Bitcoin's use as margin collateral in crypto futures trading is growing

Bitcoin (BTC) is unlikely to shed its tag as an unpredictable and volatile asset any time soon because crypto traders are increasingly using the largest cryptocurrency as a margin in futures trading.

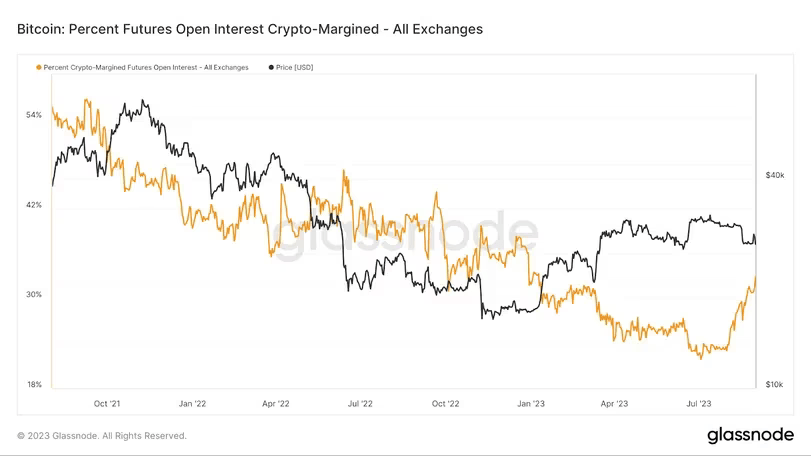

Since July, the percentage of bitcoin futures open interest margined with bitcoin has risen to 33% from roughly 20%, according to data tracked by Glassnode. Cash or stablecoin-margined contracts still account for 65% of the total open interest.

Futures are leveraged products, allowing traders to maximize exposure for a deposit at the exchange, known as margin, which is a small percent of the contract size. The exchange provides the rest of the value of the trade. The renewed interest in BTC-margined contracts means potential for volatility-boosting liquidations cascades, according to research provider Blockware Intelligence. That occurs when multiple liquidations – or forced closure of positions due to margin shortage – happen consecutively, causing a rapid price change.

"Using BTC as collateral for a BTC derivative is effectively a double whammy," analysts at Blockware Intelligence said in a weekly newsletter. "If you're long BTC with BTC posted as collateral, the price going down brings you to your liquidation point faster because the value of your collateral is declining at the same time. "Leveraging against your BTC during its monetization phase is extremely risky, [as] you can be correct directionally, but volatility can wipe you out regardless."

Coin-margined contracts are quoted in U.S. dollars, but margined and settled in cryptocurrencies. In other words, the collateral is as volatile as the position, creating a non-linear payoff, where a trader earns less when the market rallies and loses more when the market drops.

So, not only does a long position bleed as bitcoin's dollar-denominated price drops, but the collateral also loses value, compounding losses. That, in turn, results in a relatively quick margin shortfall and potential liquidation.

Interest in BTC-margined futures contracts is increasing. (Glassnode, Blockware Intelligence) (Glassnode, Blockware Intelligence)

The trend is worrying in a sense that should coin-margined contracts become dominant, we may see frequent volatility-boosting liquidations cascades. Such events were quite common before September 2021, when coin-margined contracts accounted for more than 50% of the global open interest.

According to Blockware, the renewed interest in such contracts represents a shortage of cash in the market.

"The spike in this metric over the past few months is curious, it may suggest that traders are running out of cash and are resorting to leveraging against their BTC as the last means of increasing their exposure," the analysts said.

Liquidity has been leaving the crypto market for some time. According to CCData, the total market value of all stablecoins contracted by 0.4% to $125 billion in August, the 17th consecutive monthly decline. The market cap of tether (USDT), the world's largest stablecoin by market value, has fallen almost $1 billion to $82.87 billion in the past four weeks, CoinGecko data show.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.