it is shut down or sanctioned.

Bitcoin BitMEX reserves

Source: CryptoQuant

Apart from the severe BTC outflow, the experts registered a sharp drop in trading activity. According to the data provided by the analytical service Glassnode, the open interest (OI) to the perpetual Bitcoin Futures on BitMEX dropped from $590 million to $450 million, the lowest level since May.

3/ #Bitcoin open interest in perpetual futures contracts on BitMEX saw a significant decline as well.

— glassnode (@glassnode) October 4, 2020

It decreased by almost 24%, from $590M to currently $450M – levels not seen since May 2020.https://t.co/wR6whijn4y pic.twitter.com/n9Z5XT6RM3

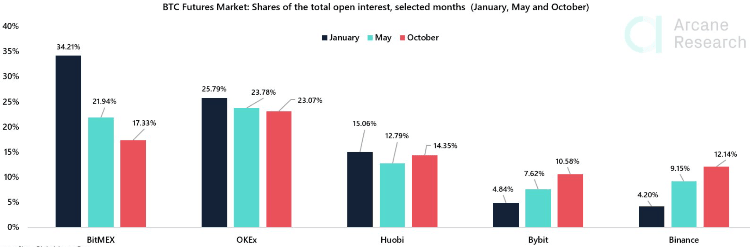

Since the beginning of the year, BitMEX's share on the Bitcoin futures market dropped from 36.9% до 16.8% as the place has become more crowded. There are currently five exchanges holding over 10% of the total OI in the BTC futures market. OKEx is the biggest one with a market share of $23, BitMEX sits in the second position with nearly 17%.

BTC Futures market

Source: Arcane Research

Meanwhile, the cryptocurrency market experts believe that the declining BitMEX's market dominance may be a good thing for the industry. It makes the market less vulnerable to the shutdowns and other external and internal shocks.

The fact that the OI in the BTC futures market has spread its wings to new exchanges is a healthy sign for BTC going forward, as the BTC derivatives market is less exposed for sudden clampdowns on certain exchanges, such as the very recent BitMEX incident.https://t.co/CUEm0r12T9

— Vetle Lunde (@VetleLunde) October 5, 2020

Bitcoin shows little reaction

The spot market turned a blind eye to the BitMEX top-management reshuffle. The flagship cryptocurrency is changing hands at $10,600, mostly unchanged on a day-to-day basis. As the FXStreet previously reported, BTC/ISD has bumped into strong resistance in the area of $10,700-$10,800. a sustainable move above this barrier is needed for the upside to gain traction.

Other top coins, including ETH and XRP, are also dormant in tight ranges. The total capitalization of all digital assets in circulation settled at $334 billion.

Author

Tanya Abrosimova

Independent Analyst