- The on-chain metrics shows that investors have been moving stableoins to exchanges after the BTC sell-off.

- The trend implies that traders are waiting for the right moment to start buying.

According to the recent on-chain metrics, the large cryptocurrency investors, also known as whales, may be ready to buy the dip after the recent BTC sell-off below $10,000. In particular, the growing inflows of stablecoins to top cryptocurrency exchanges may signal that people looking into buying opportunities as BTC is hovering around the critical support area of $10,000.

While people still can buy other assets with their stablecoins, there is a relationship between Bitcoin's price movements and the exchange flows. Let's have a closer look at what stablecoins have been flowing into the exchanges and what it means for Bitcoin.

How it works

Stabelcoin is a cryptocurrency pegged to fiat money like US Dollar or Euro, or other physical assets, like gold or platinum. They have the relative stability of traditional currencies and usability of digital coins, making them a perfect instrument for buying and sending digital assets. Many people tend to hold some stablecoins to be able to react quickly to the changing cryptocurrency market environment and tweak their crypto portfolio by buying more coins at a favorable price.

Thus when investors start moving their stablecoins to cryptocurrency exchange wallets, the chances are that they want to add more coins to their crypto portfolios.

What's going on

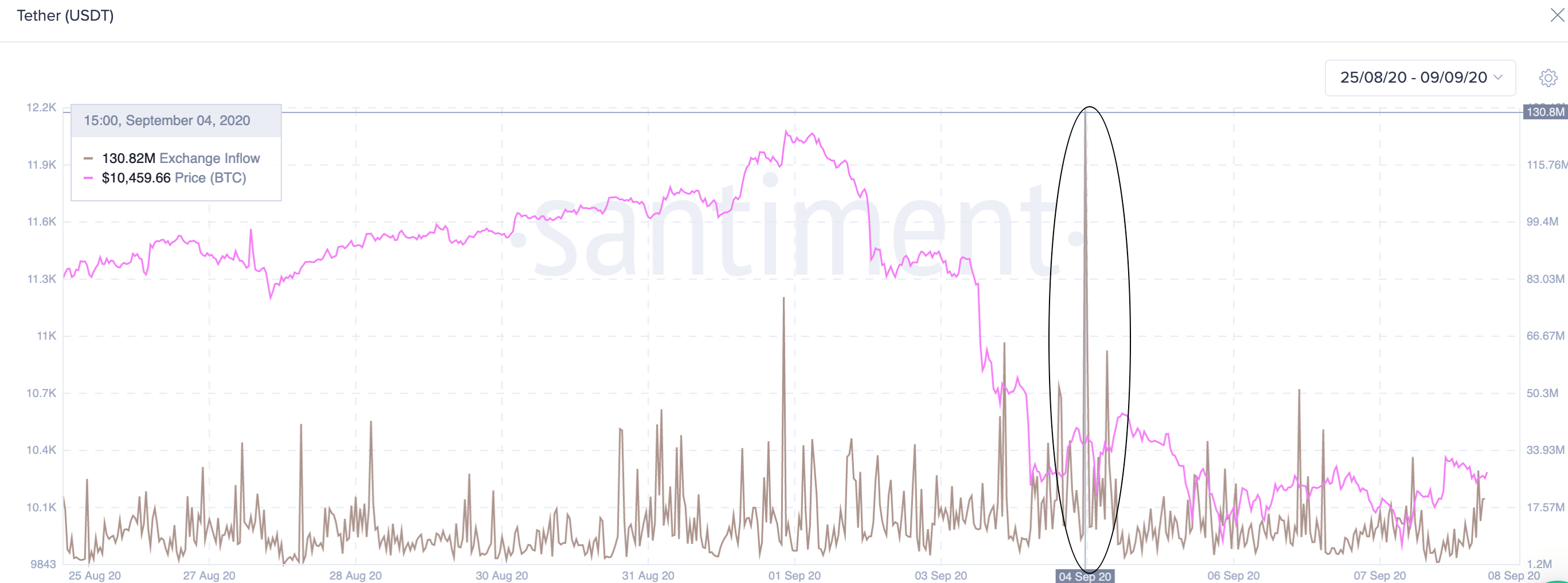

After BTC price recovered to $10,500 after the drop below $10,000 on September 4, an inflow of all major stablecoins to the cryptocurrency exchanges spiked and stayed elevated ever since. ERC-20 Tether to known centralized exchange wallets jumped to $130 million from the recent $30 million on average. Notably, at the same time, the collective balances of the addresses with 10k-100k USDT shrank by 84.8 million coins, which is another indirect confirmation of large cryptocurrency investors getting ready for a move.

Tether inflows to the cryptocurrency wallets

Source: Santiment

The same trend applies to the second largest stablecoin by market cap, USDC. As shown below, holders moved over 1 billion USDC to exchange wallets over the past three days, with the most significant spike registered on Monday, September 7.

USD Coin inflows to the cryptocurrency wallets

Source: Santiment

DAI, BUSD, and Gemini register a similar trend with the sharp inflows starting from September 4. This upcoming buy-on-dip theory is confirmed by the CryptoQuant potential BUY/SELL indicator. As we have discussed, the ratio of the amount of BTC held on the exchanges and the number of stablecoins implies that the market is in good shape for a strong rally from the current levels.

When moon?

The inflow of stabelcoins to the cryptocurrency exchanges after Bitcoin dived under $10,000 may indicate that the crypto whales are getting ready to buy the dip. If USDT and USDC holders continue funneling millions of dollars in digital assets to the trading platforms, the buying pressure will intensify and eventually lead to a sharp rally above the local resistance levels of $11,000 and $12,000. This development may inspire more confidence among long-term and retail investors and created an intense recovery momentum.

BTC/USD daily chart

To conclude: the stablecoin reserves on the exchanges may serve as a leading indicator of BTC price movements, provided that it is confirmed by other metrics, including technical and fundamental factors. At the time of writing, BTC/USD is drifting to a lower boundary of the recent consolidation channel of $10,000-$9,800. This support has been verified on numerous occasions since the beginning of September and potentially attracted new large buyers. The coin may stay sidelined while the whales accumulate stablecoins on the exchange accounts. A sustainable move above $10,500 may serve as a trigger to send the price above $12,000 and to new highs of 2020.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Cardano stabilizes near $0.62 after Trump’s 90-day tariff pause-led surge

Cardano stabilizes around $0.62 on Thursday after a sharp recovery the previous day, triggered by US Donald Trump’s decision to pause tariffs for 90 days except for China and other countries that had retaliated against the reciprocal tariffs announced on April 2.

Solana signals bullish breakout as Huma Finance 2.0 launches on the network

Solana retests falling wedge pattern resistance as a 30% breakout looms. Huma Finance 2.0 joins the Solana DeFi ecosystem, allowing access to stable, real yield. A neutral RSI and macroeconomic uncertainty due to US President Donald Trump’s tariff policy could limit SOL’s rebound.

Bitcoin stabilizes around $82,000, Dead-Cat bounce or trendline breakout

Bitcoin (BTC) price stabilizes at around $82,000 on Thursday after recovering 8.25% the previous day. US President Donald Trump's announcement of a 90-day tariff pause on Wednesday triggered a sharp recovery in the crypto market.

Top 3 gainers Flare, Ondo and Bittensor: Will altcoins outperform Bitcoin after Trump's tariff pause?

Altcoins led by Flare, Ondo and Bittensor surge on Thursday as markets welcome President Trump's tariff pause. Bitcoin rally falters as traders quickly book profits amid Trump's constantly changing tariff policy.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

[13.06.24, 08 Sep, 2020]-637351587260341220.png)

-637351587655172227.png)