Bitcoin’s stabilization could be key for LUNA price to trigger a move to $3.5

- LUNA price is finishing up the last leg of a triple tap setup, suggesting that the bulls are back and in control.

- Investors can expect the altcoin to trigger a 40% run-up to $2.80, but in some cases, revisit the $3.51.

- A four-hour candlestick close below $1.94 will invalidate the triple tap setup for Terra bulls.

LUNA price shows the formation of a bottom reversal setup that could trigger a bullish move. Investors need to pay close attention to the immediate support level, a breakdown of which could result in further descent.

LUNA price ready for gains

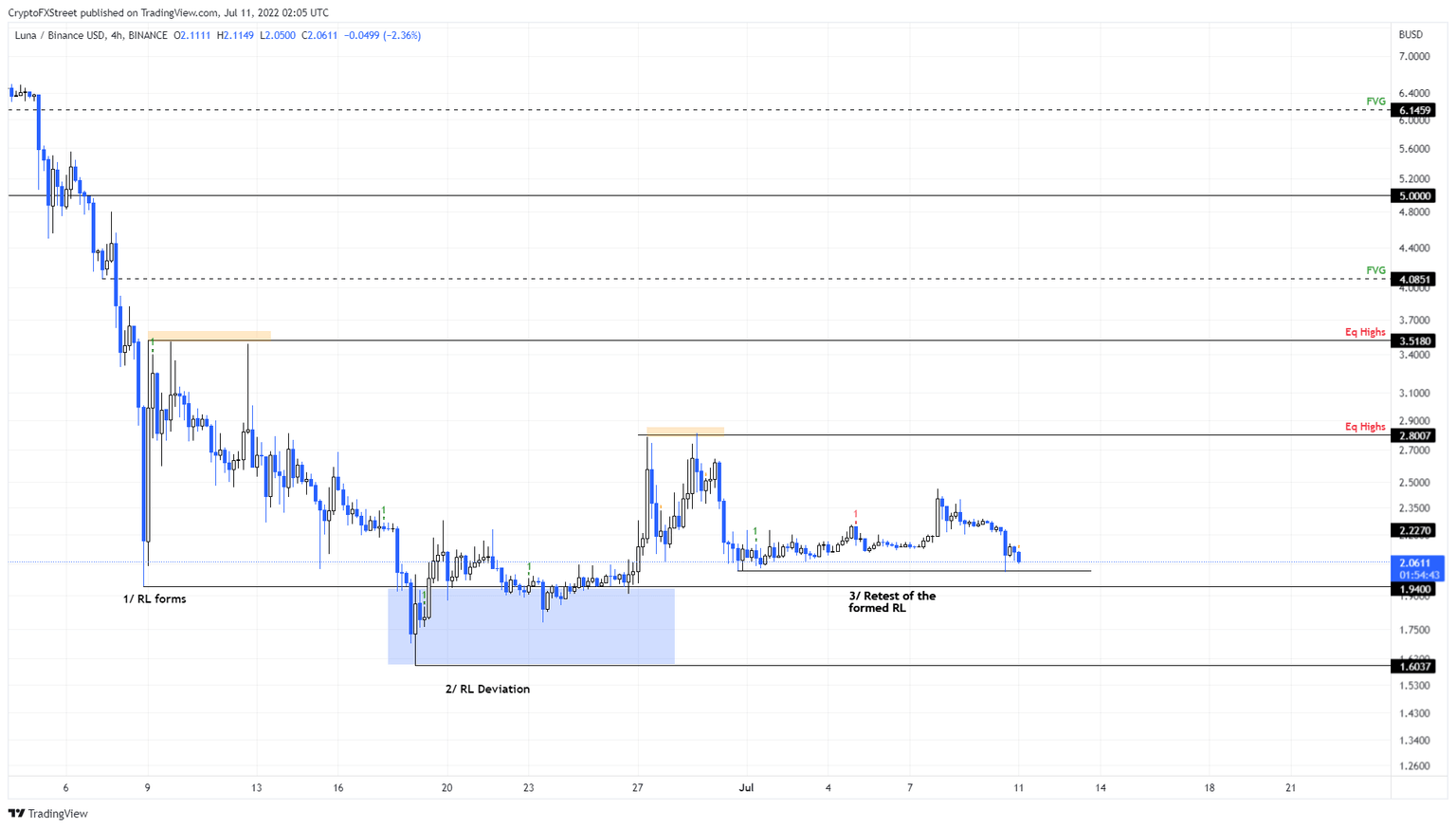

LUNA price set a swing low at $1.94 on June 8 after crashing 89% since May 31. This move was the last leg of the downswing and set a base for the triple tap setup. The technical formation contains three distinctive swing lows, with the central one deeper than the rest. The first and the third swing points are often along the same trend line.

However, in some cases, the third swing low is formed a little higher than the first, creating a variation of the triple tap setup. This setup forecasts a reversal in trend favoring the bulls if it is formed after a downtrend.

In Terra’s case, the last leg of the triple tap setup has already been made and all that’s left is to trigger a bullish move. Interestingly, Bitcoin price is also showing signs that it wants to rally, adding credence to the reversal outlook.

Investors can expect a 40% run-up to $2.80, which is the initial target for LUNA price. If this barrier is flipped into a support floor, the rally might extend from 40% to 70% with a target of $3.51.

LUNA/BUSD 4-hour chart

On the other hand, if LUNA price fails to move higher but instead starts to drop, it will indicate that buyers are not in control. In such a case, if LUNA price produces a four-hour candlestick close below the $1.94 support level, it will invalidate the triple tap setup.

In such a case, Terra might drop 17% and revisit the $1.60 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.